Sentiment Analysis: GBP/USD, EUR/USDGBP/USD at extended levels: where to from here? EUR/USD showing signs of bullish fatigueInstitutional speculators

Sentiment Analysis: GBP/USD, EUR/USD

- GBP/USD at extended levels: where to from here? EUR/USD showing signs of bullish fatigue

- Institutional speculators and IG retail client sentiment at opposite ends of the positioning spectrum

- IG client sentiment – a well-known contrarian indicator – positioned in favour of reversals in both pairs

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

Recommended by Richard Snow

Find out where opportunity lies in Q3

GBP/USD at Extended Levels: Where to From Here?

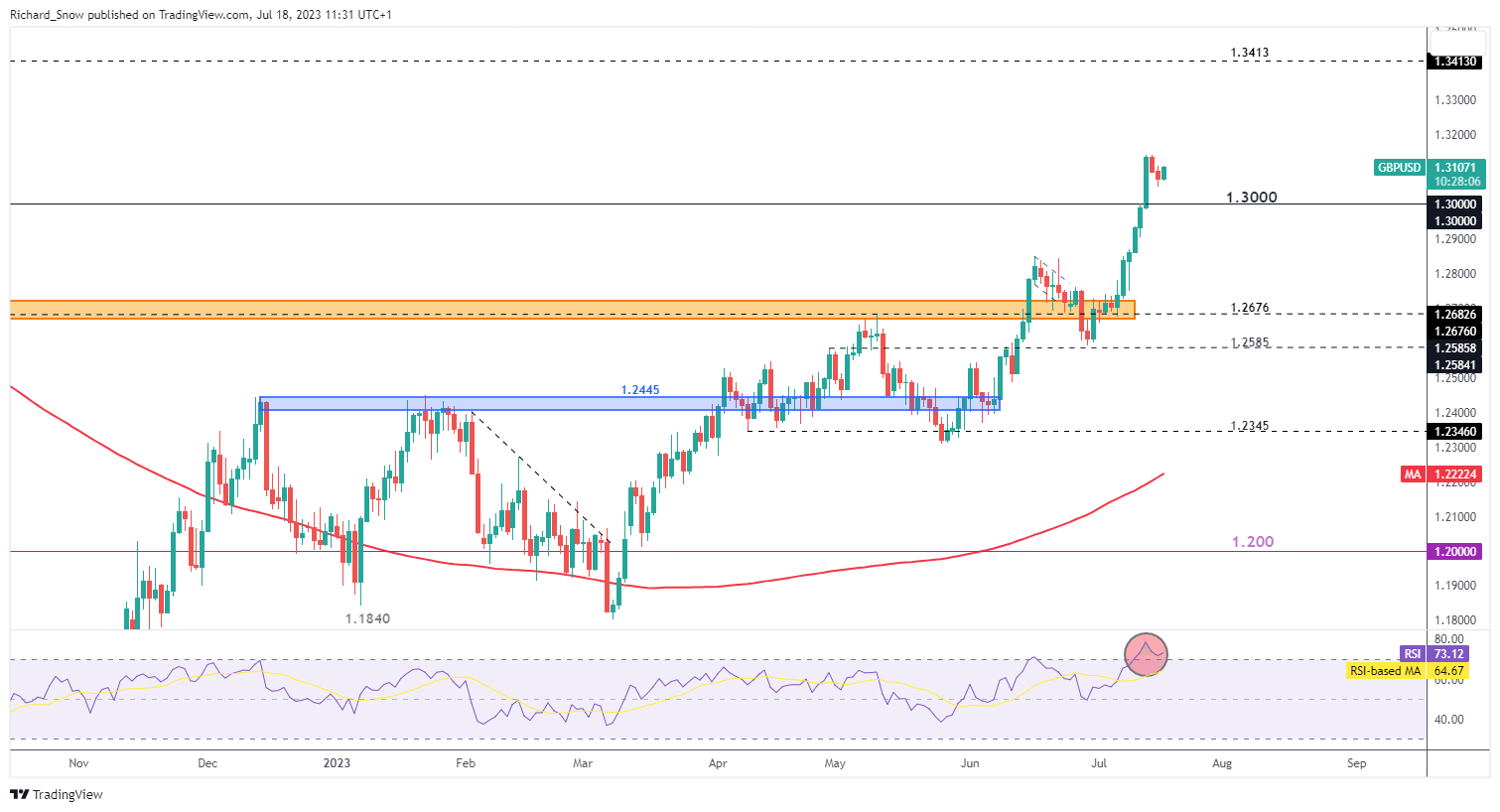

Cable has accelerated higher, mainly on the back of a sharp dollar selloff in the wake of much improved US inflation data. The move however, appears over extended and recent price action has revealed a shallow pullback thus far. In strong trending markets, pullbacks tend to be shallow, and today’s intra-day move higher might be the start of the next leg higher in the pair but more confirmation is required.

A break and hold of the recent swing high helps provide a greater degree of confidence to the current uptrend as the RSI attempts to see a return to more ‘normal’ conditions. Support remains at the psychological level of 1.3000, with resistance all the way up at 1.3413.

GBP/USD Daily Chart

Source: TradingView, prepared by Richard Snow

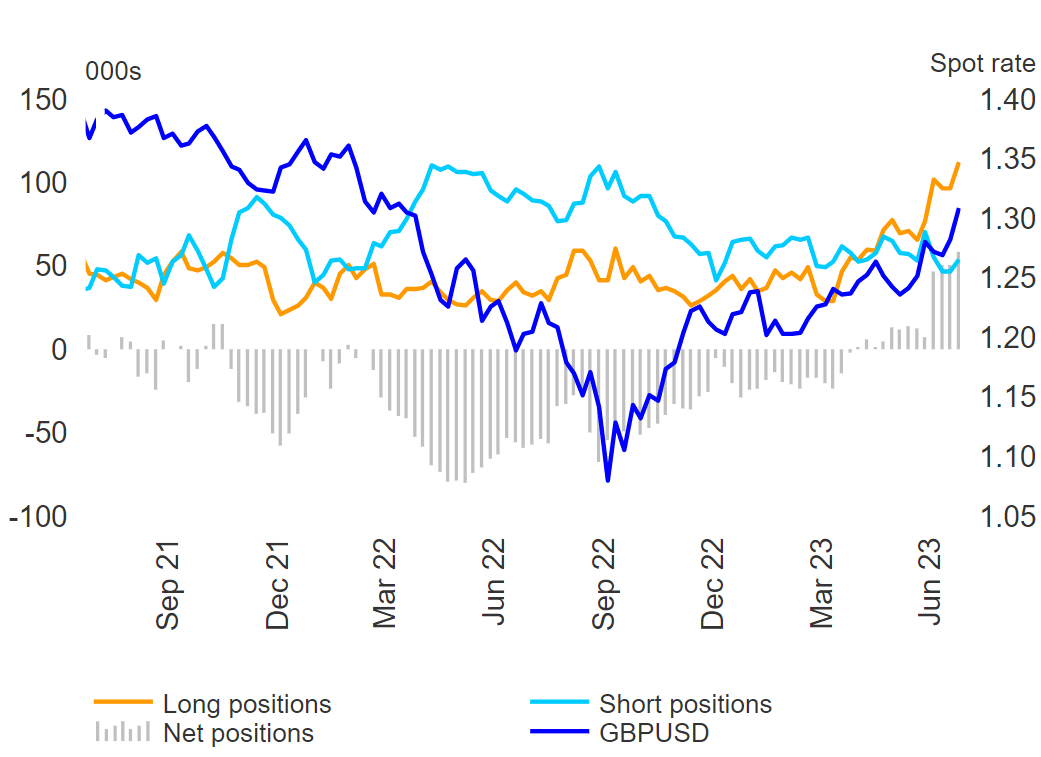

Large Speculators (Hedge Funds) Favour Bullish Continuation in GBP/USD

CFTC data derived from the commitments of traders reports reveals that large institutional speculators who are obliged to report positioning with the CFTC, shows what has been an increasing appetite for further GBP/USD upside. Aggregate positioning is more net long than before – suggesting further upside in cable. However, the latest data points do not include positioning after the pivotal US inflation print last Wednesday. Data up until today will be reported on Friday so keep an eye out for those to see if large speculators are even more in favour of GBP/USD upside.

Large Speculators (Typically Hedge Funds) CoT Data Positioned for Further Upside

Source: Refinitiv, CFTC Commitment of Traders Report, prepared by Richard Snow

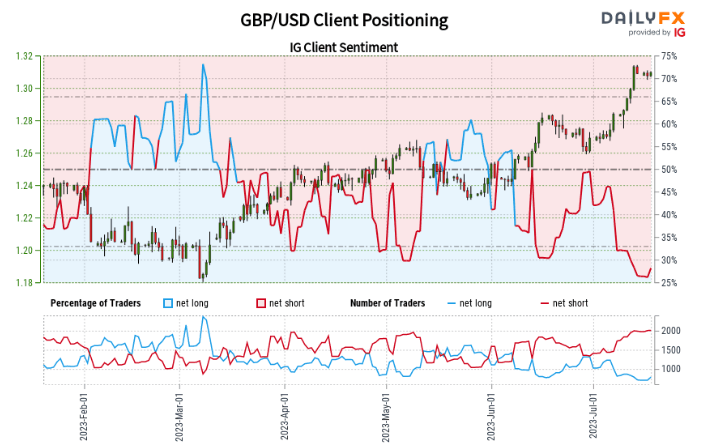

IG client sentiment encapsulates a rather unfortunate reality among traders which is the tendency to call tops and bottoms in strong trending markets. More than 71% of traders are net-short, seeking an imminent reversal. Unfortunately, price action and retail positioning exhibit an inverse relationship – hence the contrarian tag.

IG Client Sentiment (Contrarian Indicator) Showing Massive Short Bets

Source: TradingView, prepared by Richard Snow

Recommended by Richard Snow

See what our analysts foresee in GBP in Q3

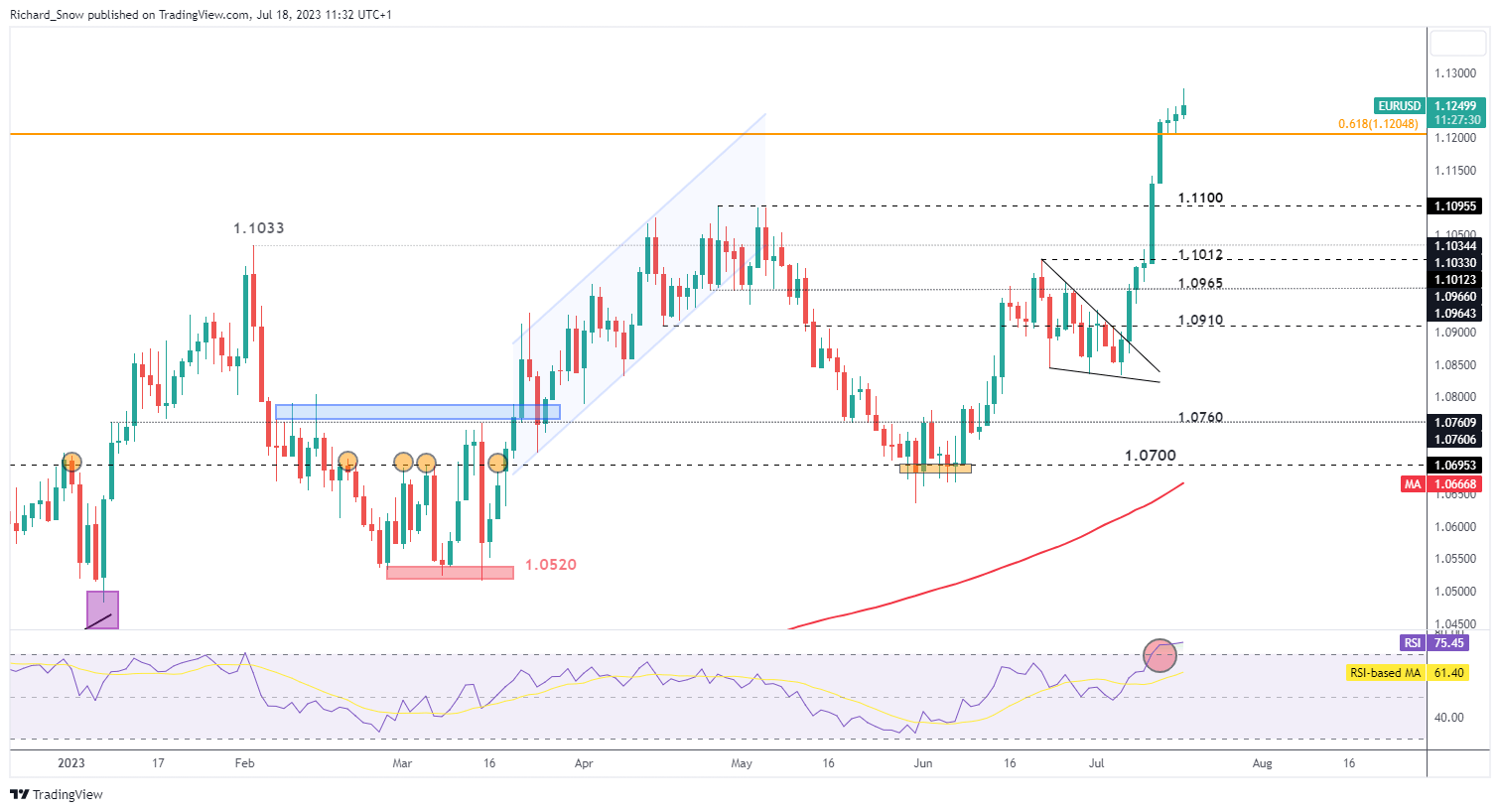

EUR/USD Bullish Advance Shows Signs of Possible Fatigue

EUR/USD has advanced at an alarming rate ever since the USD selloff took hold. However, the appearance of extended upper candle wicks suggest there could be a challenge to further upside. Resistance appears at 1.1360 – a zone of prior resistance at the end of 2021 with support at the 61.8% Fibonacci retracement of the major 2000 to 2008 major advance. The RSI also indicates that we could be due a minor retracement but keep in mind that a weaker dollar would keep the pair stuck in oversold territory for some time yet.

EUR/USD Daily Chart

Source: TradingView, prepared by Richard Snow

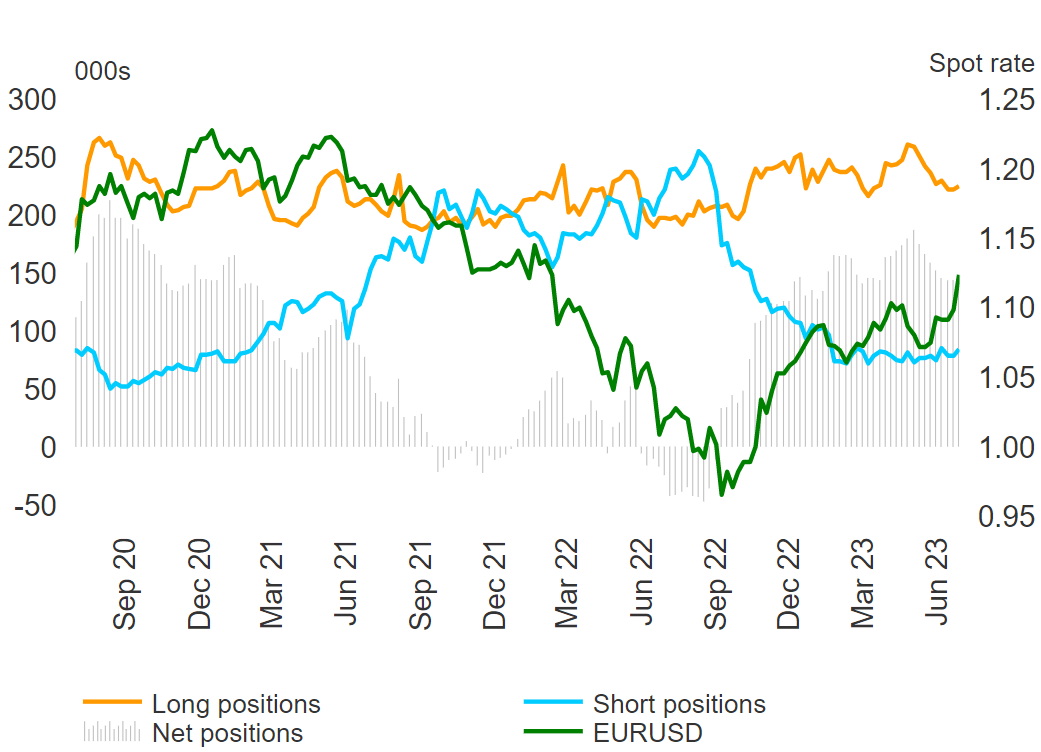

EUR/USD Remains Net-Long but Speculators Are Reducing Long Positioning

Large speculators remain heavily net-long but the less of a degree than before, possibly die to worsening fundamental data weighing on lofty rate expectations or an overvalued euro. The vertical bars reveal the net positioning and a steady decline can be seen from the June high as shorts remain steady but longs decline notably.

Large Speculators (Typically Hedge Funds) CoT Data Sees Decline in Long Positioning

Source: Refinitiv, CFTC Commitment of Traders Report, prepared by Richard Snow

Recommended by Richard Snow

See what our analysts foresee in EUR in Q3

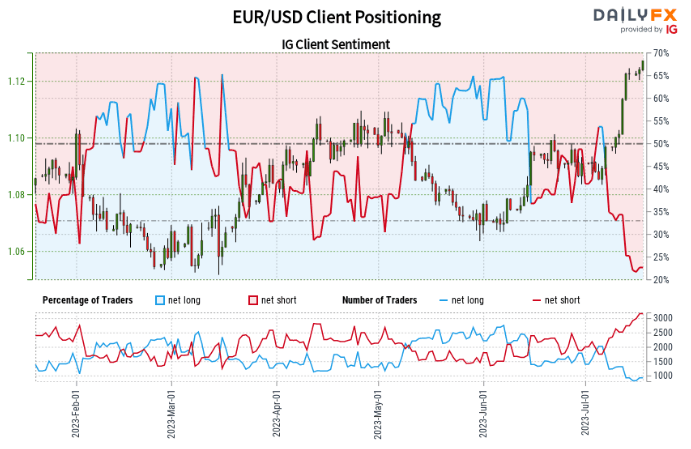

IG client sentiment reveals that more than 75% of traders are net short EUR/USD. As noted before, such one-sided positioning flies in the face of a strong trending market. Eventually, a reversal will happen, the question is simply a matter of time but thus far price action has seen impressive moves higher.

IG Client Sentiment Revealing Massive Short Bets

Source: TradingView, prepared by Richard Snow

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com