It appears that the AUD/USD and NZD/USD currency pairs are experiencing a bearish reversal which started last week as the risk sentiment deteriorates.

It appears that the AUD/USD and NZD/USD currency pairs are experiencing a bearish reversal which started last week as the risk sentiment deteriorates. The preliminary private sector Purchasing Managers’ Index (PMI) data for June in Australia has garnered attention on Friday.

The latest data for the Australian economy shows a negative trend. The services PMI (Purchasing Managers’ Index) declined from 52.1 to 50.7, indicating a slowdown in the services sector. Meanwhile, the manufacturing sector continued to contract, although there was a slight improvement as the manufacturing PMI increased from 48.4 to 48.6 in June. Economists had predicted PMI figures of 50.1 for services and 48.1 for manufacturing, respectively.

Of particular significance is the composite PMI output index, which provides an overall snapshot of the economy. It fell to a three-month low of 50.5 in June, compared to May’s reading of 51.6. This indicates a slowdown in overall economic activity. It’s worth noting that these negative figures coincide with concerns about the Chinese economy, which have been impacting the Australian dollar (AUD) and New Zealand dollar (NZD).

NZD/USD Daily Chart – Buyers Failed at the 100 Daily SMA

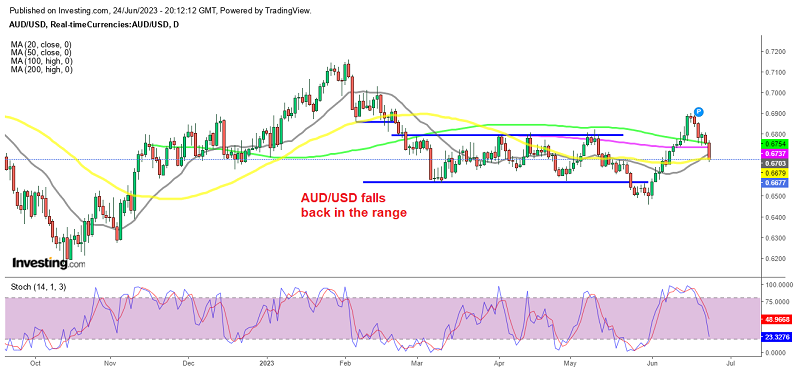

Can the 20 SMA hold the decline?

There are a couple of noteworthy updates regarding China and its economic recovery, which seems to be facing some challenges.

According to tourism data reported on China’s state TV (CCTV), travel during the Dragon Boat Festival holiday from June 22 to 24 was higher than in 2022 but down by 22.8% compared to the pre-COVID levels of 2019. Specifically, the number of railway trips during this period increased by 12.8% compared to the same period in 2019. However, road travel was down by 33.3% and trips on buses were down by 43.6% from the pre-COVID levels in 2019. On the other hand, flights experienced a modest increase of 3% compared to 2019.

In addition, it has been reported that at least two South Korean airlines, Korean Air Lines and Asiana Airlines, have reduced flights to and from China. This decision was attributed to lower demand and strained relations between the two countries.

Market observers are closely monitoring data from China to gauge the progress of its economy as it moves past the initial recovery phase from the impact of COVID-19. Attention is also focused on potential stimulus measures. While recent policy rate cuts, such as the central bank’s reduction in LPRs (Loan Prime Rates), have been relatively small in magnitude, there is a belief that more substantial fiscal stimulus would alleviate market concerns to a greater extent.

AUD/USD Live Chart

AUD/USD

www.fxleaders.com