It’s been a quiet week on the markets for safe-haven property, with the USD/CHF, USD/JPY, and GOLD posting average buying and selling ranges. As w

It’s been a quiet week on the markets for safe-haven property, with the USD/CHF, USD/JPY, and GOLD posting average buying and selling ranges. As we roll into the weekend, will probably be attention-grabbing to see if merchants restrict threat and hit these property with some bids.

Minutes in the past, Kansas Metropolis FED President Esther George made a few public feedback on the U.S. economic system. In a nutshell, George said that COVID-19 has put state governments in monetary hassle and restoration is “far off.” Nonetheless, George additionally stated that FED actions have eased strain on the financial system and coverage shall be data-dependent transferring ahead. So, though the financial image is unsure, the FED is assured that its huge QE program is acceptable.

Wanting ahead to Friday, there are a number of occasions in the course of the U.S. session value being conscious of:

Occasion Projected Earlier

Core Private Consumption (MoM, Might) 0.0% -0.4%

Private Revenue (Might) -6.0% 10.5%

Private Spending (Might) 9.0% -13.6%

UM Shopper Sentiment Index (June) 79.0 78.9

Other than Private Revenue, every of those numbers is predicted to enhance month-over-month. For my part, the important thing determine right here is the UM Shopper Sentiment Index (June) ― be looking out for an exceptionally excessive studying as a result of COVID-19 restart.

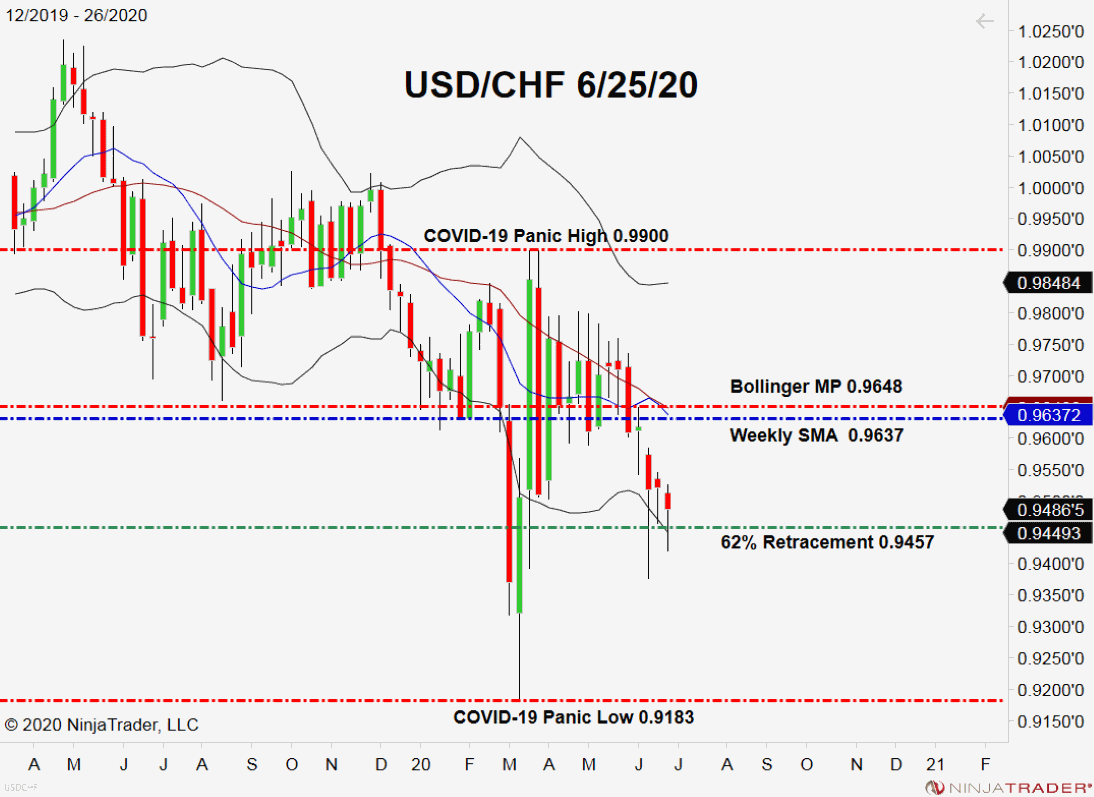

To this point, merchants are comfy with their publicity to the safe-havens. Let’s check out the USD/CHF and see how the Swissy is faring.

Secure-Havens, USD/CHF Maintain Agency

Over the course of the COVD-19 pandemic, the Swissy has earned its status as a safe-haven. At present, charges have stabilized simply above the 62% COVID-19 Retracement (0.9457).

+2020_26+(11_47_00+AM).png)

Overview: So long as the USD/CHF stays above the important thing 62% Fibonacci Retracement (0.9457), a bullish bias is warranted. Nonetheless, if this degree provides method, charges are more likely to rapidly take a look at the Spike Low at 0.9375.

In case you are buying and selling the safe-havens, particularly the USD/JPY, do not forget that the Tokyo CPI (June) is due out in the course of the American in a single day. Ought to we see any surprises, short-term volatility is more likely to plague the yen forward of tomorrow’s U.S. session.