Most Read: Market Q2 Forecasts - US Dollar, Gold, Euro, Oil, Bitcoin, Yen, Equities OutlooksTrading often tempts us to follow the herd – buying when e

Most Read: Market Q2 Forecasts – US Dollar, Gold, Euro, Oil, Bitcoin, Yen, Equities Outlooks

Trading often tempts us to follow the herd – buying when everyone else is buying, and selling in a frenzy of fear. But savvy traders understand the potential hidden in contrarian strategies. Indicators like IG client sentiment offer a unique window into the market’s collective mood, revealing instances where overwhelming optimism or pessimism can signal a potential reversal.

Of course, contrarian signals aren’t a crystal ball. They shine brightest when used to enrich an already robust trading strategy. By combining contrarian insights with careful technical and fundamental analysis, traders gain a richer understanding of the forces driving the market – forces that the crowd might easily overlook. Let’s explore this concept by examining IG client sentiment and its potential impact on the euro across four key FX pairs: EUR/USD, EUR/CHF, EUR/GBP, and EUR/JPY.

Want to stay ahead of the EUR/USD’s next major move? Access our quarterly forecast for comprehensive insights. Request your complimentary guide now to stay informed on market trends!

Recommended by Diego Colman

Get Your Free EUR Forecast

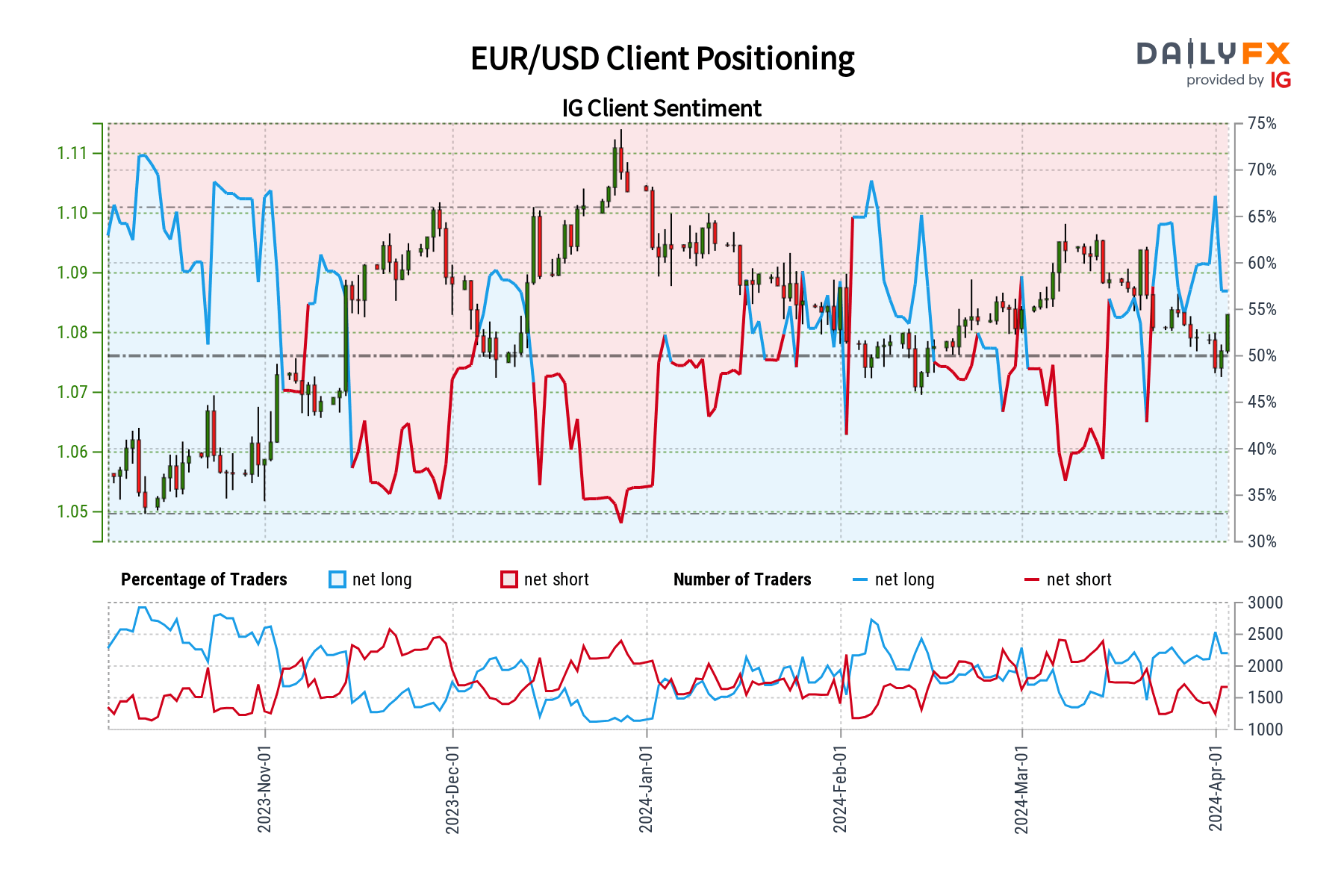

EUR/USD FORECAST – MARKET SENTIMENT

IG data reveals a slight but fading bullish bias towards the EUR/USD among retail traders. Currently, 53.15% of clients hold net-long positions, resulting in a long-to-short ratio of 1.13 to 1. This positive tilt has weakened significantly, with net-long positions down a substantial 10.90% compared to yesterday, despite a tiny 0.05% increase over the week. Mirroring this, net-short positions surged by 31.26% since yesterday and are up 11.10% over the week.

Typically, a net-long stance hints at potential declines from a contrarian perspective. But, the recent shift in sentiment complicates the outlook. While a slight majority still favors the upside, the growing number of traders leaning bearish could signal an impending bullish burst for EUR/USD.

All in all, EUR/USD presents a mixed picture. It’s essential for traders to proceed with caution and not rely solely on sentiment. These insights should be combined with thorough technical and fundamental analysis for a well-informed trading strategy.

Disheartened by trading losses? Empower yourself and refine your strategy with our guide, “Traits of Successful Traders.” Gain access to crucial tips to help you avoid common pitfalls and costly errors.

Recommended by Diego Colman

Traits of Successful Traders

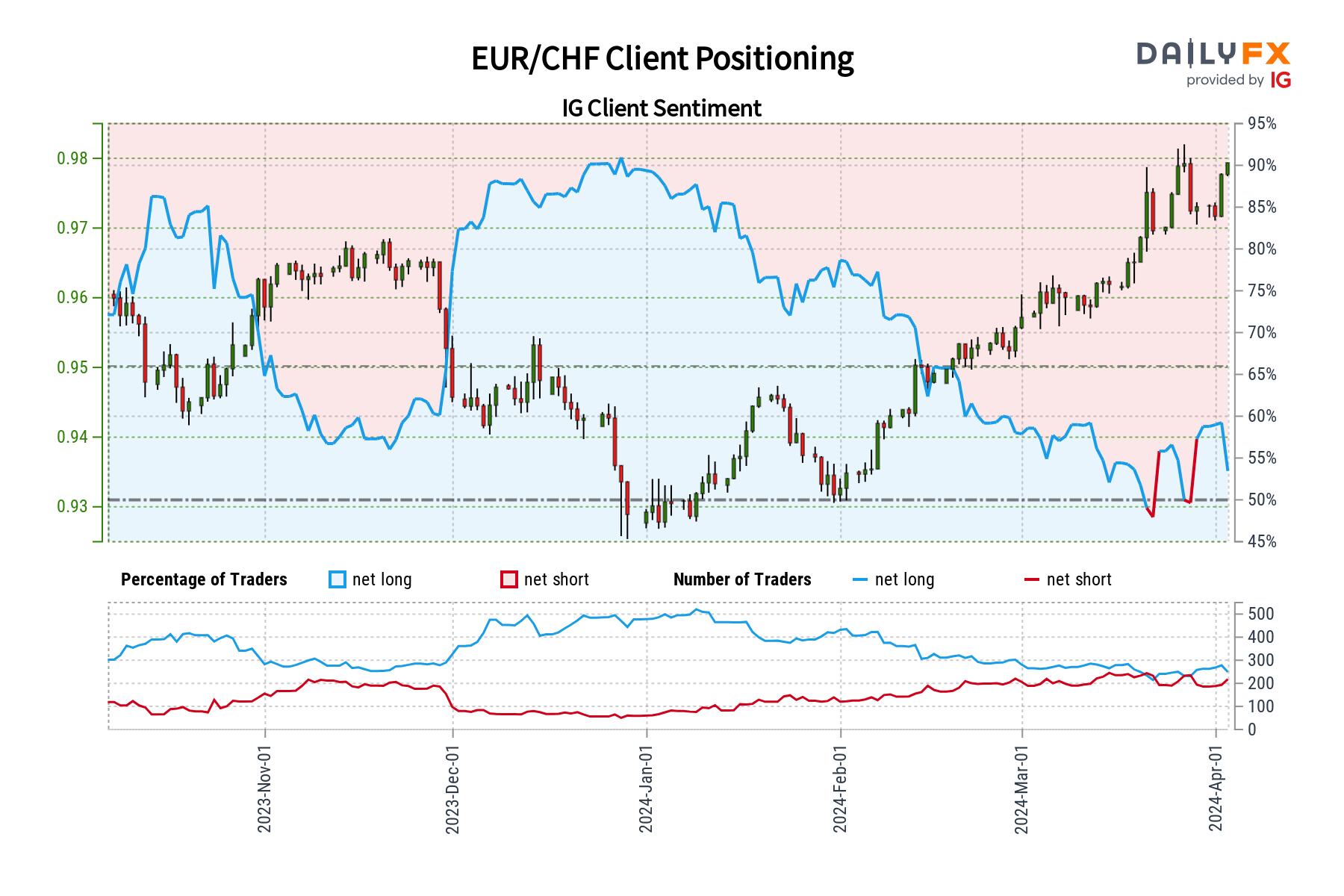

EUR/CHF FORECAST – MARKET SENTIMENT

Data from IG reveals clients are bullish on EUR/CHF, with 53.08% of traders currently holding net-long positions. This results in a long-to-short ratio of 1.13 to 1. However, sentiment appears to be weakening, with net-long positions down 3.10% since yesterday, even while they’ve increased by 8.70% compared to last week. Mirroring this, net-short positions are up 12.18% from yesterday but down 6.75% compared to last week.

Our typical contrarian approach suggests EUR/CHR could be in for a pullback. However, the recent weakening of buying positions on the pair and the mixed timeframe comparisons create a less confident outlook.

Overall, the EUR/CHF presents a complex picture based on current sentiment. While there may be some downward pressure, the lack of a strong contrarian signal warrants caution. As always, traders should consider these clues within a broader technical and fundamental analysis framework before making any trading decisions.

Eager to uncover how retail positioning may shed light on EUR/GBP‘s directional path? Dive into our sentiment guide for invaluable insights into market psychology as a trend indicator. Download it now!

| Change in | Longs | Shorts | OI |

| Daily | 0% | 1% | 0% |

| Weekly | -9% | -6% | -8% |

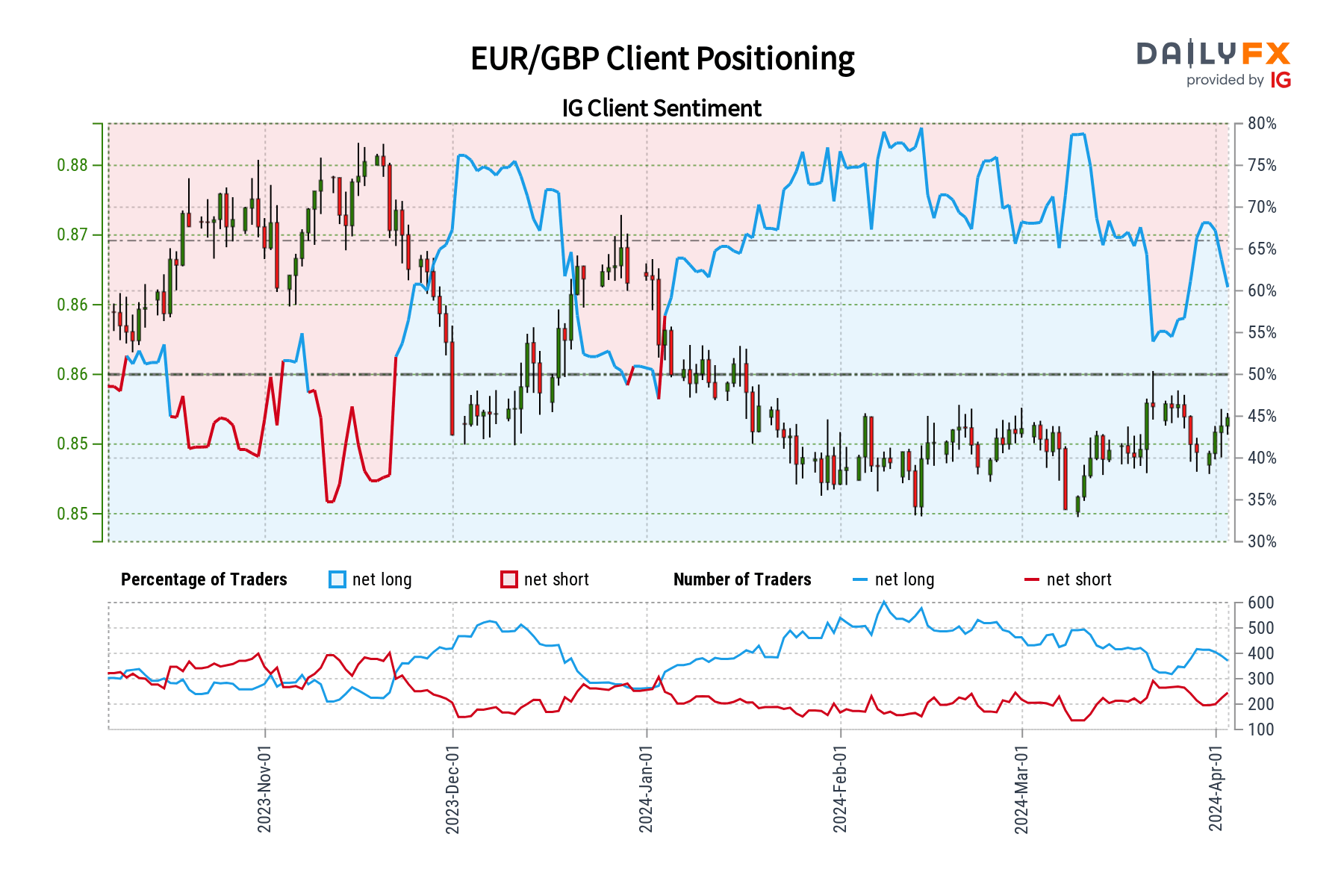

EUR/GBP FORECAST – MARKET SENTIMENT

Based on IG data, the sentiment surrounding EUR/GBP within the retail crowd appears optimistic, with 61.22% of traders maintaining net-long positions. This equates to a long-to-short ratio of 1.58 to 1. Nevertheless, this bullish stance is beginning to wane, as net-longs have declined by 1.80% since yesterday, despite a 4.95% jump over the past week. In contrast, net-shorts experienced a large 9.01% surge from yesterday but demonstrate a more consistent decrease of 12.00% versus last week’s levels.

Traditionally, substantial net-long positioning might indicate potential losses for the underlying asset from a contrarian standpoint. However, recent shifts in market positioning have clouded the clarity of this signal. Presently, EUR/GBP appears to be caught amidst conflicting forces. While contrarian indicators still suggest some downward pressure is probable, the absence of a robust, enduring trend renders it a less assured prediction.

Intrigued to learn about the outlook for EUR/JPY? Dive into our second-quarter forecast for comprehensive insights. Get yours today!

Recommended by Diego Colman

How to Trade EUR/USD

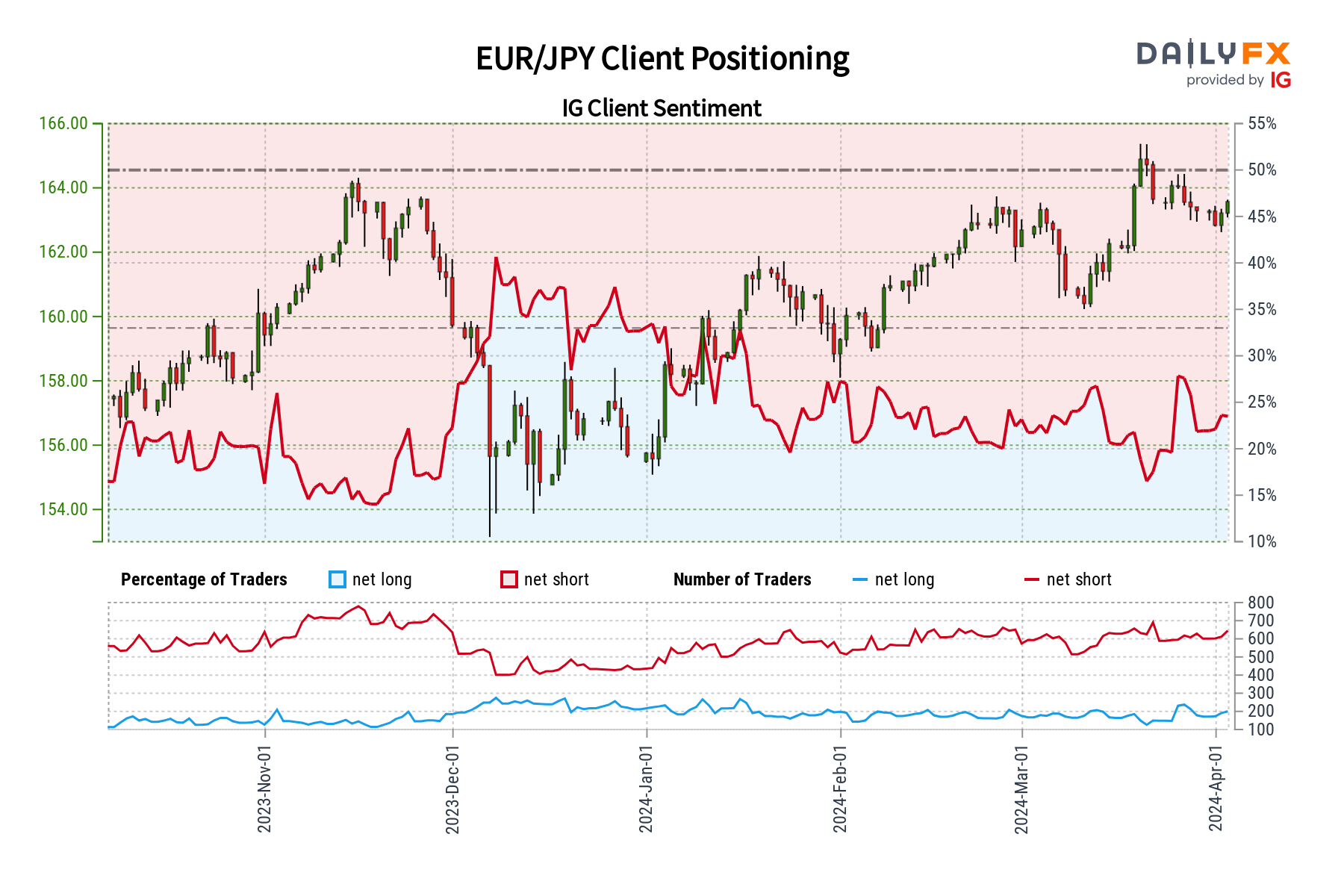

EUR/JPY FORECAST – MARKET SENTIMENT

IG data reveals a strong bearish bias towards the EUR/JPY, with 73.47% of traders currently holding net-short positions. This translates to a significant 2.77 to 1 short-to-long ratio. Notably, the number of net-short positions has climbed by 7.11% since yesterday and 1.73% compared to last week. However, net-long positions have also surged, up 25.13% from yesterday and a notable 18.78% from last week.

Our contrarian approach suggests this heavy net-short positioning could be a positive sign for the EUR/JPY. Yet, the recent weakening of the bearish bias introduces a degree of uncertainty. While the contrarian perspective still points to potential gains for the pair, the increasing number of long positions over key timeframes warns that a trend shift may be imminent.

As always, traders should carefully integrate sentiment signals with a well-rounded strategy that includes thorough technical and fundamental analysis.

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com

COMMENTS