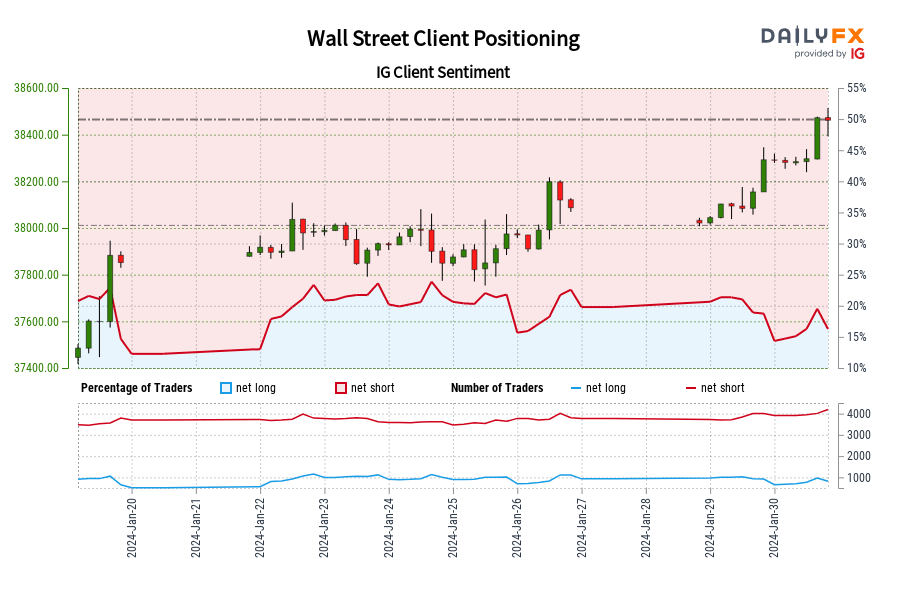

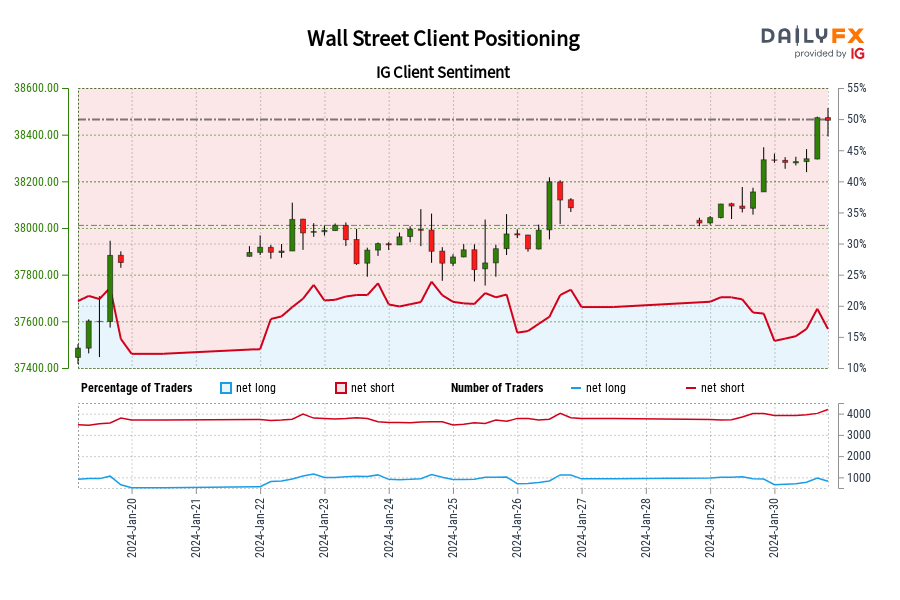

Number of traders net-short has increased by 18.13% from last week.SYMBOLTRADING BIASNET-LONG%NET-SHORT%CHANGE IN LONGSCHANGE IN SHORTSCHANGE IN OIWa

Number of traders net-short has increased by 18.13% from last week.

| SYMBOL | TRADING BIAS | NET-LONG% | NET-SHORT% | CHANGE IN LONGS | CHANGE IN SHORTS | CHANGE IN OI |

|---|---|---|---|---|---|---|

| Wall Street | BULLISH | 12.21% | 87.79% |

-10.37% Daily -35.17% Weekly |

8.02% Daily 18.13% Weekly |

5.38% Daily 7.35% Weekly |

| Change in | Longs | Shorts | OI |

| Daily | -10% | 8% | 5% |

| Weekly | -35% | 18% | 7% |

Wall Street: Retail trader data shows 12.21% of traders are net-long with the ratio of traders short to long at 7.19 to 1. Our data shows traders are now at their least net-long Wall Street since Jan 20 when Wall Street traded near 37,852.10. The number of traders net-long is 10.37% lower than yesterday and 35.17% lower from last week, while the number of traders net-short is 8.02% higher than yesterday and 18.13% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests Wall Street prices may continue to rise.

Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger Wall Street-bullish contrarian trading bias.

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com

COMMENTS