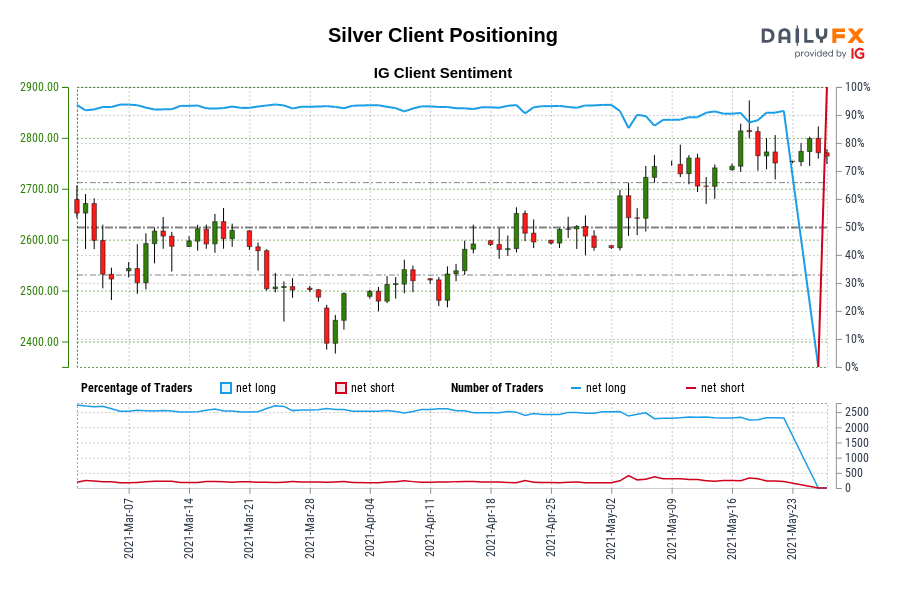

Variety of merchants net-short has decreased by 100.00% from final week. SYMBOL TRADING BIAS NET-LONG% NET-SHORT% CHANGE IN LONGS CHANGE IN S

Variety of merchants net-short has decreased by 100.00% from final week.

|

SYMBOL |

TRADING BIAS |

NET-LONG% |

NET-SHORT% |

CHANGE IN LONGS |

CHANGE IN SHORTS |

CHANGE IN OI |

|

Silver |

BEARISH |

100.00% |

0.00% |

100.00%

-99.96% |

-100.00%

-100.00% |

0.00%

-99.96% |

Silver: Retail dealer knowledge reveals 100.00% of merchants are net-long with the ratio of merchants lengthy to brief at 10,000.00 to 1. Our knowledge reveals merchants at the moment are at their most net-long Silver since Mar 08 when Silver traded close to 2,515.30. The variety of merchants net-long is 100.00% greater than yesterday and 99.96% decrease from final week, whereas the variety of merchants net-short is 100.00% decrease than yesterday and 100.00% decrease from final week.

We usually take a contrarian view to crowd sentiment, and the very fact merchants are net-long suggests Silver costs might proceed to fall.

Merchants are additional net-long than yesterday and final week, and the mix of present sentiment and up to date modifications provides us a stronger Silver-bearish contrarian buying and selling bias.

component contained in the

component. That is most likely not what you meant to do!nn Load your utility’s JavaScript bundle contained in the component as a substitute.www.dailyfx.com