Silver Worth Forecast: Silver value motion enthralled by symmetrical wedgeCCI means that Silver could also be harboring oversold

Silver Worth Forecast:

- Silver value motion enthralled by symmetrical wedge

- CCI means that Silver could also be harboring oversold circumstances

- Sentiment stays blended

Silver costs have continued to commerce sideways amid an array of political and elementary occasions that proceed to weigh on the dollar. After months of negotiations, US president Joe Biden is predicted to disclose the dimensions of the extremely anticipated Fiscal Stimulus bundle later at present, which as soon as once more raises the potential for inflationary issues; a subject that has been on the forefront of the Federal Reserve because the begin of the Coronavirus pandemic.

Whereas Silver and Gold are sometimes perceived as an inflationary hedge, a latest surge in Treasury Yields (notably the 10 yr) has jeopardized additional power for safe-haven belongings as buyers start to cost in inflation and the likelihood of price hikes sooner or later, taking a look at US Treasuries and a latest rise in yields.

Go to the DailyFX Academic Heart to find why information occasions are Key to Foreign exchange Basic Evaluation

Beneficial by Tammy Da Costa

How information can affect your trades?

Silver (XAG/USD) Technical Evaluation

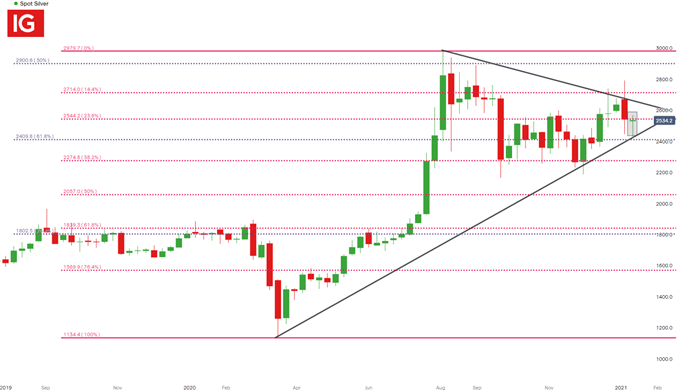

Silver costs proceed to commerce inside a latest vary, encapsulated by the bounds of a symmetrical wedge that has developed on the weekly chart. In the meantime, the Fibonacci retracement ranges from each the historic transfer (Nov 2008 – March 2011) and the short-term transfer (March 2020 – August 2020) proceed to offer help and resistance for XAG/USD, with bulls and bears battling it out to push by means of these key ranges.

Silver (XAG/USD) Weekly Chart

Chart ready by Tammy Da Costa, IG

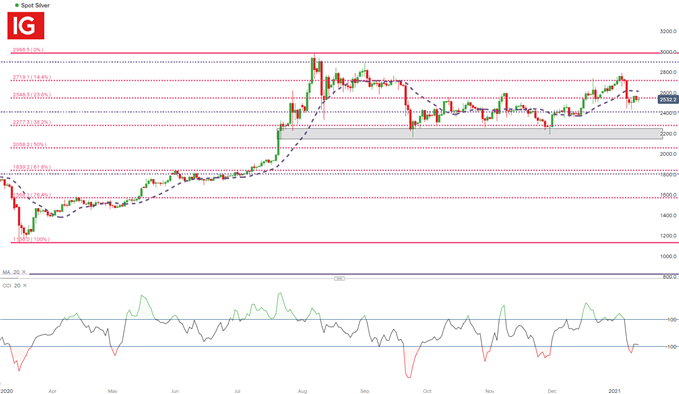

After failing to achieve the psychological stage of 2800, Silver costs fell to a key stage of help, fashioned by the 23.6% Fibonacci stage of the short-term transfer, at 2548.3. This stage is now offering resistance for the dear metallic, whereas the 61.8% retracement of the long-term transfer now holds as help at 2409.8. The Commodity Channel Index (CCI) at the moment rests at -88, bordering oversold territory with the present pattern nonetheless in favor of the bears as value motion stays beneath the 20-Day Transferring Common.

Beneficial by Tammy Da Costa

What does it take to be a assured dealer?

Silver (XAG/USD) Every day Chart

Chart ready by Tammy Da Costa, IG

For now, help potential stays round the important thing psychological stage of 2500 with the 61.8% Fibonacci retracement stage offering extra help at 2409.8

Silver Shopper Sentiment

Beneficial by Tammy Da Costa

How you can learn consumer sentiment

On the time of writing, retail dealer information reveals 91.44% of merchants are net-long with the ratio of merchants lengthy to quick at 10.68 to 1. The variety of merchants net-long is 0.40% decrease than yesterday and a couple of.68% decrease from final week, whereas the variety of merchants net-short is 0.96% larger than yesterday and a couple of.31% decrease from final week.

We usually take a contrarian view to crowd sentiment, and the actual fact merchants are net-long suggests Silver costs might proceed to fall.

But merchants are much less net-long than yesterday and in contrast with final week. Current adjustments in sentiment warn that the present Silver value pattern might quickly reverse larger regardless of the actual fact merchants stay net-long.

— Written by Tammy Da Costa, Market Author for DailyFX.com

Contact and observe Tammy on Twitter: @Tams707