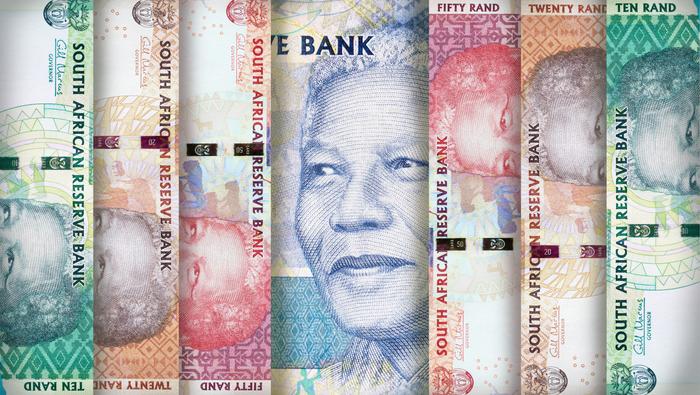

RAND ANALYSISUSD/ZAR regular on the again of sturdy commodity costsNative outlook stays grimFOMC minutes scheduled tomorrowZAR

RAND ANALYSIS

- USD/ZAR regular on the again of sturdy commodity costs

- Native outlook stays grim

- FOMC minutes scheduled tomorrow

ZAR FUNDAMENTAL BACKDROP

After a tempestuous week final week, the rand has opened up barely stronger in opposition to the U.S. greenback; primarily buoyed by rising commodity costs however extra particularly South African linked commodities reminiscent of platinum, gold and iron ore that are all buying and selling larger in the present day.

GET YOUR Q3 RAND FORECAST HERE!

LOCAL CHALLENGES ESCALATE

From the South African perspective, COVID-19 considerations stay whereas vaccine rollouts have been slower than initially anticipated. Whereas instances are steadily rising, the nation stays in lockdown alert degree four which may very well be extended if the present trajectory persists.

Politically, discussions concerning the former President Jacob Zuma’s incarceration has flooded native headlines with query marks over the capability of the present President Cyril Ramaphosa and the judicial system to observe by on the imprisonment of Mr. Zuma.

A further dent to investor confidence has been the case of Rio Tinto saying drive majeure over native mining firm Richards Bay Minerals (RMB). That is largely as a result of local people extorting the mining firms which at its worst led to the demise of an RMB worker. This might have a contagion impact on different companies which can contribute to rand weak point long-term.

ATTENTION ON FOMC THIS WEEK

Upcoming danger occasions are slim relative to final week’s bombardment of excessive influence bulletins. Tomorrow, the Federal Market Open Committee (FOMC) minutes (see calendar under) might be a key focus for greenback crosses (together with USD/ZAR) which may present some steering on tapering, and the disposition of Fed officers on potential rate of interest changes. Volatility is prone to construct up pre-announcement which may prolong ought to any surprises come up from the assembly.

USD/ZAR ECONOMIC CALENDAR

Supply: DailyFX financial calendar

TECHNICAL ANALYSIS

USD/ZAR DAILY CHART

Chart ready by Warren Venketas, IG

USD/ZAR briefly peaked above the long-term trendline resistance zone (black) which rapidly pulled again closing barely under the zone final week. An in depth above this degree could have prompted a bullish begin to the week.

Worth motion appears to be reverent of the 100-day EMA (yellow) as resistance and 20-day EMA (purple) as assist since Sunday’s open. A break above or under these respective areas may give merchants a short-term directional bias.

The Relative Energy Index (RSI) reveals slowing upside momentum which is contradictory to cost motion which illustrates larger highs for a similar interval. This might recommend bearish divergence supported by the latest pullback by rand bulls. Ought to this proceed, 14.1357 will function preliminary assist with the 14.0000 psychological degree the next goal.

Bulls will monitor costs ought to break above the 100-day EMA happen. If that’s the case, the latest swing excessive will come into focus at 14.4026.

— Written by Warren Venketas for DailyFX.com

Contact and observe Warren on Twitter: @WVenketas

ingredient contained in the

ingredient. That is in all probability not what you meant to do!Load your software’s JavaScript bundle contained in the ingredient as an alternative.

www.dailyfx.com