It’s been a giant day for U.S. shares, led by a run at all-time highs within the S&P 500 SPX. Values are driving north of 3300.00 and approach

It’s been a giant day for U.S. shares, led by a run at all-time highs within the S&P 500 SPX. Values are driving north of 3300.00 and approaching the pre-COVID-19 ranges of final February. For now, the market drivers are a bit obscure. A second spherical of COVID-19 stimulus funds seems to be doubtful, U.S./China relations have gotten much more frayed, and COVID-19 an infection charges are on the rise. Whereas in the present day’s motion is robust, it’s a problem to determine what precisely is driving the optimistic sentiment.

On the commodity entrance, WTI crude oil is exhibiting power above $42.50. A minimum of among the good cheer could also be attributed to a different drop in U.S. oil provides. Earlier, the EIA reported a drop of -4.512 million barrels, the third main lower in a row. This isn’t unusual for the summer season driving season because the demand for refined fuels is powerful. Finally, we’ll see how lengthy the power lasts ― Labor Day weekend is underneath a month away, marking the unofficial finish of the summer season trip season.

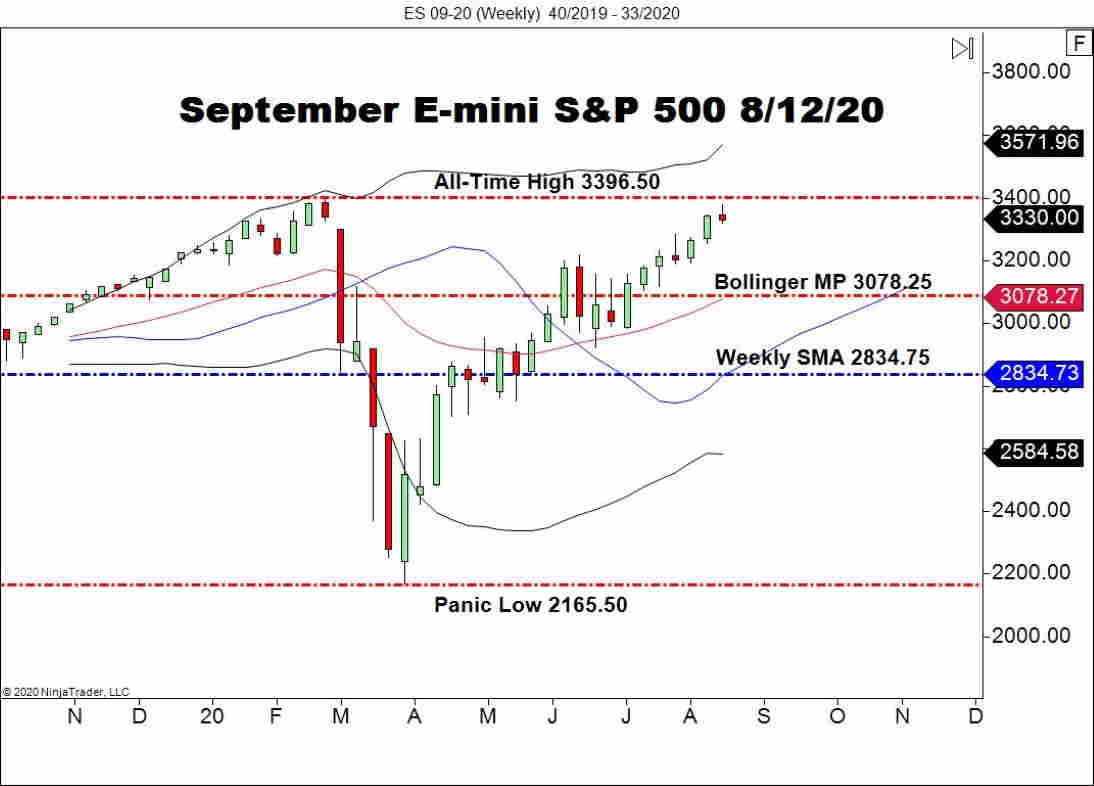

Bidders are in agency management of the S&P 500, sending the market some 1.20% larger for the session. Let’s dig into the weekly technicals for the September E-mini S&P 500 and see the place this market stands.

S&P 500 On The Doorstep Of February’s Highs

Under is a weekly chart of the September E-mini S&P 500 as of Tuesday’s shut. As you’ll be able to see, the all-time excessive of 3396.50 was in line for a take a look at. The weekly bullish pattern stays legitimate and a late-summer rally seems to be a foregone conclusion for U.S. shares.

++40_2019+-+33_2020.jpg)

Overview: As we head towards mid-August commerce, COVID-19 information is taking a backseat to inflationary pricing. This week has introduced us exploding COVID-19 an infection charges in addition to a spike in inflation. Up to now, buyers have chosen to get out in entrance of inflation as an alternative of limiting publicity on account of COVID-19. Whereas a viable vaccine seems to be a methods off, it appears to be like just like the markets are already pricing an finish to the pandemic’s financial attain.