US STOCKS OUTLOOK POST FOMC:The FOMC raises its benchmark rate by 50 basis points to 0.75-1.00%, in line with market expectations. The bank also anno

US STOCKS OUTLOOK POST FOMC:

- The FOMC raises its benchmark rate by 50 basis points to 0.75-1.00%, in line with market expectations. The bank also announces a plan to begin trimming its massive balance sheet

- Powell states that there is a path for the economy to soft-land and rules out increasing borrowing costs in 75 bps increments in the future

- S&P 500 and Nasdaq 100 rally sharply as traders cheer Powell’s comments indicating no appetite for supersize hikes

Most read: Rising Rates and Volatility are Features, Not Bugs – Top Trade Opportunities

U.S. stocks struggled for direction for most of the day, oscillating between small gains and losses, but managed to rally violently in the late trade after the Federal Reserve’s monetary policy announcement brought no hawkish bombshells. When it was all said and done, the S&P 500 surged 2.99% to 4,300, its highest close since April 21. The Nasdaq 100, for its part, led the advance on Wall Street, soaring 3.41% to 13,535, bolstered by broad-based strength in the tech sector amid lower U.S. Treasury yields.

The FOMC concluded today its May meeting and raised the federal funds rate by 50 basis points to 0.75-1.00%, in line with consensus expectations. The hike, which was the second during this cycle and the first non-standard 25 bps adjustment since early 2000 during the Alan Greenspan era, was delivered by unanimous decision, a sign that hawks are not currently pushing for more forceful measures to tackle the fastest inflation in four decades.

The central bank also announced a plan to begin trimming its balance sheet, with implementation beginning on June 1. The process, known as quantitative tightening, will be carried out primarily by decreasing reinvestments of principal payments, rolling maturing securities off the portfolio at an initial combined monthly pace of $47.5 billion, increasing the caps to $95 billion over three months.

The policy statement did not change significantly compared to the one issued in March, although there were some differences. On the growth front, the communiqué noted that overall economic activity edged down in the first quarter, but stressed that household spending and fixed investment remained strong. Elsewhere, the document reiterated that inflation remains elevated, reflecting pandemic-related supply and demand imbalances and higher energy prices, while highlighting that the war in Eastern Europe and COVID-related lockdowns in China could create upside risks. On monetary policy, the language remained the same and stressed that the Committee anticipates that “ongoing increases in the target range will be appropriate”.

U.S. stocks lacked clear directional conviction after the bank’s decision was made public, but began rallying violently during Chairman Jay Powell’s appearance before the media. In his press conference, Powell emphasized that there is a path for a soft landing, but more importantly, ruled out the possibility of raising borrowing in 75 bps increments (as I predicted here), remarking that the FOMC is not actively considering hikes of that magnitude amid hopes that inflation will begin to flatten out.

Policymakers face the difficult mission of engineering a soft landing for the U.S. economy, a very rare outcome according to the historical playbook. If tightening is too slow, the central bank risks falling further behind the curve and allowing inflation to spiral out of control, a situation that could require even harsher measures in the future. On the flip side, if policy accommodation is withdrawn too quickly, the institution could destabilize the financial system, trigger a significant bear market, and push the economy into recession. Judging by today’s price action, it appears that traders were reassured by the signal that the central bank will not withdraw support in an overly aggressive manner and to the point of causing significant economic damage.

With Fed jitters abating and sentiment on the mend, equities could stabilize and begin a steadier recovery in the days and weeks ahead. Tech stocks, which have sold off and de-rated dramatically, could lead the charge higher, especially if U.S. Treasury yields accelerate their descent.

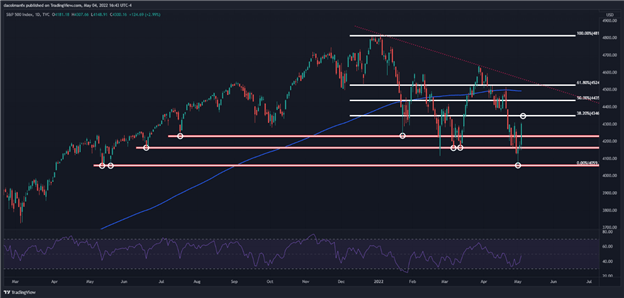

S&P 500 TECHNICAL ANALYSIS

After encountering support near the 4,060 area, the S&P 500 staged a remarkable rebound, rallying almost 6% from those levels. While the broader outlook remains bearish after April’s epic sell-off, sentiment could begin to improve if gains accelerate in the coming sessions. That said, if the index manages to follow-through on the topside, resistance is seen around 4,346, the 38.2% Fibonacci retracement of the 2022 decline. On further strength, the focus shifts up to 4,435. On the other hand, if sellers return and fade the recent rally, initial support comes in at 4,225. If this floor is taken out decisively, the S&P 500 could revisit the 4,160 zone in short order.

S&P 500 TECHNICAL CHART

S&P 500 Chart Created Using TradingView

EDUCATION TOOLS FOR TRADERS

- Are you just getting started? Download the beginners’ guide for FX traders

- Would you like to know more about your trading personality? Take the DailyFX quiz and find out

- IG’s client positioning data provides valuable information on market sentiment. Get your free guide on how to use this powerful trading indicator here.

—Written by Diego Colman, Market Strategist

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com