UK Unemployment Rate Rises to 4.3%, While Earnings Remain ElevatedThe UK unemployment rate rose to 4.3% in March from a prior 4.2% as tight monetary

UK Unemployment Rate Rises to 4.3%, While Earnings Remain Elevated

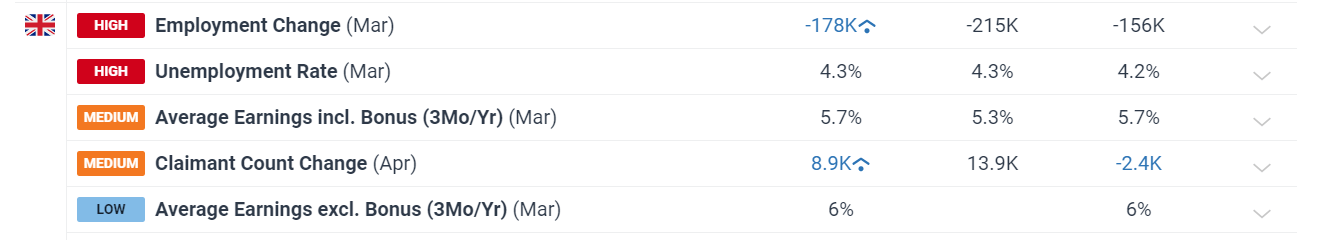

The UK unemployment rate rose to 4.3% in March from a prior 4.2% as tight monetary conditions are slowly having an effect on the real economy. One area where contractionary policy is not having as much of an effect is on earnings. The measure of UK wages that includes bonuses remained at 5.7% while the measure excluding bonuses remained steady at 6%. The decline in earnings growth has started to peter out, suggesting wage pressures remain.

However, the Bank of England (BoE) hinted at it’s most recent meeting that it is not looking too closely into wage dynamics as it is showing to have a diminished effect on influencing the overall level of prices in the economy.

Customize and filter live economic data via our DailyFX economic calendar

Get your hands on the Pound Sterling Q2 outlook today for exclusive insights into key market catalysts that should be on every trader’s radar:

Recommended by Richard Snow

Get Your Free GBP Forecast

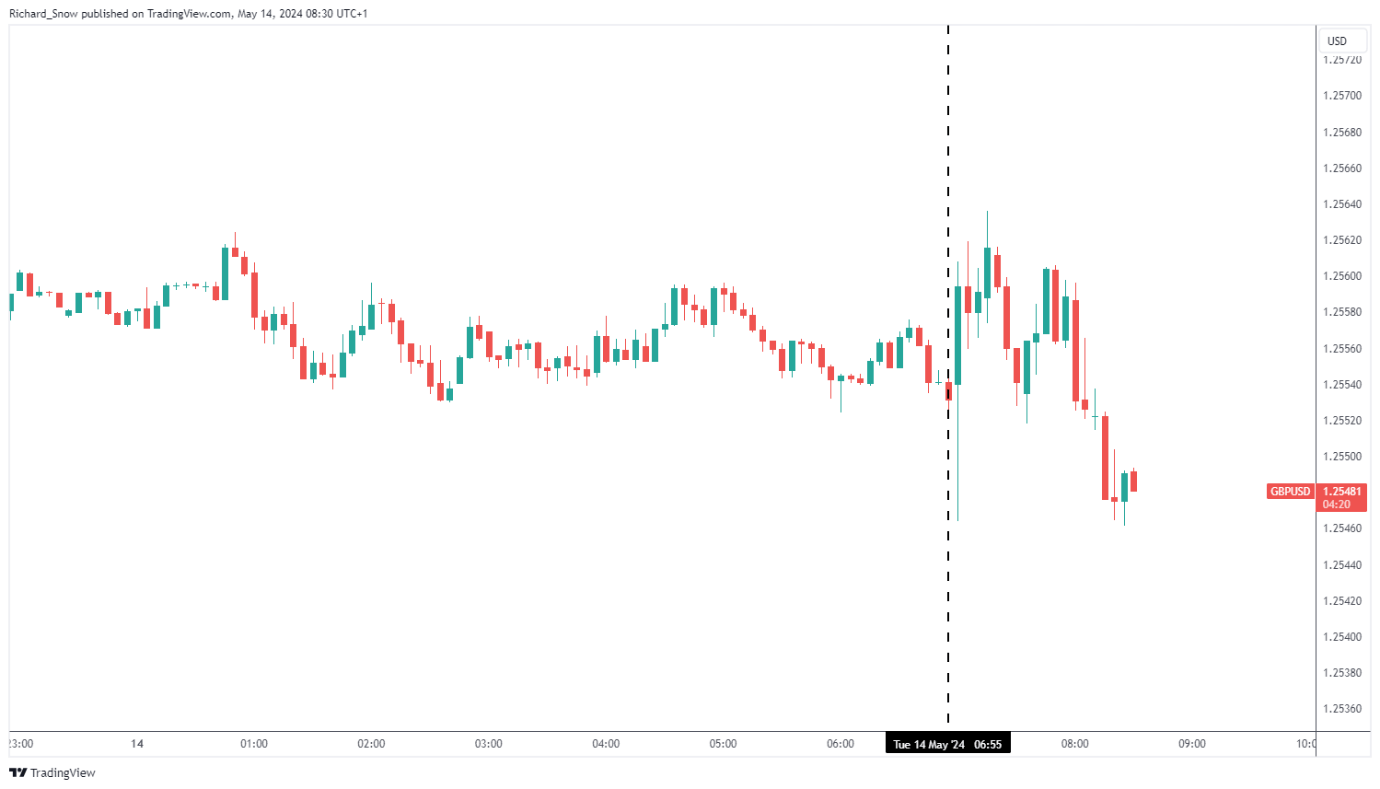

Cable’s immediate market reaction involved a move higher, which was ultimately reversed within minutes.

GBP/USD Immediate Reaction (5-Minute Chart)

Source: TradingView, prepared by Richard Snow

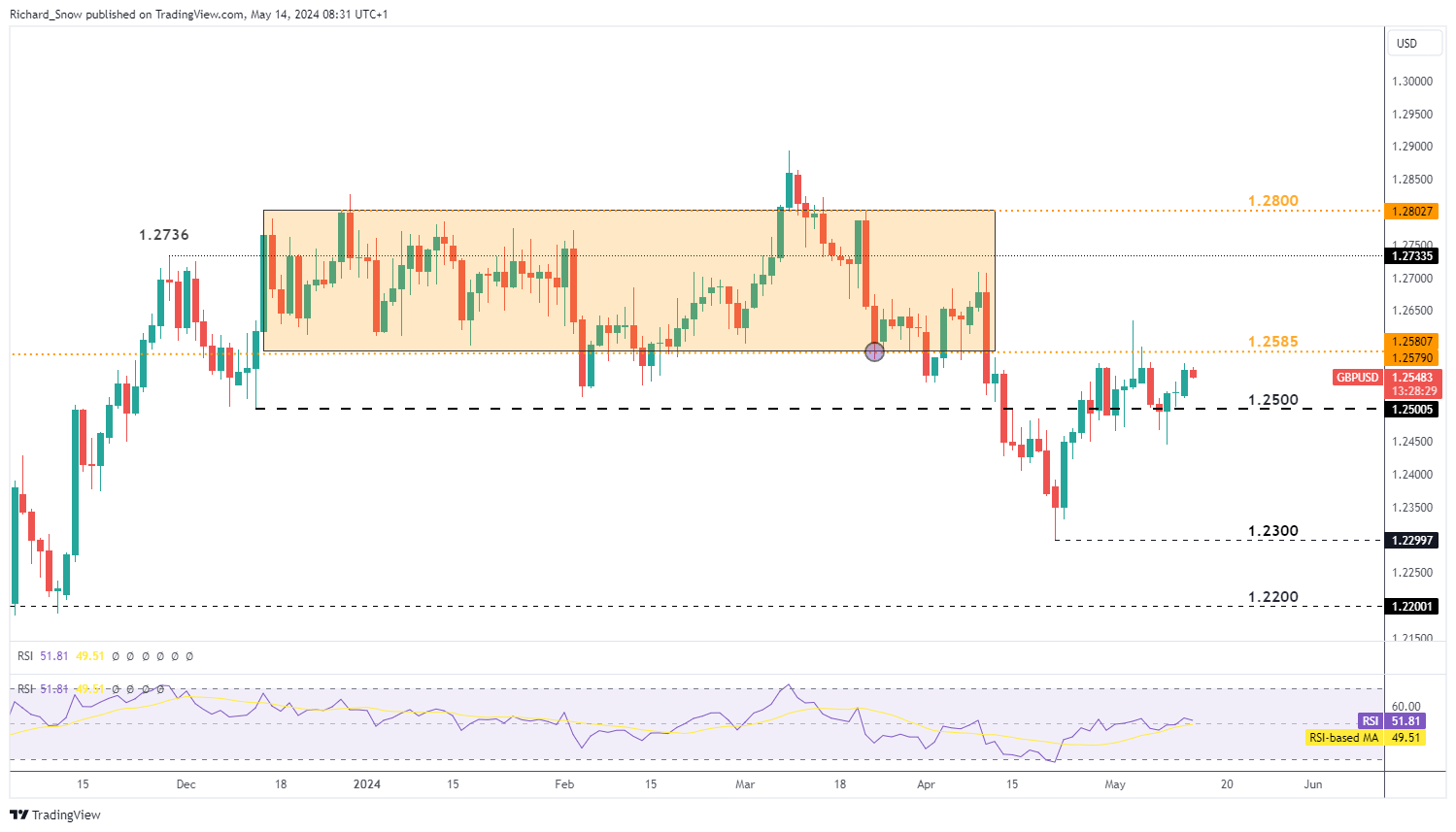

GBP/USD appears to be eying a move lower on the back of a softer labour market and ahead of tomorrow’s US CPI data. Today’s US PPI data may provide some movement on its release if there can be any read across for tomorrow’s main inflation reading.

A hotter CPI print tomorrow could buoy the greenback, sending GBP/USD lower. Recent soft data like the 1-year ahead estimates of inflation according to the University of Michigan Consumer Sentiment report, as well as the NY Fed Survey, suggest tomorrow’s lower CPI estimates might be premature. 1.2500 remains a key psychological level, separating bullish and bearish plays. Bullish continuation setups may look to a move above 1.2585 for confirmation, while a move below 1.2500 and the recent spike low at 1.2446 may be sought out for greater confidence centered around bearish biases.

GBP/USD Daily Chart

Source: TradingView, prepared by Richard Snow

| Change in | Longs | Shorts | OI |

| Daily | -5% | 19% | 6% |

| Weekly | -6% | 16% | 4% |

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com

COMMENTS