Amid the backdrop of fairly strong equity markets globally, continued inflation, but fairly stable cross-currency rates, the online trad

Amid the backdrop of fairly strong equity markets globally, continued inflation, but fairly stable cross-currency rates, the online trading FX and CFDs industry had a fairly good year overall in 2023.

However, as we’ve seen previously, it was a very haves-and-have-nots type market, with some brokers and providers setting records while others were struggling to survive, leading to increased consolidation in the sector.

Looking at the B2B segment – i.e. those companies which provide technology and services to the brokerage sector and directly to larger traders – following last year’s drastic move by Apple to remove the popular MT4 and MT5 trading platforms from its App Store (although MT4/MT5 were reinstated in Q1-2023) there was continued movement by brokers to add alternative trading platforms and apps to their lineups. This also led to increased partnerships among various B2B solution suppliers of CRM, KYC and onboarding, liquidity, and bridging and platform technologies for brokers, with tech and service providers looking to be able to provide more comprehensive and integrated “turnkey” solutions to an increasingly receptive brokerage community.

Our Top FX and CFD trading industry news stories of 2023 are a combination of the most-read articles of the year here on FNG, themes which emerged during the year, as well as stories which are bound to help shape the sector as we move forward into 2024.

What were the most-read stories this past year on FNG?

Which rising brand names in the FX/CFDs business were somewhat humbled in 2023?

What were the key “deals of the year” and top management moves in the FX/CFDs sector?

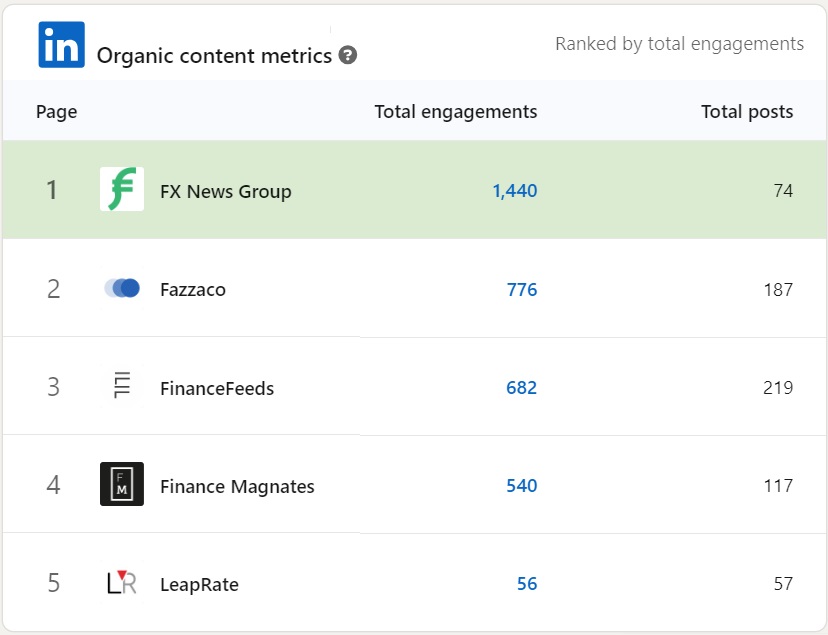

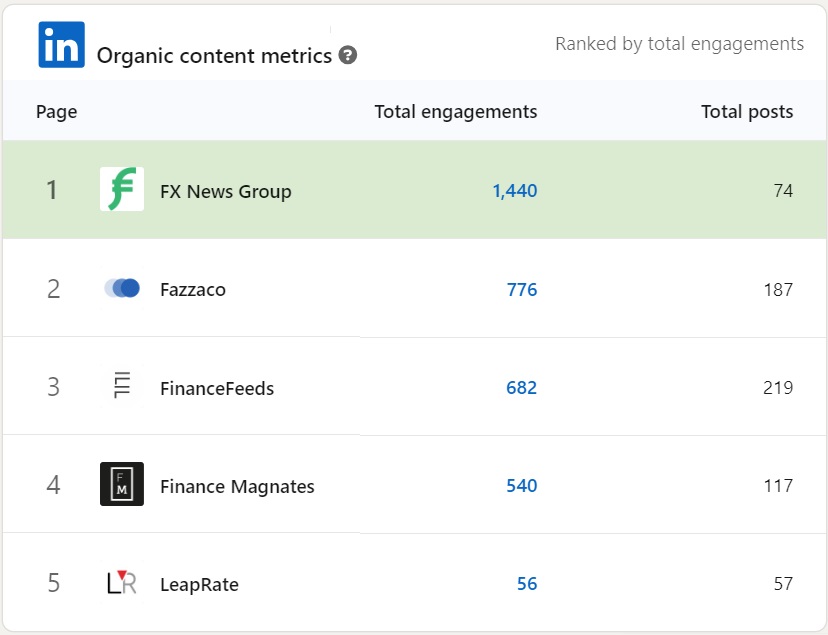

Before we begin, we here at FNG would like to take this opportunity to wish all our readers happy holidays, and a healthy and prosperous 2024. We appreciate you all making us the most-read (and, by our competitors, most copied!) FX/CFDs industry news site in 2023 as we broke virtually every news story in the sector that mattered – and we will continue to take that responsibility very seriously into 2024. FNG articles also dominated social media (see LinkedIn’s latest 30-day Competitor stats at right), getting several x the Engagement as compared to other “FX news” sites that just copy our headlines, publish promotional articles, and give out paid-for awards.

Before we begin, we here at FNG would like to take this opportunity to wish all our readers happy holidays, and a healthy and prosperous 2024. We appreciate you all making us the most-read (and, by our competitors, most copied!) FX/CFDs industry news site in 2023 as we broke virtually every news story in the sector that mattered – and we will continue to take that responsibility very seriously into 2024. FNG articles also dominated social media (see LinkedIn’s latest 30-day Competitor stats at right), getting several x the Engagement as compared to other “FX news” sites that just copy our headlines, publish promotional articles, and give out paid-for awards.

Hope to meet you all in person as well as online in the new year!

1. MT4 / MT5 reinstated on Apple App Store

As MetaQuotes goes, so goes the entire online trading industry. For better or for worse, MetaQuotes has been the bellwether of the FX and CFDs brokerage business for the past 20 years, with its MT4 and MT5 trading platforms accounting for more than half of trading volumes by retail trading clients globally.

As MetaQuotes goes, so goes the entire online trading industry. For better or for worse, MetaQuotes has been the bellwether of the FX and CFDs brokerage business for the past 20 years, with its MT4 and MT5 trading platforms accounting for more than half of trading volumes by retail trading clients globally.

So when MT4 and MT5 were suddenly removed by Apple from its App Store in September of 2022, there followed a mad scramble by brokers to add alternative trading platforms from MetaQuotes’ up-and-coming competitors, creating the first real shakeup in the trading platform business in more than a decade.

While MetaQuotes did (in our view) handle the crisis well and worked closely (and quietly) with Apple to get its apps back up – which it did in March 2023 – the door was opened for other providers like Match-Trade and X Open Hub to get brokers to add their platforms and white label solutions, and encourage clients to use them. MetaQuotes responded later in the year with the largest upgrade of MT5 in recent years. However with the “door opened” to new providers, we also saw increased partnerships between various point technology and service providers (more on that below), with various B2B companies positioning themselves to be part of a more comprehensive solution for brokers.

How will things shake out in the trading platform business in 2024? We’ll see, but it should be interesting.

2. FX and CFD broker Rebrandings

With brokers effectively offering fairly similar products on nearly identical trading platforms, a lot of success in the business relies on branding – as being trusted, safe, properly regulated, as well as providing good customer service, tight spreads, and reliable deposit and withdrawal mechanisms.

With brokers effectively offering fairly similar products on nearly identical trading platforms, a lot of success in the business relies on branding – as being trusted, safe, properly regulated, as well as providing good customer service, tight spreads, and reliable deposit and withdrawal mechanisms.

So it should come as no surprise that brand-dependent brokers look at rebranding their entire businesses more than in other sectors. Either because the old brand isn’t really viewed well any more, or due to a change in focus or ownership or management, or just to shake things up a little.

Some of the more interesting and prominent rebrandings this past year in the FX and CFDs sector included:

- iS Prime became iSAM Securities. One of the more important liquidity providers to the FX and CFD brokerage sector underwent a change in senior management early in the year, with major shareholder iSAM deciding to consolidate its various FX and CFD industry-facing brands under the iSAM Securities banner.

- GKFX rebranded as Trive. A restructuring of Turkish entrepreneur Kasim Garipoglu’s holdings included the transfer of the GKFX online brokerage business to Amsterdam based financial services company Trive Financial, in which he has a financial interest. The business itself was then rebranded as Trive, with the FCA licensed GKPro institutional business becoming Trivepro.

- TigerWit is rebranding as Calico Capital following a sale of the company (see more in #7 below).

- Australia based institutional CFDs broker Invast Global rebranded as 26 Degrees, as operator INV Inc saw its share price fall to a 52 week low amid a decrease in profitability and cash outflows.

- Zenfinex rebrands Retail FX arm to Taurex.

3. ThinkMarkets IPO

FNG’s coverage of the ThinkMarkets IPO saga – from initial announcement in May until the deal was pulled in early December – is in our view a good example of why FNG has become the leading FX and CFDs industry news site, and the only one really trusted and followed by both serious traders and industry executives alike.

FNG’s coverage of the ThinkMarkets IPO saga – from initial announcement in May until the deal was pulled in early December – is in our view a good example of why FNG has become the leading FX and CFDs industry news site, and the only one really trusted and followed by both serious traders and industry executives alike.

While other “news sites” basically copy-pasted press releases put out by the parties to the transaction, which would have seen ThinkMarkets merge into a publicly traded special purpose acquisition company (SPAC) called FG Acquisition Corp, FNG dug deep and uncovered what was really going on behind the scenes.

Large losses and growing debt at ThinkMarkets.

A going-concern warning issued by ThinkMarkets’ auditors.

The decision by virtually all of FG’s public shareholders to get their money back instead of going ahead with the deal.

And, ultimately, the decision of the parties to part ways and cancel the ThinkMarkets IPO transaction.

In aggregate, our coverage of the ThinkMarkets IPO story from beginning to end was FNG’s most-viewed article series of the year.

From an industry perspective, and in fairness to ThinkMarkets, this was the third consecutive failed attempt by a Retail FX and CFDs broker to go public in the past two years, all via the (attempted) SPAC-merger route. Israel based, social-trading focused broker eToro tried to merge with a NASDAQ listed SPAC at a $10 billion valuation, but that deal was pulled in the summer of 2022. And last December Copenhagen based Saxo Bank terminated its $2 billion IPO attempt via a merger with Euronext Amsterdam listed Disruptive Capital Acquisition Co.

It simply isn’t easy to “go public” if you’re in the online brokerage business.

Will another broker (or brokers) try again in 2024?

4. Exness, the $4 trillion broker

A question we often hear spoken quietly in the FX and CFDs sector is “how does Exness do it?”

A question we often hear spoken quietly in the FX and CFDs sector is “how does Exness do it?”

While we won’t try to venture an answer here, but by “it” folks mean a seemingly never-ending ceiling of clients and trading volumes.

After becoming (by our estimation) the first-ever Retail FX and CFDs broker to top the $3 trillion monthly trading volumes mark in February 2023, the broker hit $4 trillion by August before setting an all-time best with Exness topping $4.8 trillion in October 2023. (November volumes were a measly $3.9 trillion).

Exness now has more than 600,000 active retail clients trading on its platform every month.

5. New CEOs at various FX/CFD brokers and platforms

The year 2023 might be viewed somewhat as a changing of the guard in the business, with a number of leading CEOs leaving and new executives stepping in to carry the torch. We counted no less than 10 new CEOs at important industry companies including IG Group, Capital.com (for the second year in a row), FXSpotStream and Spotware.

Some of the key executive moves reported here at FNG over the past 12 months follow:

-

Breon Corcoran IG Group appoints Breon Corcoran as CEO. Following the departure earlier this year of June Felix and the naming of CFO Charlie Rozes as Interim CEO, leading UK online broker IG Group went outside the company (and the industry) to hire a new chief executive.

- Kypros Zoumidou replaces Peter Hetherington as CEO of Capital.com. One of the big “coups” of the year 2022 was Capital.com nabbing former IG Group CEO Peter Hetherington as CEO. While Mr. Hetherington successfully rebuilt the entire senior management team at Capital.com (with many coming from IG), his tenure at Capital.com lasted just over a year, before he decided to leave.

- Michael Milonas replaces Ben Bilski as CEO of NAGA Group.

- FXSpotStream hires CME’s EBS chief Jeff Ward as CEO.

- Ilia Iarovitcyn becomes CEO of cTrader developer Spotware.

- Stavros Anastasiou named CEO of Markets.com.

- Joe Rundle joins Intertrader as CEO.

- Mohamad Ibrahim joins XS.com as Group CEO.

- StoneX exec Alex Howard replaces Joel Murphy as CEO of Eightcap.

- Scope Markets names Pavel Spirin as CEO.

6. Partnerships among B2B suppliers

The idea of FX and CFD industry B2B suppliers partnering to some degree is not a new one.

But in 2023 it was taken to new heights, driven mainly by the increased openness of brokers to adding alternative trading platforms, as we noted in #1 above. There is also seemingly more awareness among brokers that to compete in the future they need to improve and update their technology stack, everything from CRM to onboarding to risk management and trading systems.

However brokers don’t want to have to deal with several disparate suppliers, nor do they want to worry about integrating different best-in-breed solutions from various providers, which can cause more headaches than it solves.

Enter the era of B2B partnerships.

Some of the interesting partnerships we noted during 2023 included:

- Bridging and connectivity specialist Centroid Solutions inked a number of partnerships in 2023, including with FX Back Office (CRM), Iress pricing data and trading APIs, Skale (CRM), and TransactCloud (ops support for brokers).

- Trading tech provider Match-Trade also signed a number of partnerships this year around its Match-Trader multi-asset trading platform, such as B2Broker (white label solution), FPFX Tech (Prop Trading solution), and Broctagon’s AXIS (CRM for brokers).

- Leading MT4/MT5 tech solutions provider Gold-i expanded its capabilities to better serve the Cyprus based brokerage community by partnering with local firm DL Consulting. Gold-i also partnered this year with Finalto which embedded Gold-i’s MatrixNET into its ClearVision account management system.

7. FX and CFDs industry acquisitions and consolidation

Although more than one of the following stories fit into our Top 10 most-read articles of the year and could qualify individually for “Top Story” consideration, when looking at the M&A activity in the Retail FX and CFDs sector as a whole we had one reaction – consolidation.

Although more than one of the following stories fit into our Top 10 most-read articles of the year and could qualify individually for “Top Story” consideration, when looking at the M&A activity in the Retail FX and CFDs sector as a whole we had one reaction – consolidation.

As industries mature, consolidation is almost always a given as some operators seem to aggressively pursue growth having access to capital, while others prefer (or need) to sell for one of a variety of reasons – short term cash crunch, a major backer/shareholder shifting priorities, or just a desire to “cash out” by selling to a competitor.

We seem to have seen a little of all of that in 2023, with some brokers who ran into some of trouble or issue selling their clients / brand / business.

Some of the top M&A deals-of-the-year in the online trading sector included:

Capital.com buys out OvalX (formerly ETX Capital). After OvalX major shareholder Jump Capital decided it was no longer going to put more capital into the company to cover continued losses, OvalX’s client base was sold to rival Capital.com.

BUX acquired by ABN Amro. Once one of the high-flying EU neobrokers, Amsterdam based BUX was taken over by one of its original backers, Dutch banking giant ABN Amro. The move came after BUX abandoned a failed (and expensive) attempt to expand to the UK, and a decision to shut down its Cyprus based CFDs brokerage business branded as Stryk.

Capex.com acquires NAGA Group. Another previous high-flyer, social trading focused NAGA Group dealt with a huge 2022 loss of €37 million and a drop in Revenues during 2023 by finding a “white knight” in Capex.com, which agreed to merge with NAGA. Capex.com shareholders, led by Octavian Patrascu who will become CEO of the combined company, will own about 75% of publicly traded NAGA going forward.

TigerWit sold, rebranding as Calico.

Global Prime sold, owners Jeremy Kinstlinger and Elan Bension start Afterprime.

Noor Capital expanding to UK, buying House of Borse.

Orbex acquires Retail FX clients of HonorFX.

Fortune Prime acquires ASIC licensed CFDs broker GMT Markets.

Capex.com acquires WiredMarket.com expanding to Greece.

fxnewsgroup.com

COMMENTS