It’s been a tough three days for GOLD as COVID-19 vaccine hopes have shaken safe-haven sentiment. As we speak has introduced extra ache to bullion

It’s been a tough three days for GOLD as COVID-19 vaccine hopes have shaken safe-haven sentiment. As we speak has introduced extra ache to bullion holders, with values sliding almost 1%. Now, the costs of December gold futures are within the space of a key triple-bottom sample on the every day chart.

For the session, safe-havens are as soon as once more taking it on the chin. The USD/CHF and USD/JPY are each extending weekly features. This value motion favors the Buck as market contributors shift into danger belongings. At this level, one is hard-pressed to argue that election and coronavirus uncertainty isn’t subsiding.

As soon as once more, it’s Veteran’s Day and which means a relaxed U.S. financial calendar. Nevertheless, this dynamic is quickly to vary. Thursday brings the discharge of October’s CPI figures, in addition to the weekly jobless claims numbers. Month-over-month CPI is predicted to carry agency at 0.2%, suggesting flat inflation. Whereas it is a major market mover, I don’t anticipate an entire lot of motion until we see a serious deviation from expectations.

Let’s check out December gold futures and see the place the world’s premier safe-haven could also be heading.

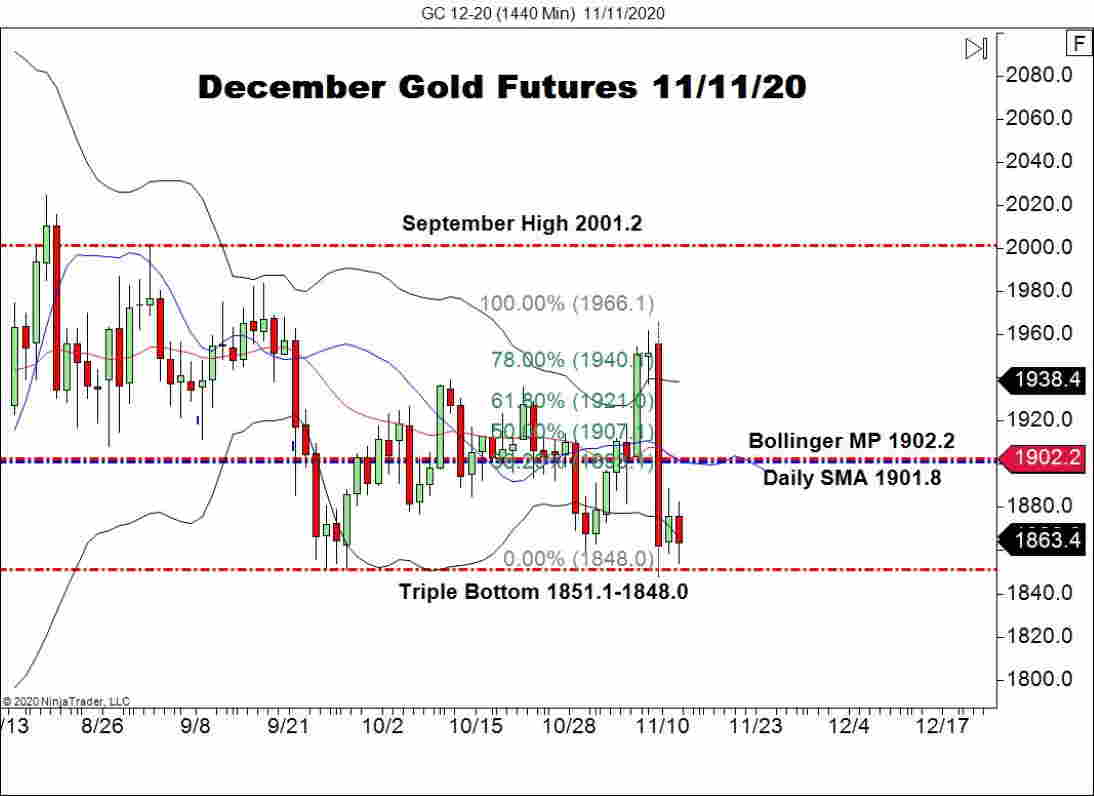

December Gold Futures Problem Each day Triple-Backside

Monday was a loopy day on the markets as Pfizer’s COVID-19 vaccine dominated headlines. December gold futures plunged amid the information, placing in a tough check of the 1850.Zero space. Now, costs stay under topside resistance and in bearish territory.

++11_11_2020.jpg)

Listed here are the important thing ranges to observe on this marketplace for the remainder of the week:

- Resistance(1): Each day SMA, 1901.8

- Resistance(2): Bollinger MP, 1902.2

- Help(1): Triple-Backside 1851.1-1848.0

Backside Line: At press time, December gold futures look like organising in a basic “L” formation. If we see a late-week bump in pricing, promoting topside resistance could also be a very good commerce.

So long as Monday’s backside is a sound swing low (1848.0), I’ll have promote orders in at 1893.9. With an preliminary cease at 1905.9, this trend-following commerce produces 100 ticks on a barely sub-1:1 danger vs reward ratio.