One of many greatest crypto tales of 2021 has been the rise of Tron (TRX). The little-known coin has rallied almost 875% prior to now 12-months, wi

One of many greatest crypto tales of 2021 has been the rise of Tron (TRX). The little-known coin has rallied almost 875% prior to now 12-months, with most of that coming since January 1st. Now, costs are holding agency in bullish territory close to $0.14.

So, what’s Tron? Tron is a decentralized platform that makes a speciality of digital leisure infrastructure. Basically, Tron goals to match content material creators and customers via integrating person-to-person blockchain expertise. In doing so, the corporate can lower out the middle-man and scale back leisure prices for customers whereas boosting profitability for creators.

Though the Singapore-based Tron is just a few years outdated, it’s changing into a significant participant within the on-line area. That includes greater than 33 million accounts and almost 2 billion transactions, Tron lauds itself as being the “fastest-growing public chain.” For crypto merchants and traders, the fledgling coin’s upside is rising more and more enticing.

Tron Holds The Line At $0.1400

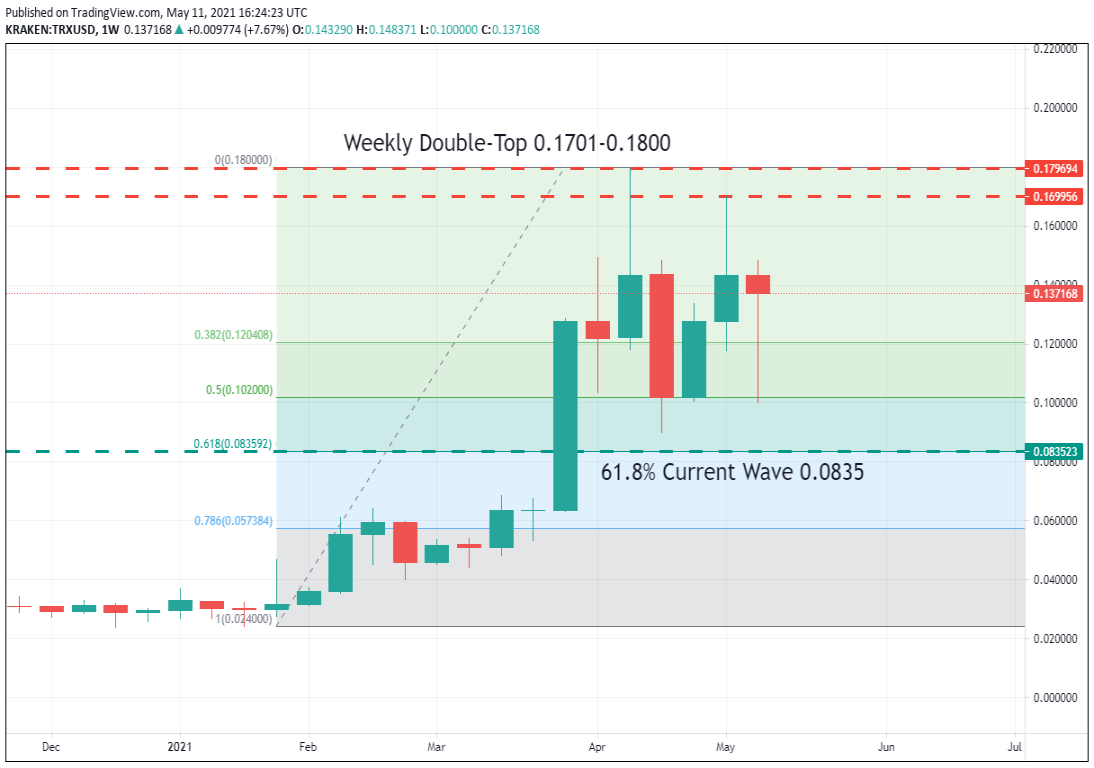

In a Stay Market Replace from yesterday, I outlined a key resistance space for Tron. This technical zone is now coming into view. Beneath is a more in-depth take a look at the weekly double-top sample that’s arrange between $0.1700 and $0.1800.

In the intervening time, listed below are the technical ranges I will likely be watching in TRX:

- Resistance(1): Weekly Double-High, 0.1701-0.1800

- Assist(1): 62% Fibonacci Retracement, 0.0835

Backside Line: As we transfer deeper into Q2, I count on Tron and plenty of different altcoins to enter consolidation phases. If this proves to be the case, then promoting the weekly double-top sample in TRX could change into play.

Till elected, I’ll have promote orders within the queue from $0.1700. With an preliminary cease loss at $0.2050, this commerce produces 17.6% ($0.03) on a barely sub-1:1 threat vs reward ratio.