EUR/GBP has been on a bearish trend since the beginning of 2021, with the GBP clearly being stronger than the Euro. GBP/USD was making larger gains th

EUR/GBP has been on a bearish trend since the beginning of 2021, with the GBP clearly being stronger than the Euro. GBP/USD was making larger gains than EUR/USD during the bullish period after the pandemic started until summer last year, while since then EUR/USD has turned more bearish than the cable. This shows that the GBP has had the upper hand, although the situation in Europe and the UK remains similar, both politically regarding the coronavirus and economically.

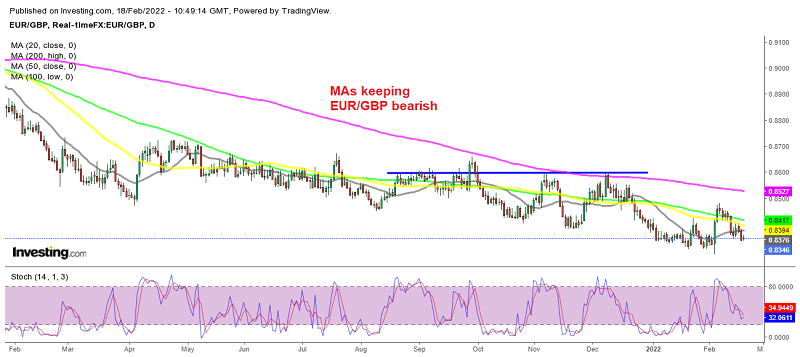

During this time, moving averages have been doing a good job providing resistance on the daily chart during retraces higher. Initially was the 20 SMA (gray), then the 100 SMA (green), and toward the end of last year, the 200 SMA took over that job, showing that the pace of the trend has been slowing.

Although, since the beginning of this year the decline has picked up pace again, with EUR/GBP printing new lows. We saw a jump for two days after the European Central Bank meeting two weeks ago, after they suggested tightening the monetary policy, but the Bank of England also sounded hawkish, as inflation keeps growing everywhere. Today’s CPI (consumer price index) inflation from France showed stagnation for January, so hopefully, the surge will stop soon. Today’s UK retail sales for January were quite strong as shown below, which should keep the GBP well bid.

UK January Retail Sales Report

- January retail sales MoM +1.9% vs +1.0% expected

- December sales were -3.7%; revised to -4.0%

- Retail sales YoY +9.1% vs +8.7% expected

- Prior Sales YoY -0.9%; revised to -1.7%

- Core retail sales (ex fuel) MoM +1.7% vs +1.2% expected

- Prior core sales MoM were -3.6%; revised to -3.9%

- Core retail sales (ex fuel) YoY +7.2% vs +7.9% expected

- Prior core sales YoY -3.0%; revised to -3.8%

After the omicron impact in December, retail sales activity picked up to start the new year with non-food stores sales volumes increasing by 3.4% on the month. That is offset by a first drop in food store sales volumes to below pre-pandemic levels for the first time (seen 0.8% below levels in February 2020). Overall, retail sales volumes were seen 3.6% higher than pre-pandemic i.e. February 2020 levels.

The data just reaffirms a bounce in economic activity, which is to be expected after the hit in December amid the spread of the omicron variant at the time. Economic conditions, in general, should continue to support the BOE narrative to tighten monetary policy in the months ahead.

The Eurozone construction output report came out negative again for January, showing that this sector remains in contraction and in fact, the annualized figures show that construction output has been declining for the entire year of 2021. As a result, EUR/GBP remains bearish and we are looking to open a sell signal soon, so follow our live forex signals page for such trade ideas.

Eurozone December Construction Output

- January retail sales MoM +1.9% vs +1.0% expected

- December sales were -0.2%

- Construction output YoY -3.9%

- Prior output +0.5%; revised to +0.4%

That’s quite the slump in construction activity, with Austria (-8.1%), Germany (-7.3%) and France (-7.0%) the main culprits. Overall, building construction declined by 4.5% on the month while civil engineering construction fell by 1.9% on the month.

EUR/GBP

www.fxleaders.com