It’s been a uncommon prevalence, however the NASDAQ is at risk of posting a shedding week. The truth is, barring a Friday rally in tech and progre

It’s been a uncommon prevalence, however the NASDAQ is at risk of posting a shedding week. The truth is, barring a Friday rally in tech and progress equities, the NASDAQ will snap a four-week successful streak. With just a few hours left in at present’s session, the DJIA DOW (-157), S&P 500 SPX (-15), and NASDAQ (-75) are all damaging.

There have been a couple of drivers of damaging sentiment at present, every revolving across the COVID-19 pandemic. First, confirmed instances and deaths proceed to rise within the U.S., with Arizona, Florida, California, and Texas main the cost. In lots of states, face masks at the moment are obligatory and rollbacks of earlier reopenings are in progress. Whereas this isn’t an entire shock, it has many monetary speaking heads calling for an August sell-off in threat belongings.

On the standard entrance, the American labor market has taken a step again. Right here’s our Thursday have a look at the weekly unemployment metrics:

Occasion Precise Projected Earlier

Preliminary Jobless Claims (July 10) 1.30M 1.25M 1.31M

Persevering with Jobless Claims (July 3) 17.338M 17.600M 17.760M

Whereas each of those numbers got here in under final week’s releases, Preliminary Jobless Claims exceeded projections. This isn’t that large of a shock; the boosted unemployment advantages are because of expire on 31 July. At this level, it appears like there’s a last-minute rush to get in on the improved COVID-19 payouts. Solely after they expire will we start to get an correct have a look at the U.S. employment state of affairs and the way the equities markets will react to the information.

U.S. Equities Stoop Forward Of The Friday Session

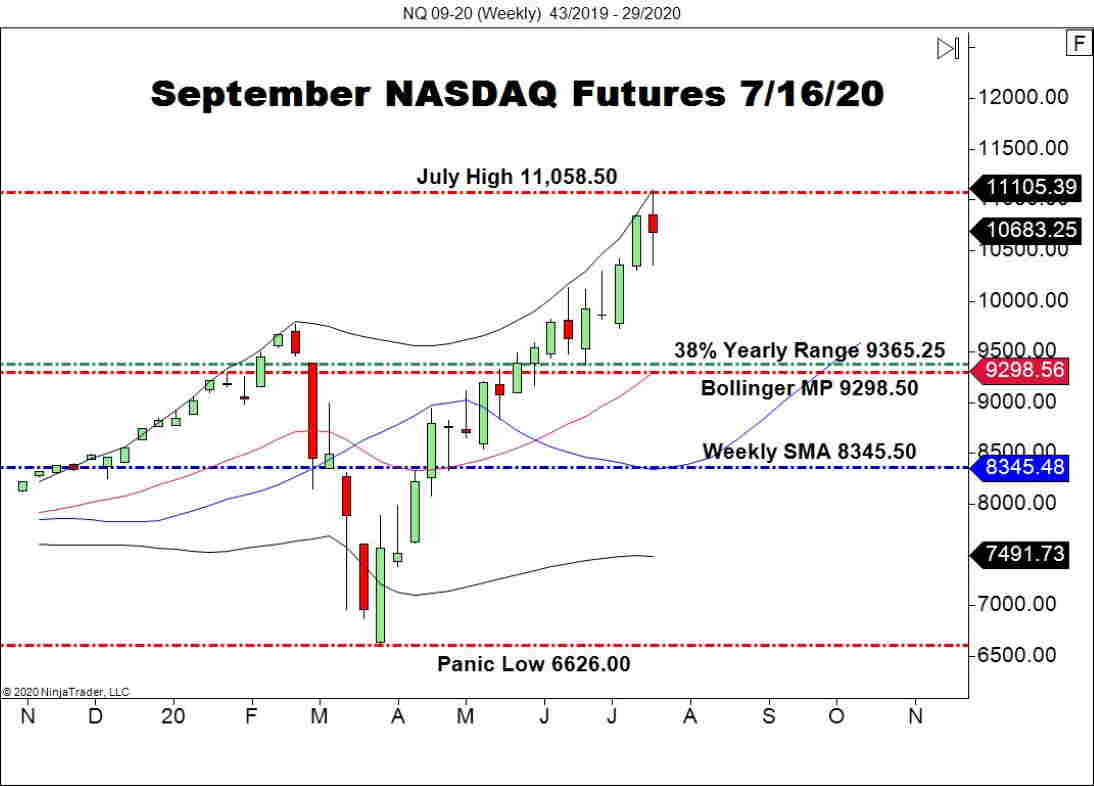

By far, the NASDAQ has been the last word performer of 2020. For the reason that panic promoting of March, solely three weeks have closed within the pink for the September E-mini NASDAQ ― and, the losses haven’t been important.

++43_2019+-+29_2020.jpg)

Overview: So, is the tide turning for U.S. equities and the NASDAQ? At this level, it’s robust to inform. When trying on the weekly chart for the September E-mini NASDAQ, costs have lastly hit the higher Bollinger Band. The final time this occurred was final February, pre-COVID-19. Whereas this doesn’t essentially sign a market reversal, it does recommend that the bullish winds could also be altering for giant tech.