With September quickly approaching, U.S. shares have recovered all COVID-19 losses. Sadly, the features are coming at the price of a deflated USD.

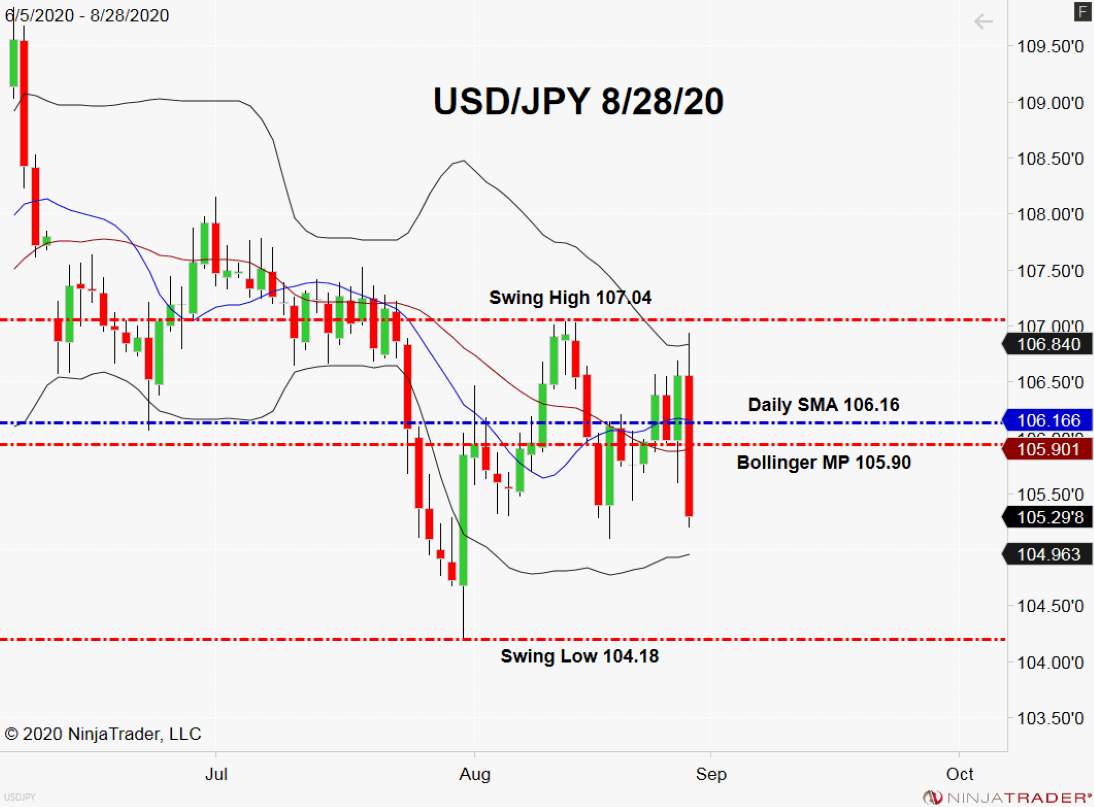

With September quickly approaching, U.S. shares have recovered all COVID-19 losses. Sadly, the features are coming at the price of a deflated USD. On the midway level of the session, the DJIA DOW (+112), S&P 500 SPX (+10), and NASDAQ (+58) are all constructive. Conversely, the Dollar is taking it on the chin, falling off throughout the majors. The most important mover has been the USD/JPY, which is reeling within the wake of a dovish FED and Shinzo Abe’s resignation as Prime Minister.

On the financial information entrance, there have been a number of objects price on right now’s schedule. Listed below are the highlights:

Occasion Precise Projected Earlier

Core Private Consumption Index (MoM, July) 0.3% 0.5% 0.3%

Core Private Consumption Index (YoY, July) 1.3% 1.2% 1.1%

Michigan Client Sentiment Index (August) 74.1 72.8 72.8

The important thing takeaway from this group of metrics is the uptick within the Michigan Client Sentiment Index (August). Whereas properly off pre-COVID-19 ranges, this determine has steadily ticked larger over the previous two months. When coupled with the manufacturing numbers from earlier this week, one could make the case {that a} restoration is underway.

For U.S. shares, the sky seems to be the restrict. It’s a a lot totally different story for the USD as FED guarantees of inflation and QE are wreaking havoc on values.

U.S. Shares Rally, USD/JPY Reverses On Abe’s Resignation

In the course of the U.S. in a single day, Japanese Prime Minister Shinzo Abe resigned his submit, citing well being issues. Any potential menace to the lax financial coverage of Abenomics has foreign exchange gamers piling into the yen.

+2020_08_28+(10_20_46+AM).png)

Overview: In a Reside Market Replace from 25 August, I issued a promote advice for the USD/JPY. The commerce carried out fantastically, taking a uncommon zero-pip draw earlier than hitting its take revenue. Given the present market fundamentals, one is properly suggested to favor rising shares and a falling greenback within the coming weeks.