With Brexit, evidently the enjoyable by no means ends. This morning has been no completely different as final evening’s “dinner talks” have appare

With Brexit, evidently the enjoyable by no means ends. This morning has been no completely different as final evening’s “dinner talks” have apparently bared no fruit. Stories are circulating that each the U.Ok. and E.U. are actually bracing for a 31 December no-deal divorce. Given immediately’s uptick in U.S. CPI, it’s little or no marvel that the GBP/USD is pushing weekly lows.

Since April, the USD has been in a freefall towards the GBP and EUR. Over such time, there have been comparatively few probabilities to purchase pullbacks on the weekly chart. Now, if we get favorable U.S. financial numbers in coming classes, shopping for into the long-term bullish GBP/USD pattern might come to cross.

Friday morning brings a set of numbers which will favor the USD. Main the cost is the Producer Worth Index (PPI) and Michigan Client Sentiment Index. Whereas PPI is predicted to reflect immediately’s CPI figures, the large query is the UM Sentiment Index. The COVID-19 second wave and election final result has damage client confidence ― will tomorrow carry a rebound?

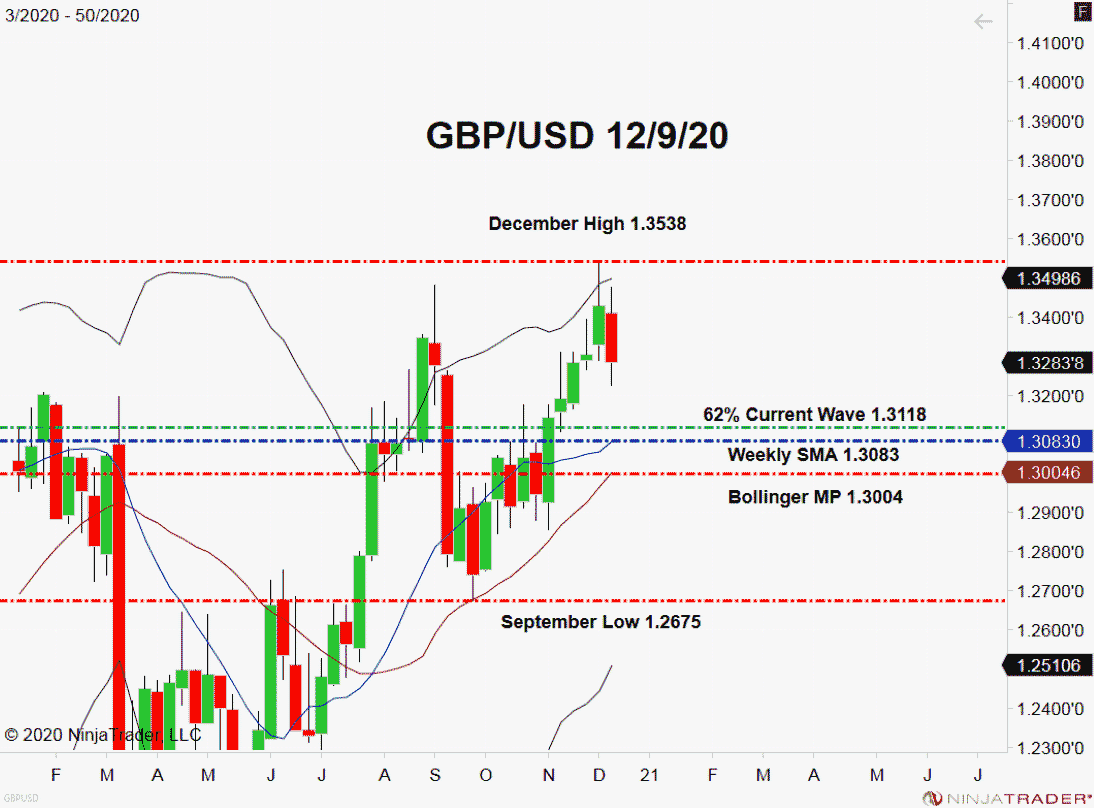

With Brexit Day solely three weeks off, the GBP/USD stays in bullish territory. Let’s dig into the weekly technicals and take a look on the motion.

GBP/USD Holds Agency Amid Brexit Talks

As you’ll be able to see from the chart under, the GBP/USD has hardly ever posted two shedding weeks in a row. Nonetheless, if it does, we might have a shopping for alternative within the coming days.

+2020_50+(11_33_37+AM).png)

Backside Line: If we see a pre Brexit Day pullback towards the 62% Fibonacci Retracement (1.3118), I’ll be trying to take a bullish place. So long as the 1.3538 December excessive holds, I’ll have purchase orders within the queue from 1.3126. With an preliminary cease loss at 1.3016, this commerce produces 220 pips on a 1:2 threat vs reward ratio.