The market mood is steadier so far today but it is still early in the day and we also have Fed chair Powell's testimony coming up later. Major currenc

The market mood is steadier so far today but it is still early in the day and we also have Fed chair Powell’s testimony coming up later. Major currencies aren’t doing a whole lot while US futures are little changed after a somewhat sluggish showing yesterday.

That will keep things a bit tight going into Europe, with traders also having to contemplate the idea of a risk rotation ahead of month-end and quarter-end.

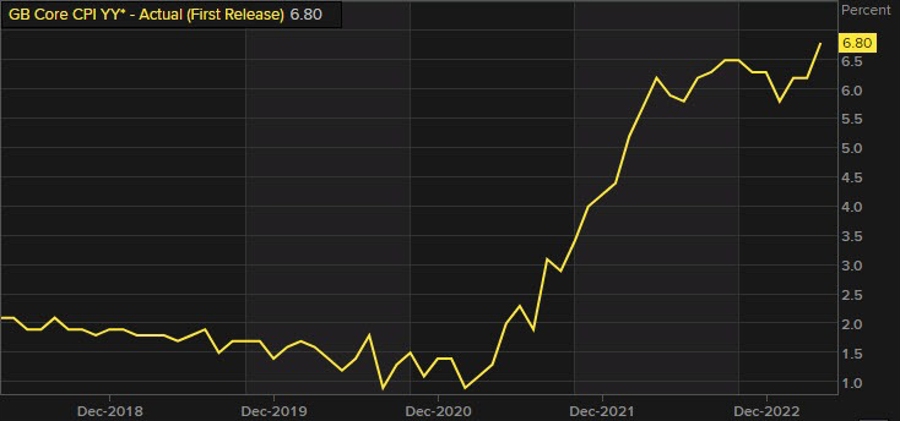

Looking ahead, there will be UK inflation data to contend with but it should just reaffirm continued prospects of a rate hike by the BOE. Core annual inflation is expected to remain at 6.8% in May and that will feed into the narrative that price pressures are not relenting yet in the UK.

Based on OIS pricing, a 25 bps rate hike is 100% priced in for this week and I don’t see that changing regardless of the data. What matters now more for the pound and UK rates is the terminal pricing. That is now seen at around 5.83%, which means there is a long way to go with the bank rate now at 4.50%.

In any case, the pound will be sensitive to the data so keep an eye out for price movements in response in the session ahead.

0600 GMT – UK May CPI figures

1000 GMT – UK June CBI trends total orders

1100 GMT – US MBA mortgage applications w.e. 16 June

That’s all for the session ahead. I wish you all the best of days to come and good luck with your trading! Stay safe out there.

www.forexlive.com