We saw the US inflation data on Thursday, which indicated that prices paid by consumers for a wide range of goods and services climbed at a somewhat f

We saw the US inflation data on Thursday, which indicated that prices paid by consumers for a wide range of goods and services climbed at a somewhat faster-than-expected rate in September, putting inflation in the limelight for policymakers. According to a Labor Department report released Thursday, the consumer price index grew 0.4% month over month and 3.7% year over year.

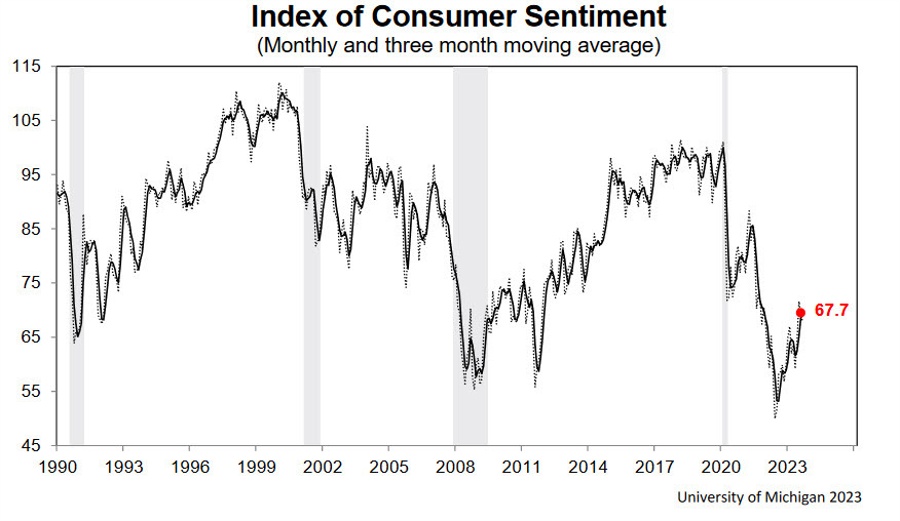

Consumer prices in the United States rose in September, which was in line with a surprising increase in rental costs, although underlying inflation pressures remained stable. According to the University of Michigan survey released on Friday, consumer mood in the United States declined substantially in October as respondents predicted more inflation in the next year.

The preliminary estimate for the University of Michigan’s overall index of consumer mood was 63.0 this month, up from 68.1 in September. Reuters polled economists, who predicted a preliminary reading of 67.2. Almost all demographic groups experienced a drop in mood, owing to the ongoing weight of high costs.

The one-year inflation expectation reading in the poll jumped to 3.8% this month from 3.2% in September. The five-year inflation forecast increased to 3.0% from 2.8% the previous month, remaining within the tight 2.9-3.1% range for 25 of the previous 27 months.

Preliminary UMich Consumer Sentiment Report for October 2023

- October prelim UMich consumer sentiment 63.0 vs 67.2 expected

- Prior was 68.1Current conditions 66.7 vs 70.4 expected (71.4 prior)

- Expectations 60.7 vs 65.5 expected (66.0 prior)

- 1-year inflation 3.8% vs 3.2% prior

- 5-10 year 3.0% vs 2.8% prior

This survey is a bit overlooked though, and the increase is most likely due to increasing fuel costs (prior to the current drop), but the market isn’t going to enjoy any of this.

www.fxleaders.com

COMMENTS