US core PCE anticipated to leap; can the Fed flip a blind eye? – Foreign exchange Information Preview Post

US core PCE anticipated to leap; can the Fed flip a blind eye? – Foreign exchange Information Preview

Posted on Could 25, 2021 at 3:02 pm GMTRaffi Boyadjian, XM Funding Analysis Desk

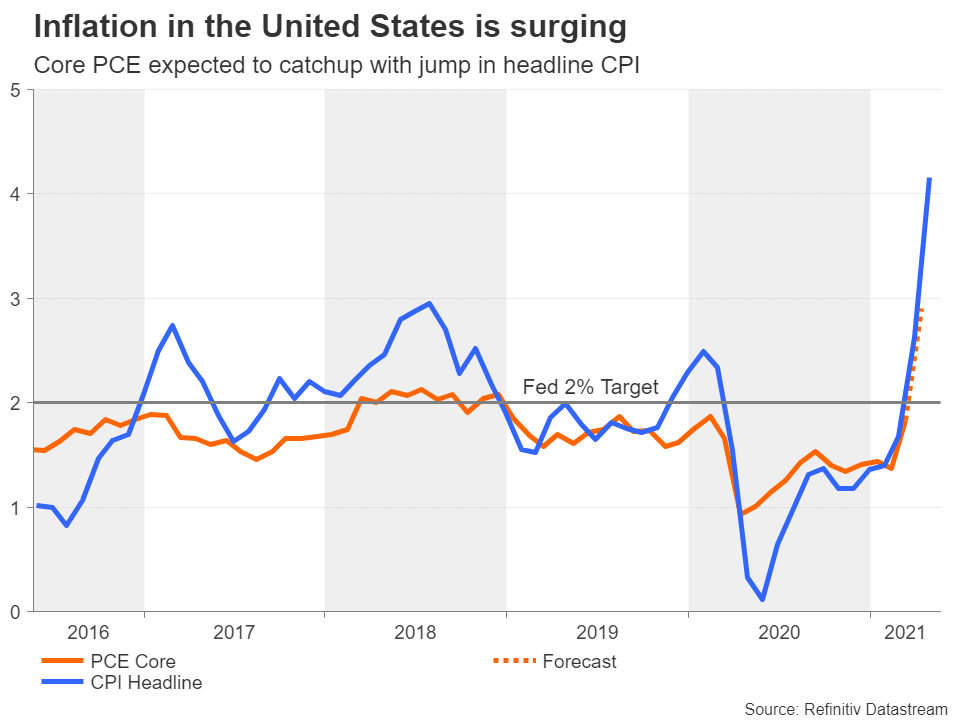

To this point, the surge in US shopper costs has not rattled policymakers on the Fed however an anticipated bounce in PCE inflation – a extra carefully watched gauge – may reawaken the hawks. The core PCE value index is out on Friday (12:30 GMT), which might be accompanied and preceded by various different key indicators, together with private consumption and sturdy items orders. The US greenback’s slide doesn’t seem like anyplace close to over as Treasury yields stay in a downward drift, so any main optimistic surprises within the upcoming knowledge may spark a major upward correction, boosting the buck.

Core PCE inflation may shoot increased

When inflation expectations first started to achieve worrying ranges, markets had been sceptical in regards to the Fed’s relaxed stance in the direction of the simmering value pressures. However after some not-so-spectacular knowledge on the labour market and consumption, buyers are happier to observe the Fed’s ultra-dovish steering on the coverage path. Nevertheless, as markets attempt to make sense of the conflicting indicators on the energy of the US restoration, the upper inflation narrative could possibly be about to develop into validated.

The core PCE value index, which is what the Fed appears to be like at when aiming to maintain inflation close to 2%, is predicted to have jumped to 2.9% year-on-year in April from 1.8% beforehand. Though the low base impact from 2020 is prone to blame for many of this enhance, the truth that the core measure is anticipated to have risen a lot so rapidly to ranges final seen in 1993 can solely be interpreted as the beginning of a really harmful pattern.

Will the Fed and markets keep cool if inflation overshoots?

After all, Fed policymakers and market individuals will first wish to see what occurs to PCE inflation over the approaching months – whether or not it begins to fall again in the direction of the tip of the summer time, and the extent to which it declines. Till then, the incoming knowledge might solely generate knee-jerk response and Treasury yields might proceed edging sideways.

Nevertheless, within the quick time period, Treasury yields have been below stress, with the 10-year yield plunging beneath 1.60%. Any surprising energy on this week’s releases may spur some contemporary promoting in bond markets, pushing yields and the US greenback increased.

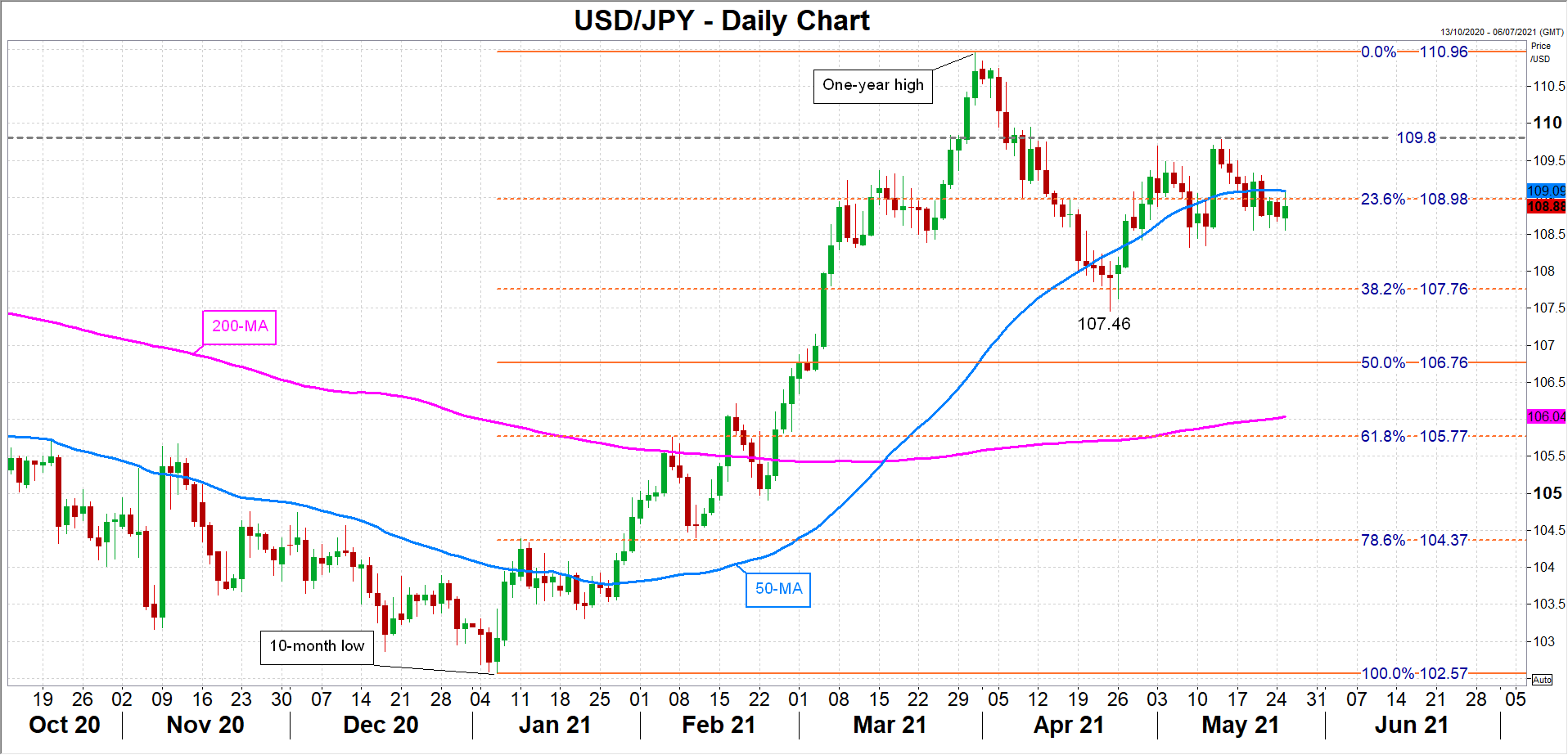

The buck has been hovering across the 109-yen stage over the previous week, slightly below the 50-day shifting common, so a contemporary upside burst may elevate the pair above this vital resistance area and in the direction of the subsequent impediment at 109.80 yen.

To the draw back, the April low of 107.46, which is close to the 38.2% Fibonacci retracement of the January-March upleg, stays the principle assist space defending the positive-to-neutral bias.

Consumption knowledge within the highlight too

If the core PCE value index fails to set a transparent course, merchants may flip to Friday’s private revenue and consumption figures. Private revenue is forecast to have plummeted by 14.1% month-on-month because the March enhance from the stimulus funds fades. Private consumption is projected to have risen by 0.5% m/m, slowing considerably from the prior 4.6% charge. A a lot milder slowdown in spending may go a way in reviving the extra bullish expectations in regards to the US economic system.

Forward of Friday’s numbers, sturdy items orders for April might be watched on Thursday, together with the second studying of Q1 GDP development. Sturdy items orders are forecast to rise for the second straight month, whereas the preliminary GDP estimate of 6.4% is predicted to get revised up barely to six.5%.

On Tuesday, the newest shopper confidence index by the Convention Board confirmed shopper sentiment was little modified in Could in comparison with April, with the index falling barely to 117.2, which is notably beneath pre-pandemic ranges of above 130.0.

Fed to remain on maintain for some time longer

The info underlines how the restoration nonetheless has some solution to go, supporting the Fed’s view that additional progress is required. Till the Fed is happy that every one sectors of the economic system have recovered or are near being totally healed from the pandemic, it’s stance on financial coverage is unlikely to vary, except after all the spike in inflation seems to be not so transitory. However that may be a story for later within the 12 months.

USDJPY