This is via the folks at eFX. For bank trade ideas, check out eFX Plus. For a limited time, get a 7 day free trial, basic for $79 per month and pre

This

is via the folks at eFX.

For

bank trade ideas, check

out eFX Plus.

For a limited time, get a 7 day free trial, basic for $79 per month

and premium at $109 per month. Get

it here.

- TD Research expects a rangebound market into the year-end.

- “We expect a mostly rangebound market into yearend, but note the asymmetric risks to the USD around this week’s event risk. For instance, the USD should sell off more on a downside CPI print, than rally on a “beat.”,” TD notes.

- “That said, we still remain above the market on the Fed outlook, underscoring prospects that real rates need to rise in early 2023. In turn, FCI should tighten anew, helping the USD consolidate before another significant drawdown next year,” TD adds.

—

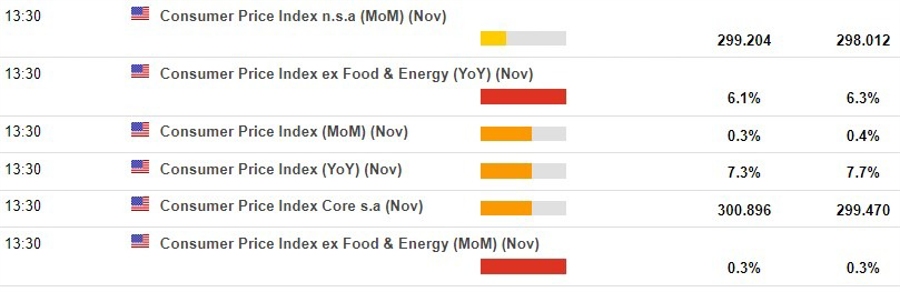

CPI is due Tuesday, 13 December 2022:

-

This

snapshot from the ForexLive economic data calendar, access

it here. -

The

times in the left-most column are GMT. -

The

numbers in the right-most column are the ‘prior’ (previous

month/quarter as the case may be) result. The number in the column

next to that, where there is a number, is the consensus median

expected.

news.google.com