MARKET FORECAST – GOLD PRICES, USD/JPY, GBP/USDThe U.S. dollar moves without directional conviction on Monday ahead of U.S. CPI dataThe January U.S. i

MARKET FORECAST – GOLD PRICES, USD/JPY, GBP/USD

- The U.S. dollar moves without directional conviction on Monday ahead of U.S. CPI data

- The January U.S. inflation report will steal the market’s attention on Tuesday

- This article focuses on the technical outlook for gold prices, USD/JPY and GBP/USD

Recommended by Diego Colman

Building Confidence in Trading

Most Read: EUR/USD Forecast – US Inflation Data to Drive Market Sentiment, Breakdown in Play

The U.S. dollar, as measured by the DXY index, traded nervously at the start of the new week, moving up and down around the flatline without making significant headway in either direction amid mixed U.S. Treasury yields.

Monday’s subdued moves in the FX space, along with low volatility, could be attributed to cautious positioning ahead of a high-impact event on the U.S. economic calendar on Tuesday morning: the release of the January consumer price index statistics.

The upcoming report is expected to show that annual headline inflation moderated to 2.9% last month from 3.4% previously, a welcome development for the U.S. central bank. Core CPI is also seen cooling, but in a more gradual fashion, easing to 3.7% from 3.9% in December.

For a complete overview of the U.S. dollar’s technical and fundamental outlook, request your complimentary Q1 trading forecast now!

Recommended by Diego Colman

Get Your Free USD Forecast

To gauge the potential market response to the data on key financial assets, traders should look at how the official results compare to consensus forecasts, paying particular attention to the trend in the core metrics.

If progress on disinflation hits a roadblock and CPI numbers surprise to the upside, yields and the U.S. dollar are likely to extend their recent rebound, weighing on gold prices. This is because sticky inflation could push out the timing of the first FOMC rate cut and reduce the odds of aggressive easing in 2024.

On the other hand, if CPI figures come in lower than anticipated, the opposite reaction could unfold, especially if the miss is significant. Under such circumstances, bond yields and the greenback could correct sharply lower in the near term, boosting precious metals in the process.

For an extensive overview of gold’s medium-term prospects, which incorporate insights from fundamental and technical analysis, download our Q1 trading forecast now!

Recommended by Diego Colman

Get Your Free Gold Forecast

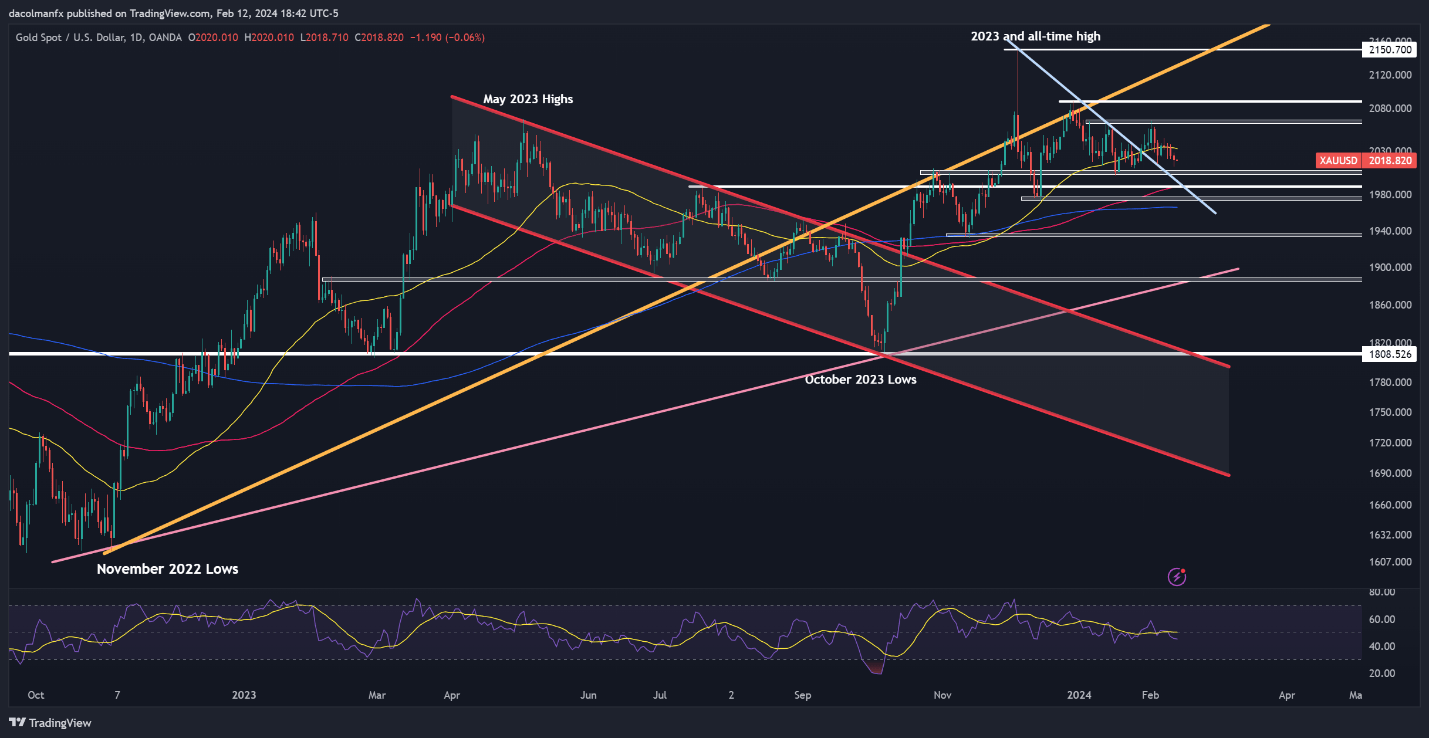

GOLD PRICE FORECAST – TECHNICAL ANALYSIS

Gold (XAU/USD) fell on Monday, but losses were limited, with the precious metal lacking strong directional conviction – a sign of market indecision. For more attractive trading setups to develop, resistance at $2.065 or support at $2.005 needs to give way.

In the event of a resistance breakout, a rally toward $2,085 could follow quickly. With continued strength, the focus will soon shift to the all-time high near $2,150. Conversely, if support is breached, attention will turn to $1,990, followed by $1,975. Below this area, the next key technical floor is located at $1,965.

GOLD PRICE TECHNICAL CHART

Gold Price Chart Created Using TradingView

Want to understand how retail positioning may impact USD/JPY’s trajectory? Our sentiment guide holds all the answers. Don’t wait, download your free guide today!

| Change in | Longs | Shorts | OI |

| Daily | 19% | 2% | 6% |

| Weekly | 1% | 1% | 1% |

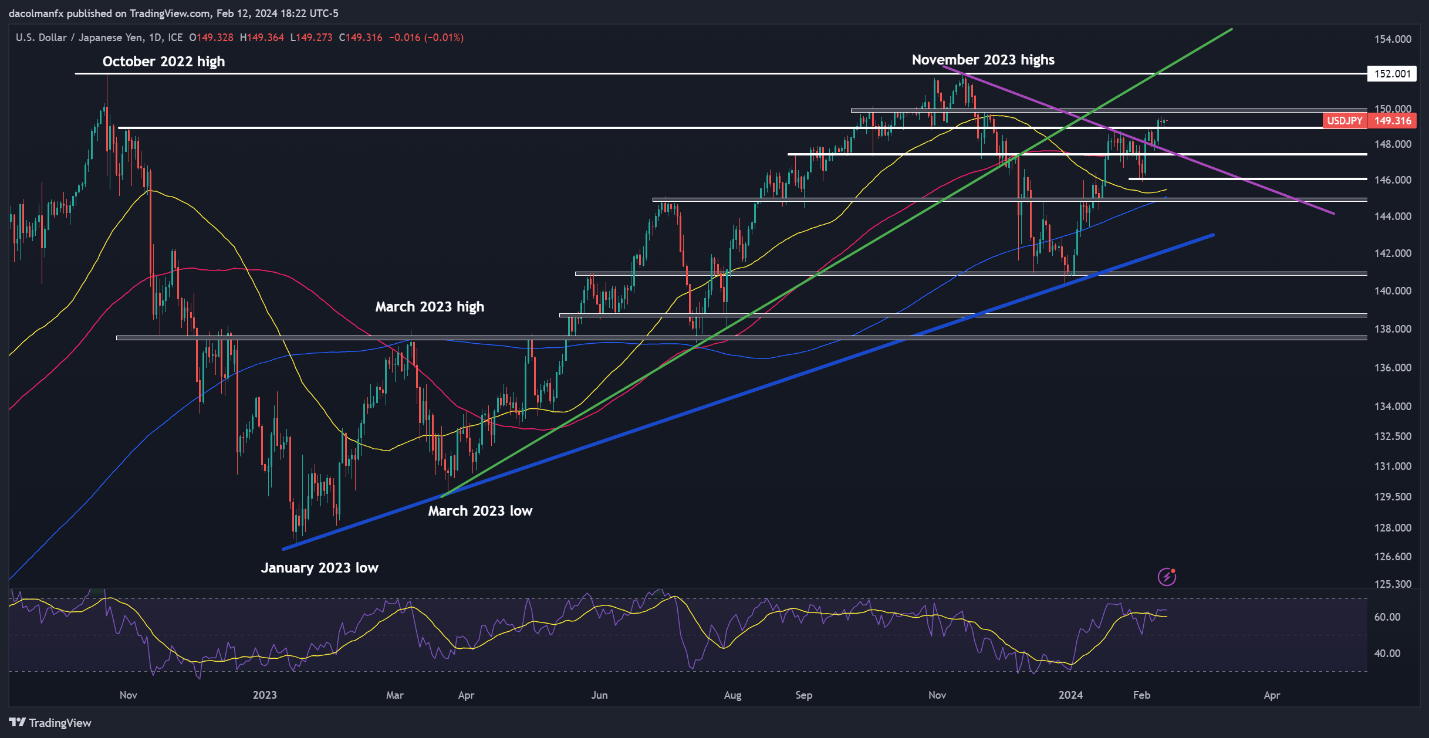

USD/JPY FORECAST – TECHNICAL ANALYSIS

USD/JPY ticked up modestly on Monday, consolidating above technical support at 148.90. If prices extend higher in the coming days, resistance emerges around the psychological 150.00 level. Bulls may struggle to clear this barrier, but in the event of a bullish breakout, a retest of the 152.00 area is likely.

Conversely, if the pair takes a turn downward and breaches support at 148.90, selling momentum could pick up pace, setting the stage for a pullback towards 147.40. Further losses from this point onward could draw attention to the 146.00 handle, followed by 145.50, the 50-day simple moving average.

USD/JPY TECHNICAL CHART

USD/JPY Chart Created Using TradingView

Wondering about the British pound’s technical and fundamental outlook? Gain clarity with our quarterly forecast. Download a free copy now!

Recommended by Diego Colman

Get Your Free GBP Forecast

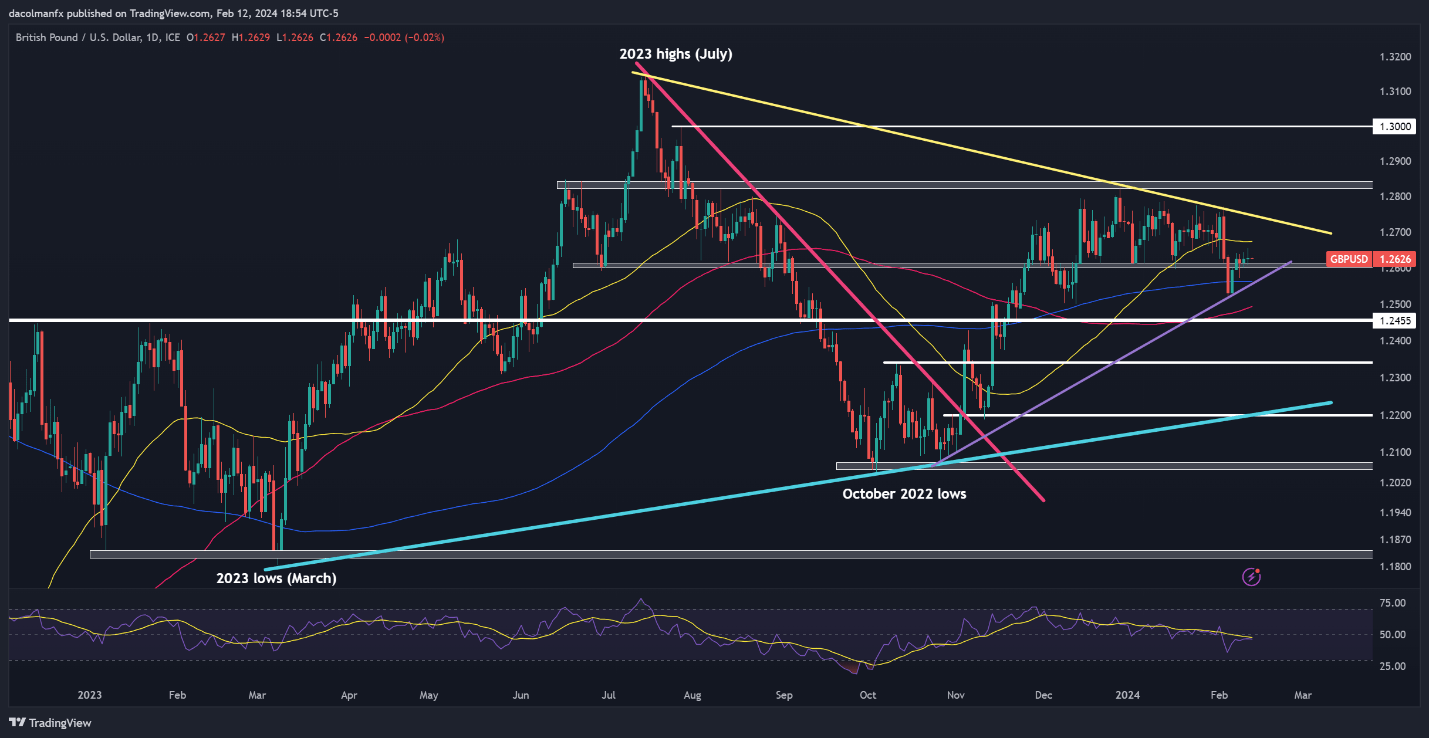

GBP/USD FORECAST – TECHNICAL ANALYSIS

GBP/USD has staged a moderate comeback after selling off earlier in the month, reclaiming its 200-day simple moving average and consolidating above the 1.2600 handle. If cable’s rebound extends over the next few trading sessions, resistance looms at 1.2675 (50-day SMA), followed by 1.2740.

On the flip side, if GBP/USD resumes its bearish reversal and dips below 1.2600, trendline support and the 200-day simple moving average appear at 1.2565. Bulls will need to defend this technical zone tooth and nail; failure to do so could usher in a move towards 1.2500.

GBP/USD TECHNICAL CHART

GBP/USD Chart Created Using TradingView

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com

COMMENTS