US DOLLAR FORECAST – EUR/USD, USD/CADThe U.S. dollar pauses after Tuesday’s strong rally, with the DXY index moving up and down around the flatlineThe

US DOLLAR FORECAST – EUR/USD, USD/CAD

- The U.S. dollar pauses after Tuesday’s strong rally, with the DXY index moving up and down around the flatline

- The absence of follow-through to the upside doesn’t necessarily signal a loss of conviction in the bullish outlook

- This article examines the near-term technical outlook for two key pairs: EUR/USD and USD/CAD

Recommended by Diego Colman

Building Confidence in Trading

Most Read: Gold Price, Nasdaq 100, EUR/USD – What Comes Next After US CPI Data?

Following Tuesday’s solid performance, the U.S. dollar showed signs of indecision on Wednesday, moving between small gains and losses, but ultimately not going anywhere, with the DXY index trading around the 104.80 level in early afternoon trading in New York.

The absence of follow-through to the upside does not necessarily signal that the bulls are losing conviction or are throwing in the towel, but may be a signal of a pause in the uptrend after the strong rally seen this year. After all, trends rarely proceed in a linear fashion without interruption.

Looking at the bigger picture, the limited progress on disinflation over the past month means that the Fed could delay the start of its easing cycle and only cut rates modestly when the process starts. Such a scenario could bias yields higher, keeping the U.S. dollar in an upward trajectory after a period of consolidation.

Leaving fundamentals aside for the moment, the remainder of this article will be devoted to examining the technical outlook for two major U.S. dollar pairs: EUR/USD and USD/CAD. In this section, we will outline important price thresholds that could act as support or resistance in the coming trading sessions.

For a comprehensive analysis of the euro’s medium-term prospects, make sure to download our Q1 trading forecast today. The guide is free!

Recommended by Diego Colman

Get Your Free EUR Forecast

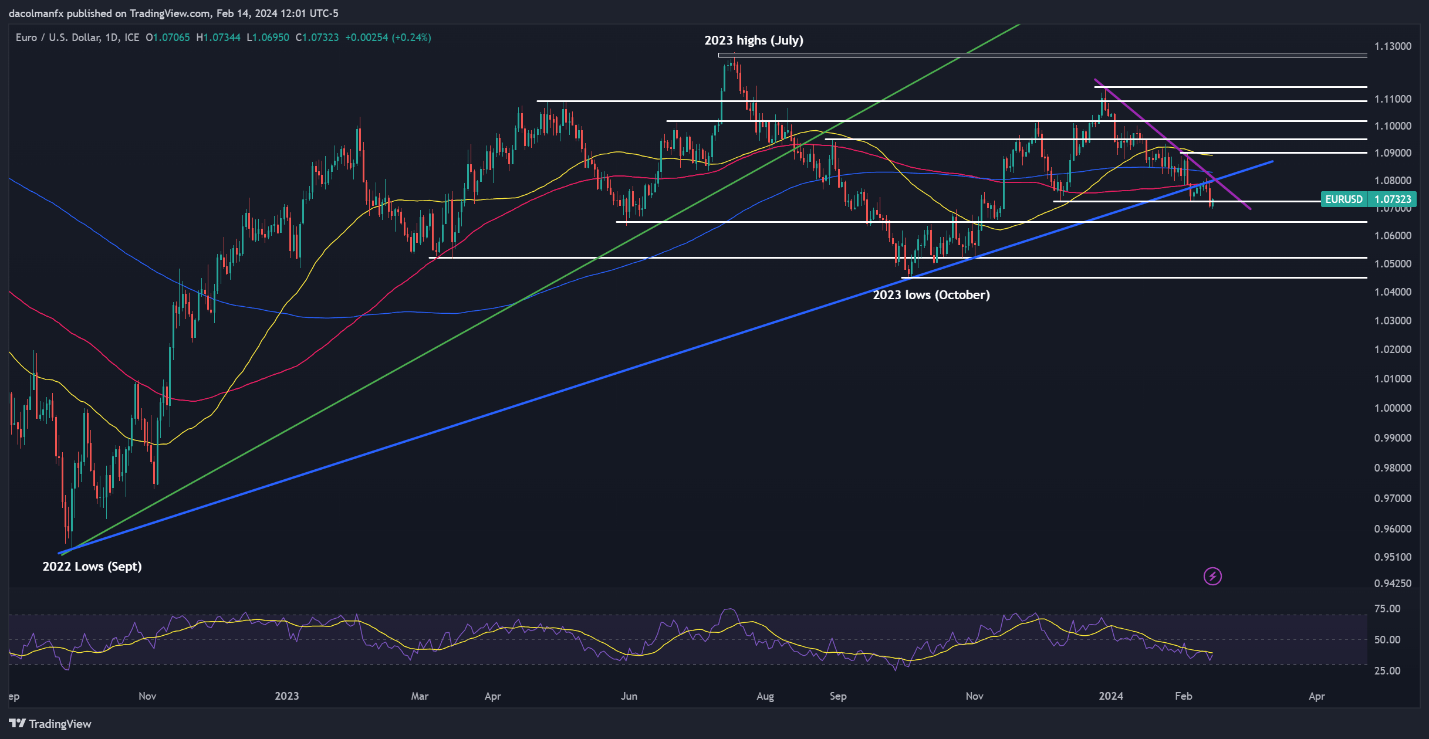

EUR/USD FORECAST – TECHNICAL ANALYSIS

EUR/USD ticked higher on Wednesday, recovering some of the previous session’s losses, with prices recapturing the 1.0720 level. If the rebound gains momentum in the coming days, resistance appears around the 1.0800 handle. On further strength, all eyes will be on the 200-day simple moving average.

Conversely, if EUR/USD resumes its retracement and slips below 1.0720 on daily closing prices, we could see a possible pullback towards 1.0650, which corresponds to the May 2023 lows. Further weakness beyond this threshold might draw attention to 1.0520.

EUR/USD CHART – TECHNICAL ANALYSIS

EUR/USD Chart Created Using TradingView

Curious about the correlation between retail positioning and USD/CAD’s short-term trajectory? Discover all the insights in our sentiment guide. Request a complimentary copy now!

| Change in | Longs | Shorts | OI |

| Daily | 19% | 18% | 18% |

| Weekly | -14% | 21% | 2% |

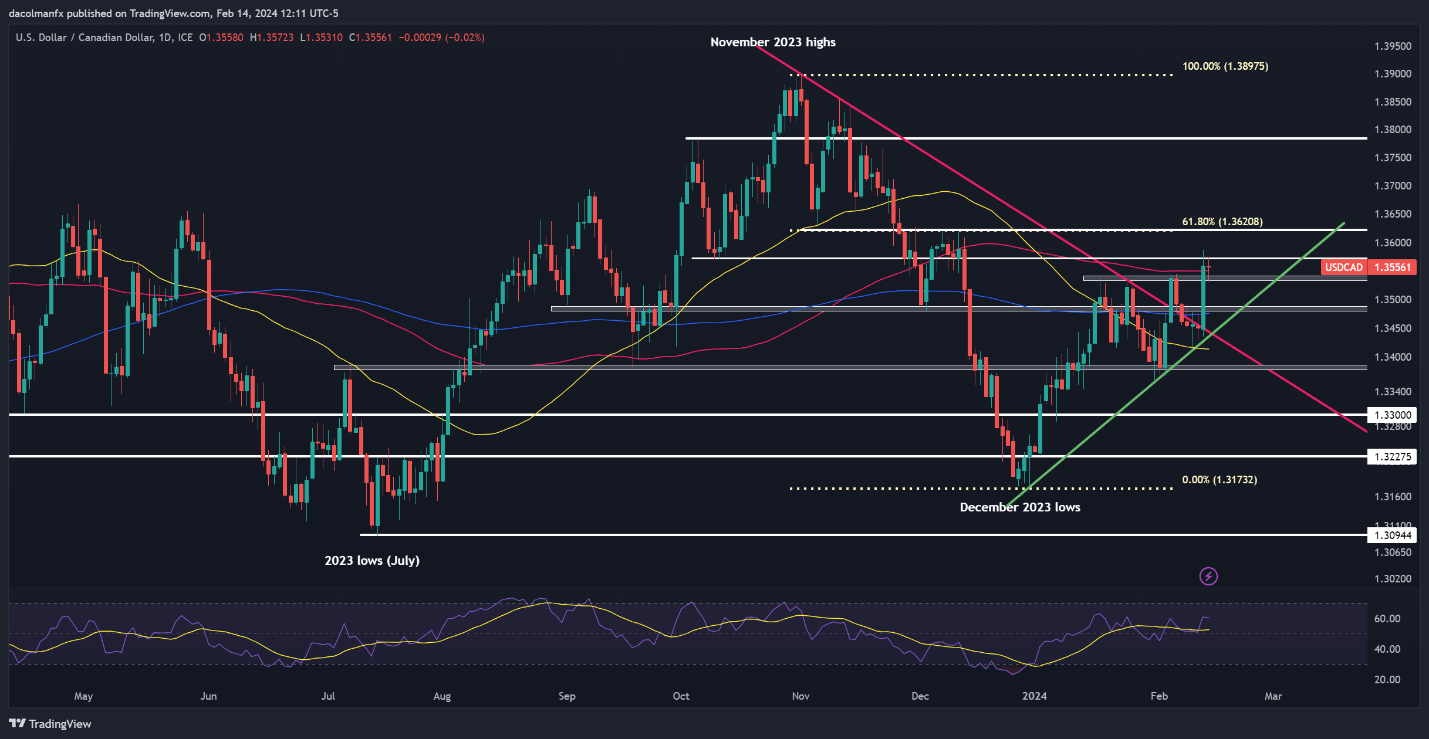

USD/CAD FORECAST – TECHNICAL ANALYSIS

USD/CAD paused on Wednesday following Tuesday’s big rally, with prices attempting to consolidate above the 100-day simple moving average. If the advance resumes over the next day days, overhead resistance emerges at 1.3570. From this point, subsequent gains could bring 1.3620 into focus.

On the flip side, if sellers return and trigger a bearish reversal from the pair’s current position, initial support can be spotted around 1.3535, followed by 1.3485, a tad above the 200-day simple moving average. Bears must defend this floor tooth and nail; failure to do so could spark a move towards 1.3450.

USD/CAD TECHNICAL CHART

USD/CAD Chart Created Using TradingView

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com

COMMENTS