USD, (DXY) News and AnalysisEconomic data and Fed speakers to provide tailwind for the dollarFed speakers with the power to prolong USD move - key re

USD, (DXY) News and Analysis

- Economic data and Fed speakers to provide tailwind for the dollar

- Fed speakers with the power to prolong USD move – key resistance assessed

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

Recommended by Richard Snow

Get Your Free USD Forecast

Economic Data and Fed Speakers to Provides Tailwind for the Dollar

The dollar is slightly softer at the time of writing but is coming off a massive two-day advance after Friday’s non-farm payroll report revealed a significant beat to the upside. The labour market not only looks robust but appears to be in the ascendancy after the December figure received a massive revision higher.

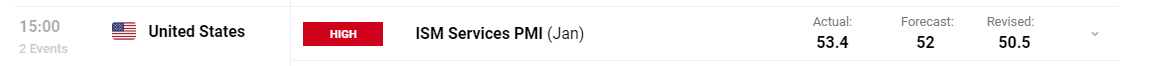

Further evidence of a resilient economy, despite restrictive monetary policy, appeared via the ISM services PMI readings below. The headline reading beat the forecast of 52 as well as the prior 50.5, continuing the expansion in the services sector for 13 straight months now.

Customize and filter live economic data via our DailyFX economic calendar

Some of the more interesting stats appear within the sub-sections of the report like ‘new orders’, ‘prices’ and ‘imports’ which all saw notable improvements. New orders is often used as a proxy for future economic conditions and the increase in prices suggests increased costs of shipping in the Red Sea is being passed down to the consumer. Imports posted the largest month on month percentage change of all the categories and suggests consumption and spending are strong.

In addition, a lesser observed report called the Senior Loan Officer Survey (SLOOS) revealed that credit providers are less reluctant to extend credit (greater supply) while demand for credit made marginal progress. The report was a main focus around the time of the regional banking instability and has come back onto the radar again after New York Community Bancorp had to cut its dividend – sending other regional bank shares lower with it.

The above data is not consistent with an economy that ought to be constrained by elevated interest rates – suggesting that the start of rate cuts may need to be pushed back even further. As such, US yields and the dollar have risen in recent sessions.

Fed Speakers with the Power to Prolong USD Move – Key Resistance Assessed

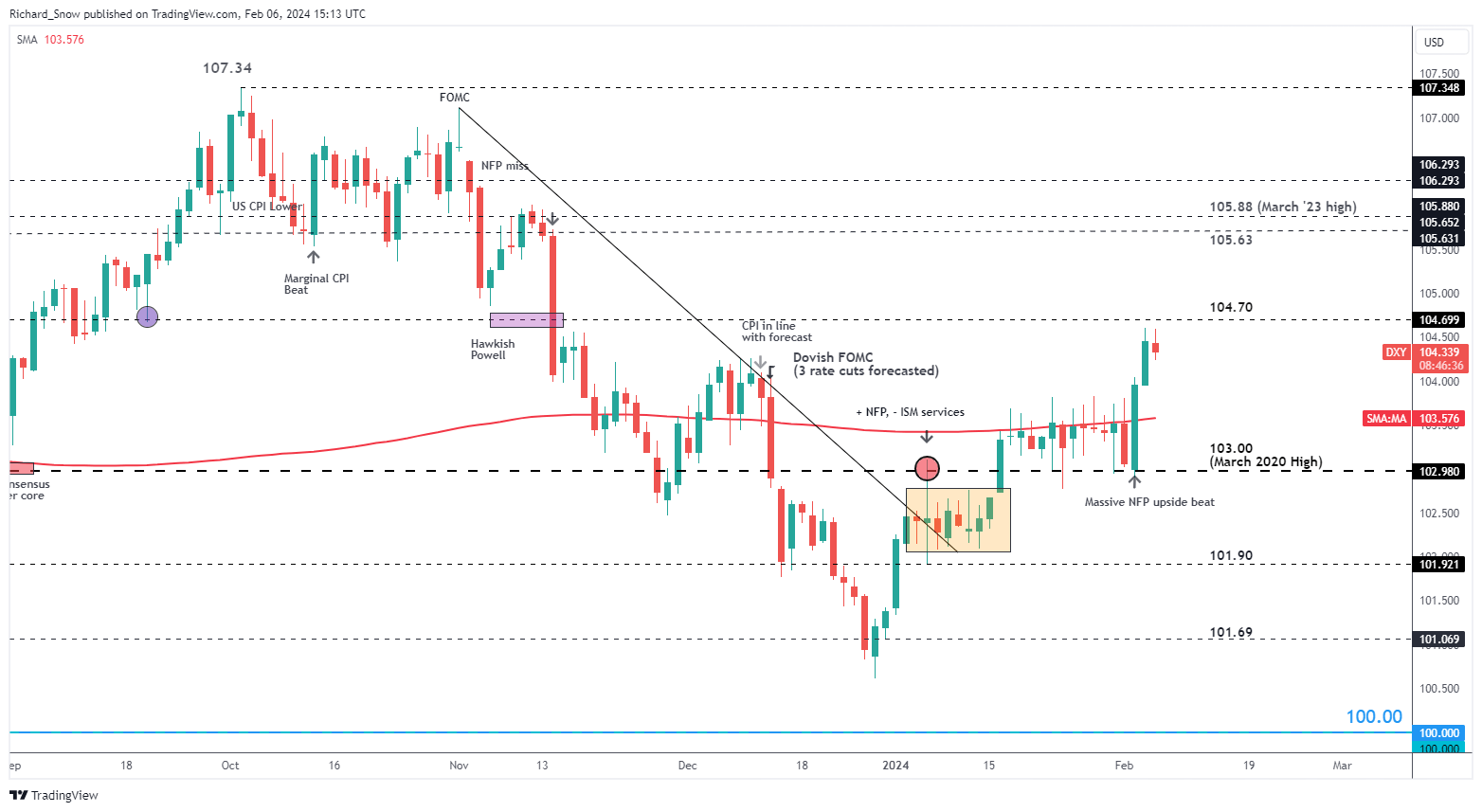

The dollar basket (DXY) is viewed as a benchmark of broader dollar performance and witnessed massive gains on Friday which continued into Monday. Today however, prices have eased back a tad, ahead of the 104.70 level which has acted as support in September and November 2023.

The Fed’s very own Neel Kashkari seemed surprised at the US economy’s strength, suggesting that the current level of interest rates is not having as much of an impact as would typically be the case if the neutral rate hadn’t been shifted higher. The neutral rate is a theoretical rate that is neither restrictive of supportive to the economy and is said to be higher in the post-Covid period.

Recommended by Richard Snow

Recommended by Richard Snow

How To Trade The Top Three Most Liquid Forex Pairs

Price action remains above the 200-day simple moving average and could continue with the help of additional Fed speakers who are lined up today to provide their thoughts on monetary policy and interest rates. Further talk about the impressive economic data and the need to move cautiously before deciding to cut rates could add to the recent USD advance.

US Dollar Basket (DXY) Daily Chart

Source: TradingView, prepared by Richard Snow

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com

COMMENTS