US Greenback, Singapore Greenback, Indonesian Rupiah, Philippine Peso, Malaysian Ringgit – Speaking FactorsUS Greenback gained in

US Greenback, Singapore Greenback, Indonesian Rupiah, Philippine Peso, Malaysian Ringgit – Speaking Factors

- US Greenback gained in opposition to SGD, IDR, PHP amid Nasdaq 100 declines

- Market temper could bitter additional, risking rising market capital flight

- Are US-China tensions heating up once more? Financial institution of Malaysia is forward

US Greenback ASEAN Weekly Recap

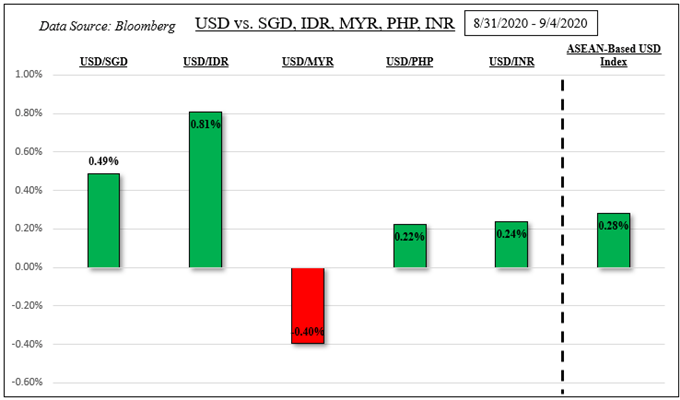

The haven-oriented US Greenback cautiously gained in opposition to its ASEAN counterparts this previous week as indicators of volatility resurfaced in monetary markets. The Singapore Greenback, Philippine Peso and Indonesian Rupiah weakened because the tech-heavy Nasdaq Composite fell probably the most since over the course of 5 days since March. A dismal US ISM providers report could have spooked traders, leading to capital flight.

Really useful by Daniel Dubrovsky

What’s the street forward for USD this quarter?

The Singapore Greenback was even unable to seek out help on less-than-dismal native retail gross sales knowledge, highlighting the main target for USD/SGD on exterior threat. A notable standout final week was the Malaysian Ringgit which barely outperformed the US Greenback, see chart beneath. Most of its positive aspects occurred after native markets reopened after the Nationwide Day vacation on Monday. USD/MYR then proceeded to commerce largely sideways.

Uncover your buying and selling character to assist discover optimum kinds of analyzing monetary markets

Final Week’s US Greenback Efficiency

*ASEAN-Based mostly US Greenback Index averages USD/SGD, USD/IDR, USD/MYR and USD/PHP

Exterior Occasion Threat – Volatility, US-China Financial and Safety Evaluate Fee

The rise within the VIX ‘worry gauge’ may place the US Greenback on the offense in a traditionally risky month for equities. US markets are offline Monday for the Labor Day vacation, creating an setting ripe for volatility as a result of thinner-than-usual liquidity circumstances. If final week’s threat aversion compounds additional, we may see the Dollar regain some misplaced floor in opposition to its ASEAN counterparts.

The US financial calendar docket is comparatively quiet this week. Traders could concentrate on the US-China Financial and Safety Evaluate Fee on Wednesday. It should maintain an annual listening to on developments this yr. Recently, US-China tensions appear to be rising heading into the November Presidential Election, significantly round know-how. Additional unease between the 2 powerhouses may increase USD.

What dangers may very well be in retailer for monetary markets if US-China tensions warmth up? Be a part of me at 00:00 GMT on September 10 for an outline!

ASEAN, South Asia Occasion Threat – Financial institution of Malaysia, Philippine Commerce Information, India Industrial Manufacturing

A top-tier occasion threat inside the ASEAN area would be the Financial institution of Malaysia fee resolution on Thursday. Economists anticipate that the in a single day coverage fee could stay unchanged at 1.75%. Merchants could concentrate on the central financial institution’s newest evaluation on financial circumstances. The second-quarter GDP plunge was worse-than-expected. With that in thoughts, the Ringgit may weaken if policymakers paint a bleak image for progress.

Earlier than the Financial institution of Malaysia, USD/PHP will probably be eyeing Philippine commerce knowledge. Exports are anticipated to shrink 9.9% y/y in July, softer than the -13.3% prior end result. On Friday, USD/INR will probably be awaiting the most recent readings on Indian industrial manufacturing. With these in thoughts, the danger of rising market capital flight forward may keep the main target for these currencies on exterior threats.

Really useful by Daniel Dubrovsky

What does it take to commerce round knowledge?

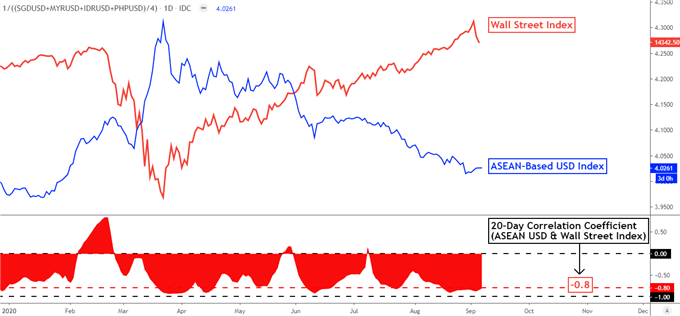

On September 4th, the 20-day rolling correlation coefficient between my ASEAN-based US Greenback index and my Wall Road index was -0.82 versus -0.80 from one week in the past. Values nearer to -1 point out an more and more inverse relationship, although it is very important acknowledge that correlation doesn’t indicate causation.

ASEAN-Based mostly USD Index Versus Wall Road Index – Each day Chart

Chart Created Utilizing TradingView

*ASEAN-Based mostly US Greenback Index averages USD/SGD, USD/IDR, USD/MYR and USD/PHP

*Wall Road Index averages S&P 500, Dow Jones and Nasdaq 100 futures

— Written by Daniel Dubrovsky, Forex Analyst for DailyFX.com

To contact Daniel, use the feedback part beneath or @ddubrovskyFX on Twitter