It was one other tumultuous week in international inventory markets. The S&P 500, DAX and Nikkei 225 all suffered one other d

It was one other tumultuous week in international inventory markets. The S&P 500, DAX and Nikkei 225 all suffered one other dismal 5-day efficiency that final matched declines witnessed throughout the 2008 monetary disaster. The coronavirus outbreak and stringent measures governments are taking to advertise social isolation are inserting international development more and more in danger

Recommended by Nick Cawley

Don’t give into despair, make a game plan

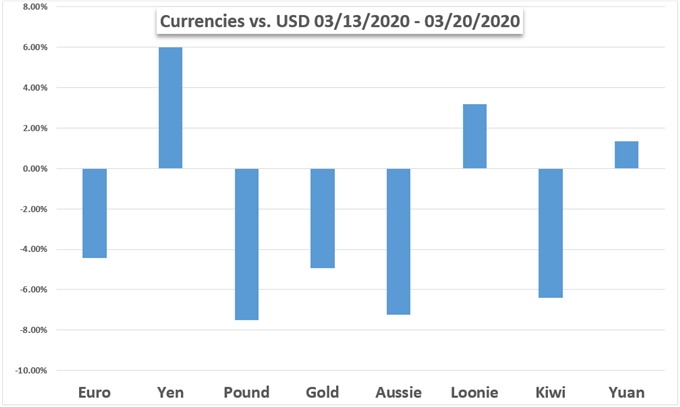

Demand for preserving capital benefited the haven-linked US Greenback because it even outpaced the anti-risk Japanese Yen. EUR/USD, GBP/USD and AUD/USD fell. Sentiment-linked crude oil costs dropped as WTI fell nearly 30% this previous week. Gold costs declined as soon as extra because the yellow metallic struggled to match the liquidity that the Buck provides because the world’s reserve forex.

Financial coverage might proceed heading into uncharted territory after per week of coordinated international strikes. Central banks such because the Fed, ECB, BoE, RBA and RBNZ stored slashing what little was left in decreasing charges within the first place. Most took unconventional coverage measures to assist the movement of capital in these unsure occasions.

It’s unclear if equities have discovered a backside with COVID-19 spreading sooner outdoors of China, notably in Europe and the USA creeping upward. Unemployment claims on the planet’s largest financial system surged at their fastest pace since 2012. Extra dismal readings might come within the weeks and maybe months forward with states and counties trying to curb journey.

All eyes within the week forward flip to extra fiscal measures, notably as Congress debates stimulus checks. The G-7 International Ministers Summit may also be eyed for maybe extra coordinated dedication. Preliminary gauges of U.S. enterprise exercise for March will present an concept of the gravity of the state of affairs. That is as shopper sentiment crosses the wires on Friday.

Recommended by Nick Cawley

Are retail traders leaning into momentum or fighting it?

Basic Forecasts:

US Greenback Goals Larger as Markets Liquidate on Coronavirus

The US Greenback has soared as capital spooked by the coronavirus outbreak flooded out of world monetary markets and into essentially the most liquid money on provide. Extra of the identical appears doubtless.

Euro Forecast: EUR/USD Outlook Stays Bearish

Final Wednesday’s launch of a €750 billion emergency asset-purchase program by the European Central Financial institution did little to stabilize the Euro, suggesting additional EUR/USD losses are doubtless within the week forward.

Australian Greenback Knowledge Drought Will Depart Coronavirus In Cost

The Australian Greenback faces an absence of scheduled financial or central financial institution information this week. That’s not more likely to be excellent news for its remaining bulls.

Gold Costs Give up as Virus-Induced Recession Fears Swell

Gold costs might proceed to fall if recession fears from the coronavirus overwhelm the optimism from stimulatory measures by central banks and governments world wide.

S&P 500, DAX 30, ASX 200 Forecasts for the Week Forward

World fairness markets swung wildly final week as declines slowed within the latter half. With a fabric pullback in volatility, can threat urge for food enhance within the week forward?

Technical Forecasts:

Oil Worth Technical Forecast: RSI on Cusp of Flashing Purchase Sign

The value of oil might stage a bigger restoration over the approaching days because the Relative Power Index (RSI) is on the cusp of flashing a textbook purchase sign.

Gold Worth Outlook – Excessive Volatility and Wild Worth Swings

Gold has traded in $250/oz. vary within the final 11 days, sending volatility to multi-year extremes. Merchants ought to issue this in when taking a look at entry and exit ranges.

Canadian Greenback Outlook: USD/CAD Weak spot Seems Short-term

USD/CAD noticed some extra energy final week earlier than weakening a bit; a pullback could also be short-loved because the broader development larger is pointed up.

EUR/USD On Verge of Getting Crushed Beneath 20-Yr Development-line

The euro acquired hit onerous final week, now flirting with a 20-year trend-line break that would take it to parity, if not worse.

DAX 30, FTSE 100 Technical Outlook: Pricing in a World Recession

One other week of losses for international equities amid a worldwide recession repricing. DAX seems to 2016 lows, whereas FTSE 100 eyes 5000 break.

US Greenback Outlook, 19-Yr Excessive Subsequent? EUR/USD, GBP/USD, USD/CAD, USD/JPY

The US Greenback is fast-approaching its most-expensive common value since 2001 and 2002. EUR/USD, GBP/USD, USD/CAD and USD/JPY all face their subsequent vital technical ranges.

Sterling Worth Outlook: Pound Plunge Accelerates as Virus Spreads

Sterling plummeted to multi-decade lows because the Coronavirus international pandemic fuels greenback demand. Listed below are the degrees that matter on the GBP/USD weekly technical chart.

Japanese Yen Technical Forecast: EUR/JPY, AUD/JPY, GBP/JPY, USD/JPY

The wild volatility continued throughout international markets and the Japanese Yen stays within the cross-hairs in various forex pairs.