U.S. Greenback in Election YrGreenback has demonstrated pretty constant path since 1980However 2020 is proving something however

U.S. Greenback in Election Yr

- Greenback has demonstrated pretty constant path since 1980

- However 2020 is proving something however a typical U.S. election 12 months

- Positioning heading into the election is the main focus

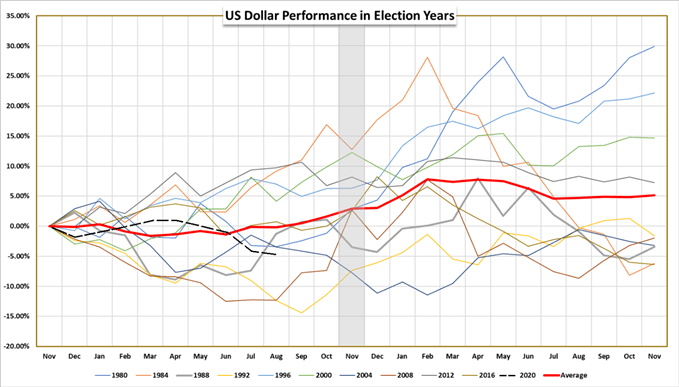

The U.S. Greenback typically follows an attention-grabbing sequence in historic election years. But the query with this cycle is with a lot happening as a result of coronavirus, will the markets resort to related tendencies this time round? So far as financial and financial insurance policies are involved, the novel virus has made this a novel 12 months when contemplating how the election consequence – Trump (Republican) or Biden (Democrat) – will impression markets.

So let’s have a look at the election cycles since 1980 after which take into account the positioning of the USD because the election nears to find out what could play out this 12 months. Trying on the prior ten election cycles, on common the USD rose within the months main as much as and after the election. However that is solely a mean set of adjustments; and once more with this 12 months being so removed from common, we could also be greatest served to take the norm with a grain of salt.

Contemplating how the market oftentimes locations its personal vote forward of main occasions, it might be unsurprising to see an preliminary countertrend transfer develop because the market’s anticipated consequence is baked in. This could characterize the inspiration and opening leg for the so-called ‘purchase the rumor, promote the information’ parable. For instance, shopping for or promoting into the election might be met with opposition by way of a corrective transfer earlier than resuming the prior development. However it’s additionally totally attainable we see an outright development reversal.

Some of the constant outcomes price noting, is that in every cycle since 1980 -whether it was initially following the election or within the a number of months thereafter – there was a point of power to observe. Remember, although, the election is just one driving power and the Greenback could rapidly shift its focus to a extra urgent set of basic elements.

Advisable by Paul Robinson

Discover Out the #1 Mistake Merchants Make

USD Efficiency in Election Years

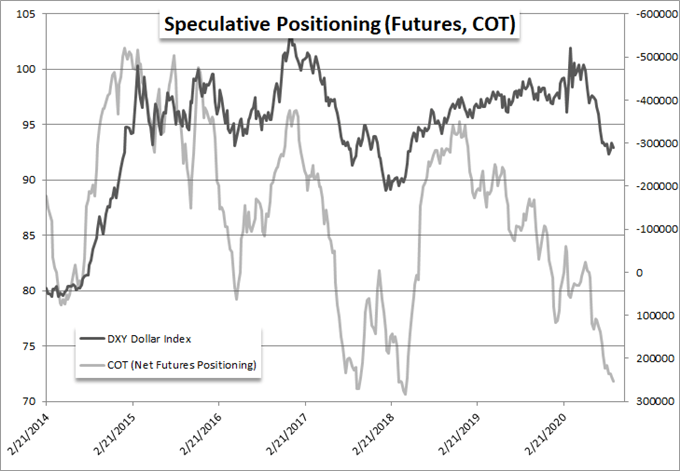

One other have a look at the present situations, and the way it could skew the Greenback’s response to the essential occasion, is the standing of speculative curiosity within the markets. There are a number of indicators and property that may replicate upon market pursuits, however one of many extra recognizable metrics is the CFTC’s Dedication of Merchants (COT).

Utilizing this report’s insights on futures positioning, we discover that speculative pursuits (versus business and hedging) have pushed internet Greenback publicity to an excessive place via the latter weeks of September. It’s attainable that there’s a rebalance earlier than election night time, however its present footing will additional create a skew to account for when assessing whether or not we’re due a ‘typical’ election response from the Dollar.

Internet Combination Speculative Futures Positioning in Greenback

Open a demo FX buying and selling account with IG and commerce currencies that reply to systemic developments.

Assets for Foreign exchange Merchants

Whether or not you’re a new or skilled dealer, now we have a number of sources accessible that can assist you; indicator for monitoring dealer sentiment, quarterly buying and selling forecasts, analytical and academic webinars held each day, buying and selling guides that can assist you enhance buying and selling efficiency, and one particularly for many who are new to foreign exchange.

—Written by Paul Robinson, Market Analyst

You possibly can observe Paul on Twitter at@PaulRobinsonFX