US jobs possible bounced again in February; can a powerful NFP fireplace up bond yields? – Foreign exchange Information Previe

US jobs possible bounced again in February; can a powerful NFP fireplace up bond yields? – Foreign exchange Information Preview

Posted on March 3, 2021 at 3:54 pm GMTRaffi Boyadjian, XM Funding Analysis Desk

After a sluggish couple of months, America’s labour market is anticipated to have regained some momentum in February. The newest nonfarm payrolls report will most likely reveal a wholesome pickup in jobs development when launched on Friday at 13:30 GMT. Nonetheless, following the latest rout within the bond market, an upbeat set of numbers runs the danger of refuelling the rally in Treasury yields, pushing the greenback greater and piling stress on the Federal Reserve to step in.

A patchy rebound

The pace of the roles restoration from the depths of the Covid disaster initially confounded expectations, taking policymakers unexpectedly. Nonetheless, the rebound slowed markedly on the finish of 2020 whilst different sectors of the economic system continued to take pleasure in strong development. This divergence highlights the truth that the stay-at-home corporations usually are not very labour intensive, and with many components of the economic system nonetheless shut or working at decreased capability, the stall within the restoration shouldn’t have come as an excessive amount of of a shock.

However now that the stimulus money from Congress is flowing to the American folks once more and virus instances are on the decline, hiring possible picked up some tempo in February. The newest analyst forecasts predict the US economic system added 180okay jobs in February, up from a meagre 49okay in January. The unemployment price is anticipated to have stayed unchanged at 6.3% as extra folks most likely re-joined the workforce.

The forecasts for wage development are additionally upbeat, with common earnings projected to have risen by 5.3% year-on-year, virtually maintaining with the prior months’ 5.4% price, which was an 8-month excessive.

Markets may like weak jobs knowledge

If the February numbers underwhelm once more, traders are unlikely to panic. In truth, one other tender jobs report might be the perfect consequence for the markets as it could reinforce the Fed’s cautious stance amid a selloff in authorities bonds on the again of the reflation commerce. A ‘Goldilocks restoration’ the place there’s no threat of a double-dip recession and but development isn’t working so sizzling as to drive the Fed to contemplate placing its ft on the accelerator is simply what shares and different threat property must hold the bull market going.

Even an incredibly dire report wouldn’t considerably alter the outlook as Congress seems to be set to quickly approve the subsequent spherical of stimulus, which ought to present a greater than sufficient increase to maintain the restoration going till vaccinations obtain herd immunity and shuttered companies can reopen.

Fed’s silence grows louder; Powell speech eyed

The larger query is what would occur if employment had been to bounce again very strongly and spark one other leap in Treasury yields. Would the Fed proceed to show a blind eye or would it not sign it could should shift a few of its asset purchases in direction of longer-dated bonds? Doing nothing dangers encouraging an unwelcome tightening in monetary situations, which might virtually definitely harm equities, while making an attempt to maintain yields depressed might additional stoke fears of upper inflation in addition to a inventory market bubble.

All this may put the highlight firmly on the Fed chief, Jerome Powell, on Thursday when he speaks at a Wall Avenue Journal occasion at 17:05 GMT.

Greenback more and more bullish versus the yen

What Powell says might dictate the size of the market strikes from the NFP knowledge on Friday. The US greenback might come below heavy promoting stress towards the likes of the euro, pound and Australian greenback if Powell makes use of more durable language on the hazards from rising yields. Nonetheless, given the general optimistic outlook for the US economic system, the greenback might endure solely delicate losses towards secure havens such because the yen. The Financial institution of Japan’s yield curve management coverage is more likely to hold the yen on the backfoot even when Treasury yields had been to retreat both from Fed intervention or poor jobs figures.

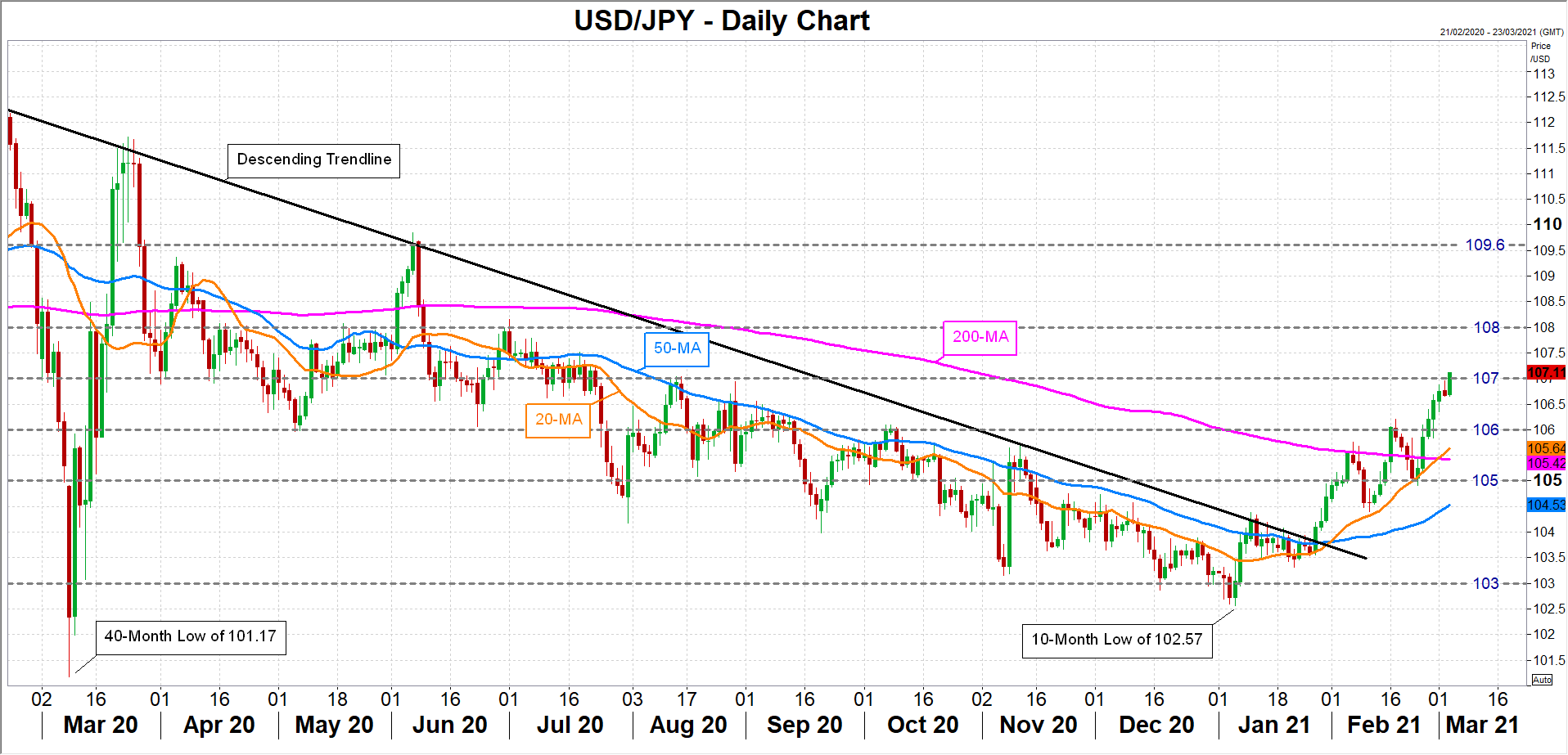

Therefore, greenback/yen is on track to surpass the 107 mark, with the 108 degree being the subsequent goal for consumers. Above that, focus would flip to the 109.60 area the place costs peaked in June 2020.

To the draw back, the 106 degree is the closest main help adopted by the 20-day transferring common (MA), presently at 105.64. So long as the pair is ready to maintain above the 20-day MA, there isn’t a threat to the near-term bullish outlook.

USDJPY