US Stocks Analysis (S&P 500, Nasdaq 100)‘Soft landing’ narrative returns as equities are set to rise in JulyS&P 500 nearing swing high – less

US Stocks Analysis (S&P 500, Nasdaq 100)

- ‘Soft landing’ narrative returns as equities are set to rise in July

- S&P 500 nearing swing high – less than 5% away from all-time-high

- Nasdaq eyes bullish continuation ahead of Apple, Amazon earnings

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

Recommended by Richard Snow

Get Your Free Equities Forecast

‘Soft Landing’ Narrative Returns as Equities are Set to Rise in July

All three major US indices are on track to end July in the green, with the Dow Jones earning a mention after an impressive rise over the last two weeks. The outperformance in the index suggests investors may be shifting out of growth stocks towards value stocks, as the Fed appears set to reach peak rates over the coming Fed meetings into year end.

Comments today from the Chicago Fed President Austan Goolsbee were largely congratulatory of the Fed in their efforts to reign in inflation without breaking the economy. With unemployment near historical lows and inflation making progress, US fundamental data looks to build on the current hot streak in the wake of the massive second quarter GDP beat. The services sector is expected to remain in expansion with Friday’s non-farm payroll (NFP) print expected to see further jobs added to the economy despite the trend of fewer additions.

This week, Apple and Amazon report earnings over the three-month period from April through June. The two tech giants represent 11.6% of the entire index measured by market cap.

S&P 500 Nearing Swing High – Less Than 5% Away from All-Time High

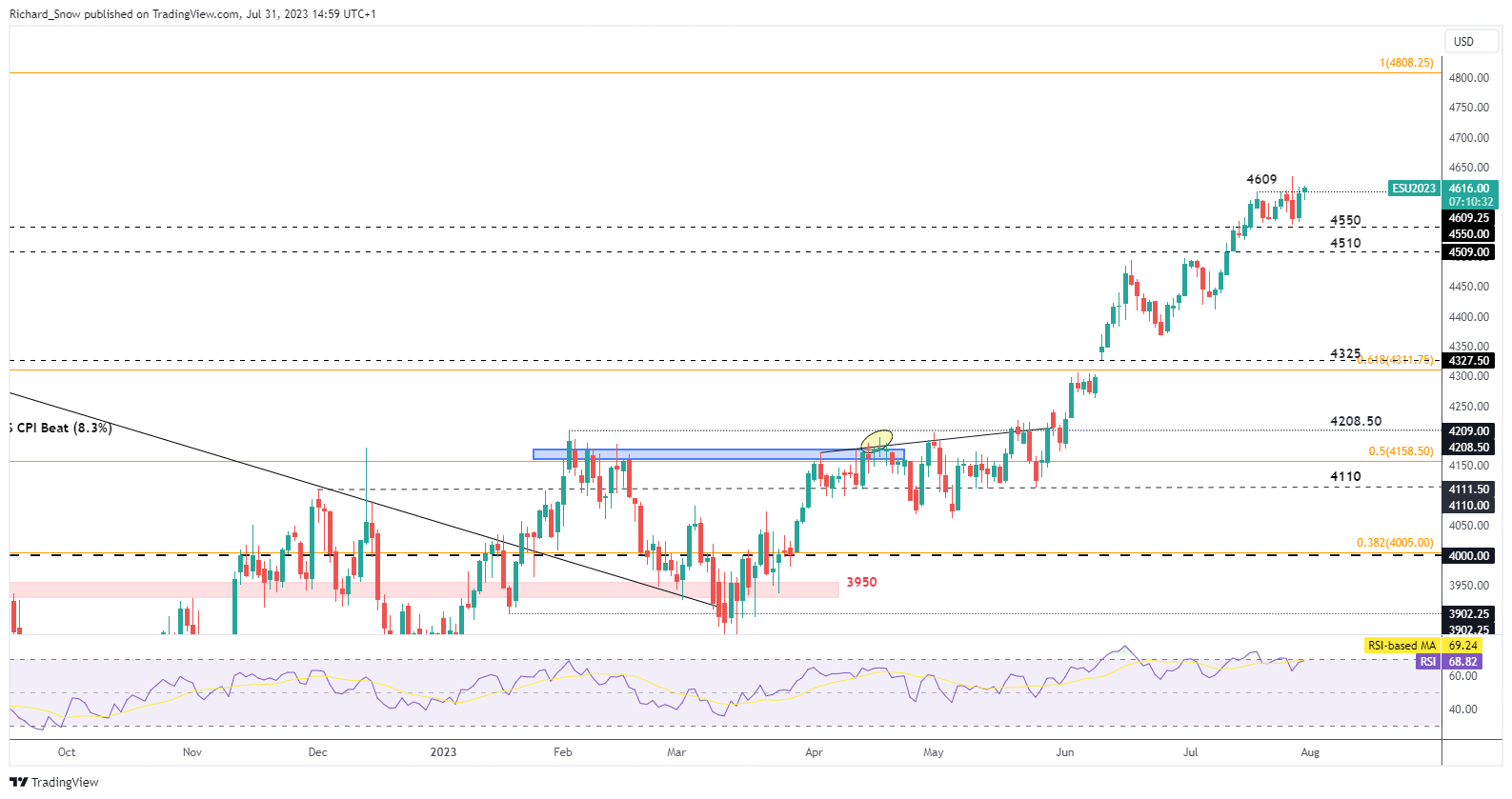

The S&P 500 opened slightly higher to start the week, eying the recent swing high of 4609 and potentially 4740. Lately, price action has struggled to rise with the same degree of momentum, oscillating between 4550 and 4609. The RSI appears on the verge of overbought territory on the daily chart but remains overbought on the weekly chart.

In the event we see a move lower from here, 4550 remains the most immediate level of support followed by 4510. Keep an eye out for US senior loan officer opinion survey data on banking conditions which is tentatively scheduled for today. If credit conditions have worsened materially since the March and May bouts of panic, widespread concern could prompt a move lower in the index.

S&P 500 (E-Mini Futures) Daily Chart Source: TradingView, prepared by Richard Snow

Tech Heavy Nasdaq Eyes Bullish Continuation Ahead of Apple, Amazon Earnings

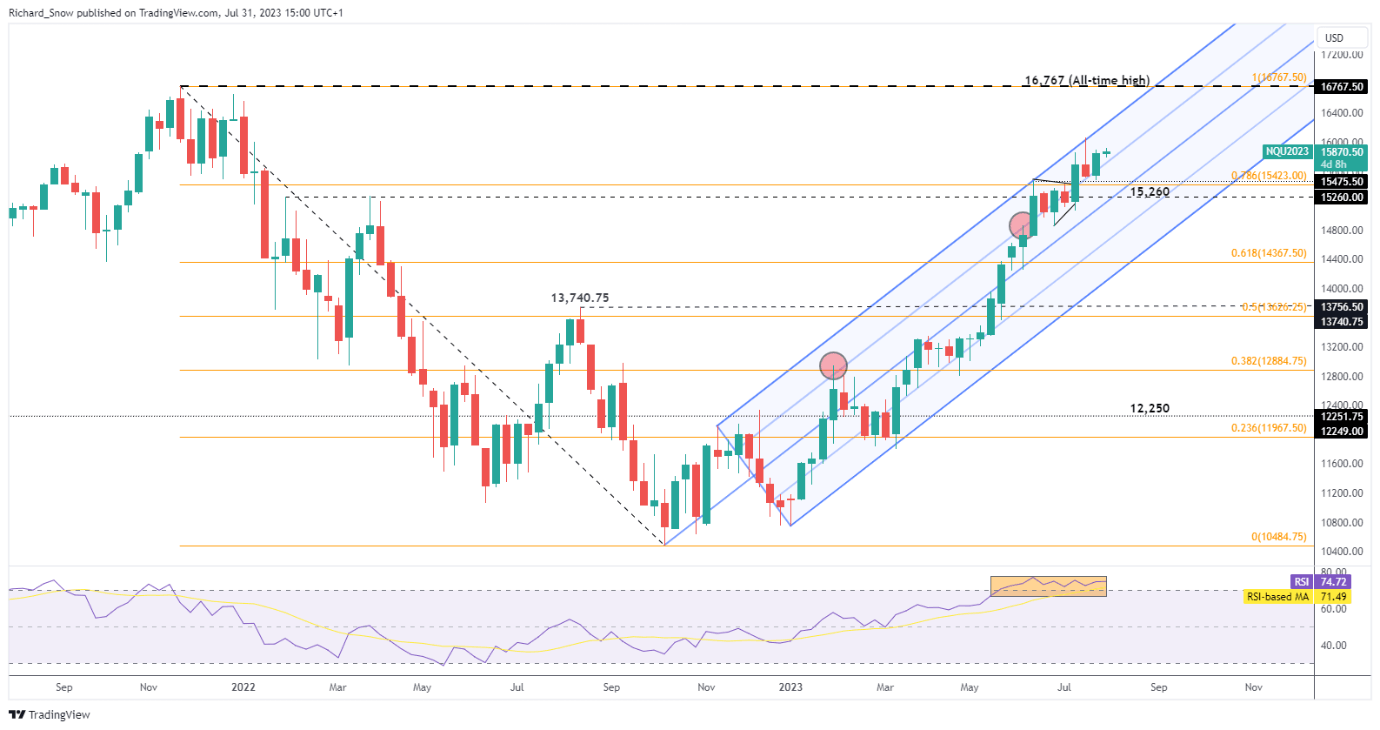

The Nasdaq continues its impressive, sustained rise. Prices continue to trade neatly within the ascending pitchfork, touching trendline resistance twice in the last three weeks without a major pullback. After each touch of resistance, prices cooled -providing better entry points for bullish continuation.

Since respecting the 78.6% Fibonacci retracement (as support) at 15,423, prices have continued higher, now eying the swing high of 16,062 ahead of the all-time-high of 16,767. Support remains at 15,423, followed by 15,260. The weekly chart remains oversold since the latter stages of May without fail. However, better-than-expected US earnings can see the bull run continue for some time yet.

Nasdaq 100 Weekly Chart (E-Mini Futures)

Source: TradingView, prepared by Richard Snow

Recommended by Richard Snow

Get Your Free Top Trading Opportunities Forecast

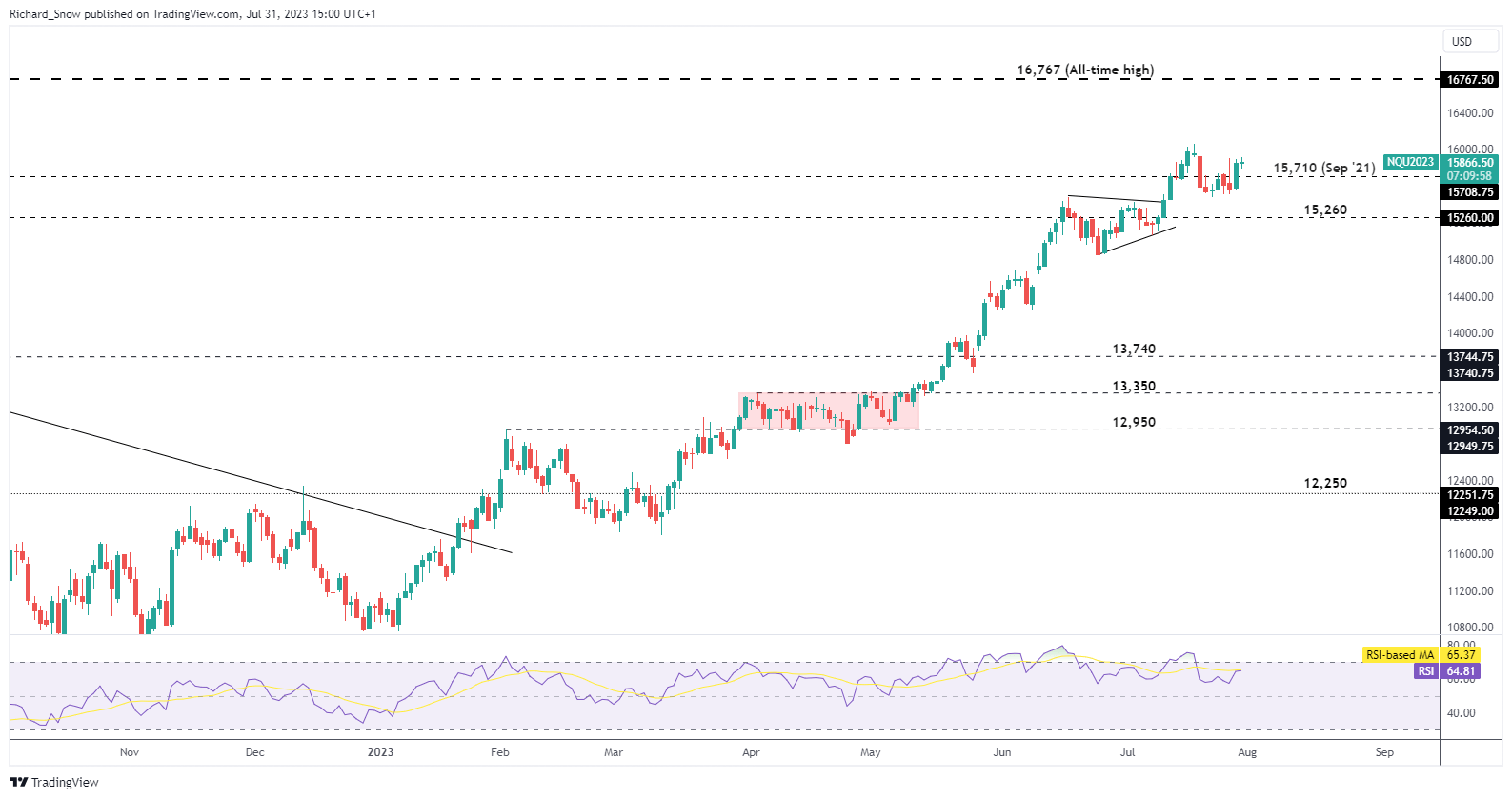

The daily chart helps to assess price action on a more granular level. Price action has consolidated around elevated levels in search for the next bullish catalyst, which could appear in the form of tech earnings, US services PMI data or even NFP data.

Nasdaq 100 Daily Chart

Source: TradingView, prepared by Richard Snow

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com