Canadian Dollar technical forecast: USD/CAD weekly trade levels Canadian Dollar reverses from multi-month trend support near consolidations lows

Canadian Dollar technical forecast: USD/CAD weekly trade levels

- Canadian Dollar reverses from multi-month trend support near consolidations lows

- USD/CAD recovery now testing initial hurdles – risk for near-term setback

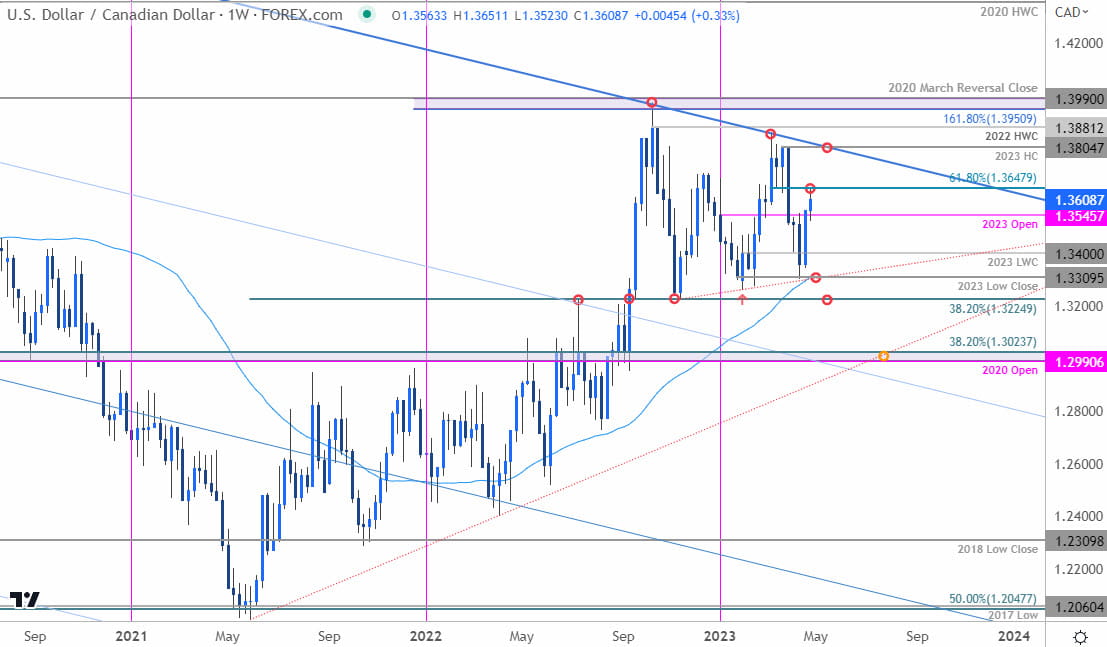

- Resistance 1.3648, 1.3805 (key), 1.3881– support 1.3545, 1.3400, 1.3309(critical)

The Canadian Dollar is on the defensive for a second consecutive week against the US Dollar as USD/CAD builds on a rebound from trend support. The move keeps price within a massive multi-month consolidation pattern just below long-term trend resistance and the focus is on a possible breakout in the weeks ahead. These are the updated targets and invalidation levels that matter on the USD/CAD weekly technical chart.

Discuss this Loonie setup and more in the Weekly Strategy Webinars on Monday’s at 8:30am EST.

Canadian Dollar Price Chart – USD/CAD Weekly

Chart Prepared by Michael Boutros, Sr. Technical Strategist; USD/CAD on TradingView

Technical Outlook: In last month’s Canadian Dollar Technical Forecast we highlighted support at the yearly low-week close at 1.34 as an area of interest while noting that, “Losses below these levels would threaten a test of the 38.2% retracement / 52-week moving average at 1.3225/46. A break lower two-weeks later faltered at the yearly low-close around 1.3309 (low registered at 1.3301), with the subsequent rally extending more than 2.6% off the lows. Note that the 52-week moving now converges on this level and further highlights the technical significance of this threshold.

The advance is testing resistance this week at the 61.8% Fibonacci retracement of the March decline at 1.3648– looking for possible near-term inflection off this mark. Yearly-open support rests at 1.3545 backed again by the 1.34 and 1.35-handles. Ultimately a close below the 38.2% retracement of the 2021 rally at 1.3225 is needed to validate a breakout of the yearly opening range towards critical support at 1.2990-1.3023.

A topside breach from here exposes key resistance at the yearly high-close around 1.3805– note that longer-term slope (blue) also converges on this region. Look for a larger reaction there IF reached with a close above needed to fuel a run towards the 2022 high-week close at 1.3881 and the 1.618% extension of the 2021 advance / 2020 March reversal close at 1.3950/90 (critical).

Bottom line: USD/CAD continues to consolidate within a massive multi-month contractionary range below slope resistance with the recent recovery now testing near-term resistance. From at trading standpoint, a good zone to reduce portions of long-exposure / raise protective stop – losses should be limited to 1.34 on pullback IF price is heading higher with a close above 1.3805 ultimately needed to mark resumption of the broader 2021 rally. Tread lightly here and stay nimble into the May open. Review my latest Canadian Dollar short-term outlook for a closer look at the near-term USD/CAD technical trade levels.

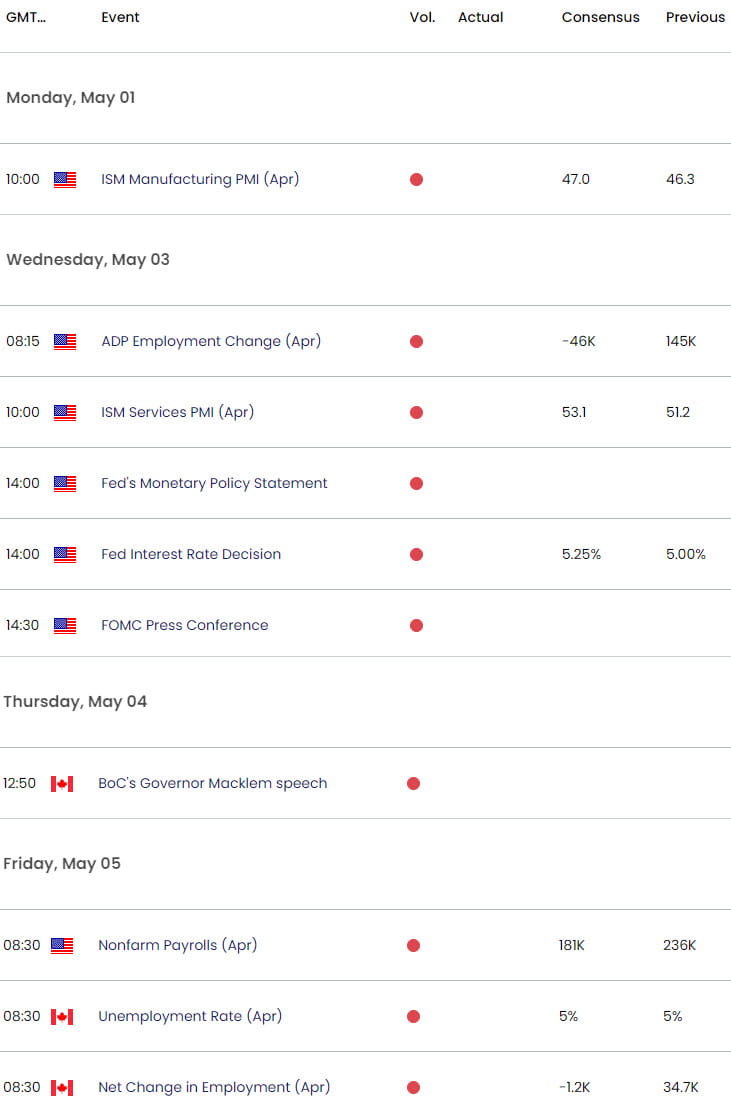

Key Economic Data Releases

Economic Calendar – latest economic developments and upcoming event risk.

Active Weekly Technical Charts

— Written by Michael Boutros, Sr Technical Strategist with FOREX.com

www.forex.com