Canadian Greenback, USD/CAD, Nikkei 225, Jerome Powell, RBNZ, Inventory Markets – Asia Pacific Market OpenFed Chair Jerome Powell

Canadian Greenback, USD/CAD, Nikkei 225, Jerome Powell, RBNZ, Inventory Markets – Asia Pacific Market Open

- Fed Chair Jerome Powell quelled market volatility, USD/CAD prolonged losses

- APAC markets have the RBNZ to stay up for, will NZD/USD decline on it?

- Nikkei 225 might hole decrease, room for losses obvious given distance to key SMA

Really helpful by Daniel Dubrovsky

What are the highest buying and selling alternatives in 2021?

At a primary look, having a look at Wall Avenue’s efficiency revealed a comparatively impartial session, with the tech-heavy Nasdaq Composite underperforming (-0.50%). The Dow Jones and S&P 500 climbed 0.05% and 0.13% respectively. However, this adopted deep draw back gaps, which have been ultimately crammed in. The VIX market ‘worry gauge’ quickly spiked to its highest in three weeks.

Sentiment was drastically deteriorating heading into the Federal Reserve’s semi-annual financial coverage report. This may need been resulting from profit-taking following persistent positive factors in inventory market benchmarks since March. In the course of the report back to the Senate Banking Committee, Fed Chair Jerome Powell reiterated the central financial institution’s dovish stance, possible inspiring buyers to ‘purchase the dip’.

Mr Powell famous that they’re nonetheless a longs approach from their targets, however that current developments level to an improved outlook for later this yr. He didn’t specific explicit concern about rising longer-term Treasury charges, noting that this is because of larger development and confidence expectations. The central financial institution additionally anticipates inflation to be unstable forward, including that they don’t suppose it’ll rise to troubling ranges.

Having a look at overseas trade markets, the US Greenback was cautiously decrease, with the British Pound and Canadian Greenback outperforming. The latter noticed a selected increase as sentiment recovered in the course of the latter half of the North American buying and selling session. The Swiss Franc was the worst-performing G10 foreign money, opening the door to additional declines following notable technical breakouts.

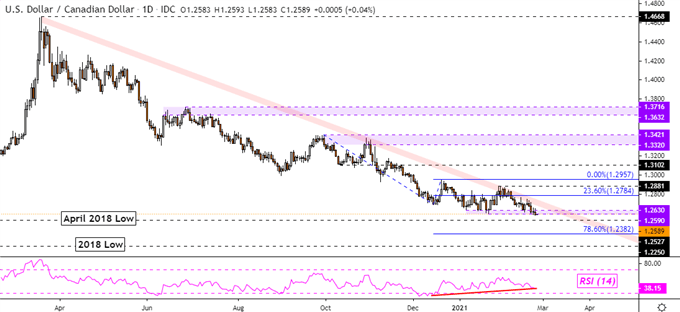

Canadian Greenback Technical Evaluation

USD/CAD prolonged its dominant downtrend since March 2020, closing at its lowest level this yr thus far. An extra draw back shut underneath the 1.2590 – 1.2630 assist zone might open the door to additional losses as lows from April 2018 close to. Nonetheless, optimistic RSI divergence does present that draw back momentum is fading, opening the door to a possible flip larger.

USD/CAD – Day by day Chart

Chart Created in TradingView

Wednesday’s Asia Pacific Buying and selling Session

Given the unstable Wall Avenue session, futures monitoring the Nikkei 225 and Cling Seng are pointing decrease as Wednesday will get going. This may occasionally open the door to a cautiously pessimistic tone, inserting the growth-linked Australian and New Zealand {Dollars} in danger. NZD/USD is eyeing the RBNZ fee determination due at 1:00 GMT. Then, Governor Adrian Orr will converse throughout a information convention an hour later.

There could also be some room for draw back potential within the Kiwi Greenback. Rising longer-term New Zealand authorities bond yields replicate rising confidence within the financial system alongside inflation bets. However, buyers could also be disenchanted if the central financial institution highlights an enhancing financial outlook whereas concurrently sustaining a dovish financial coverage stance. This may occasionally open the door to near-term Kiwi weak point.

Really helpful by Daniel Dubrovsky

What does it take to commerce round information just like the RBNZ?

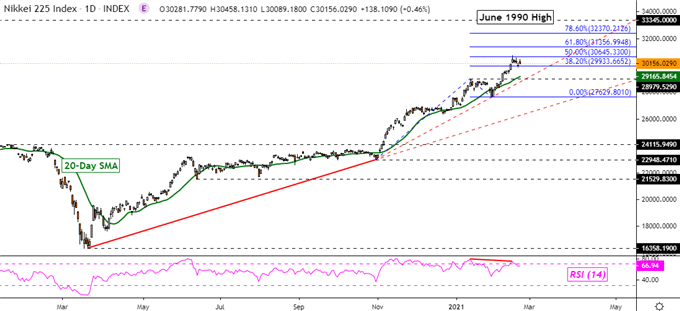

Nikkei 225 Technical Evaluation

After Japanese exchanges have been offline yesterday for The Emperor’s Birthday, the Nikkei 225 could also be eyeing speedy assist beneath at 29933 which is the 38.2% Fibonacci extension. Key resistance sits above at 30645, or the midpoint of the extension. Detrimental RSI divergence can be current right here. There could also be room for deeper losses provided that the 20-day Easy Transferring Common sits round 29165. The latter might come into play to reinstate the dominant uptrend within the occasion of a flip decrease.

Nikkei 225 – Day by day Chart

Chart Created in TradingView

— Written by Daniel Dubrovsky, Strategist for DailyFX.com

To contact Daniel, use the feedback part beneath or @ddubrovskyFX on Twitter

component contained in the

component. That is in all probability not what you meant to do!nnLoad your utility’s JavaScript bundle contained in the component as a substitute.www.dailyfx.com