Canadian Dollar Vs US Dollar, British Pound, Euro - Outlook: Recommended by Manish Jaradi The Fundamentals of Breakout Tradi

Canadian Dollar Vs US Dollar, British Pound, Euro – Outlook:

Recommended by Manish Jaradi

The Fundamentals of Breakout Trading

The Canadian dollar may have just received the boost to extend gains against some of its peers, thanks to the Bank of Canada’s (BOC) hawkish hike on Wednesday.

BOC hiked its overnight rate to a 22-year high of 4.75%, saying “concerns have increased that CPI inflation could get stuck materially above the 2% target.” The central bank, however, dropped the April language saying it “remains prepared to raise the policy rate further”, making it more data dependent. Markets are pricing in another rate hike in July, with the terminal rate seen at 5.15% by the end of the year.

IG Client Sentiment

Source: https://www.dailyfx.com/sentiment-report

Technical charts are growing supportive of CAD against some of its peers.

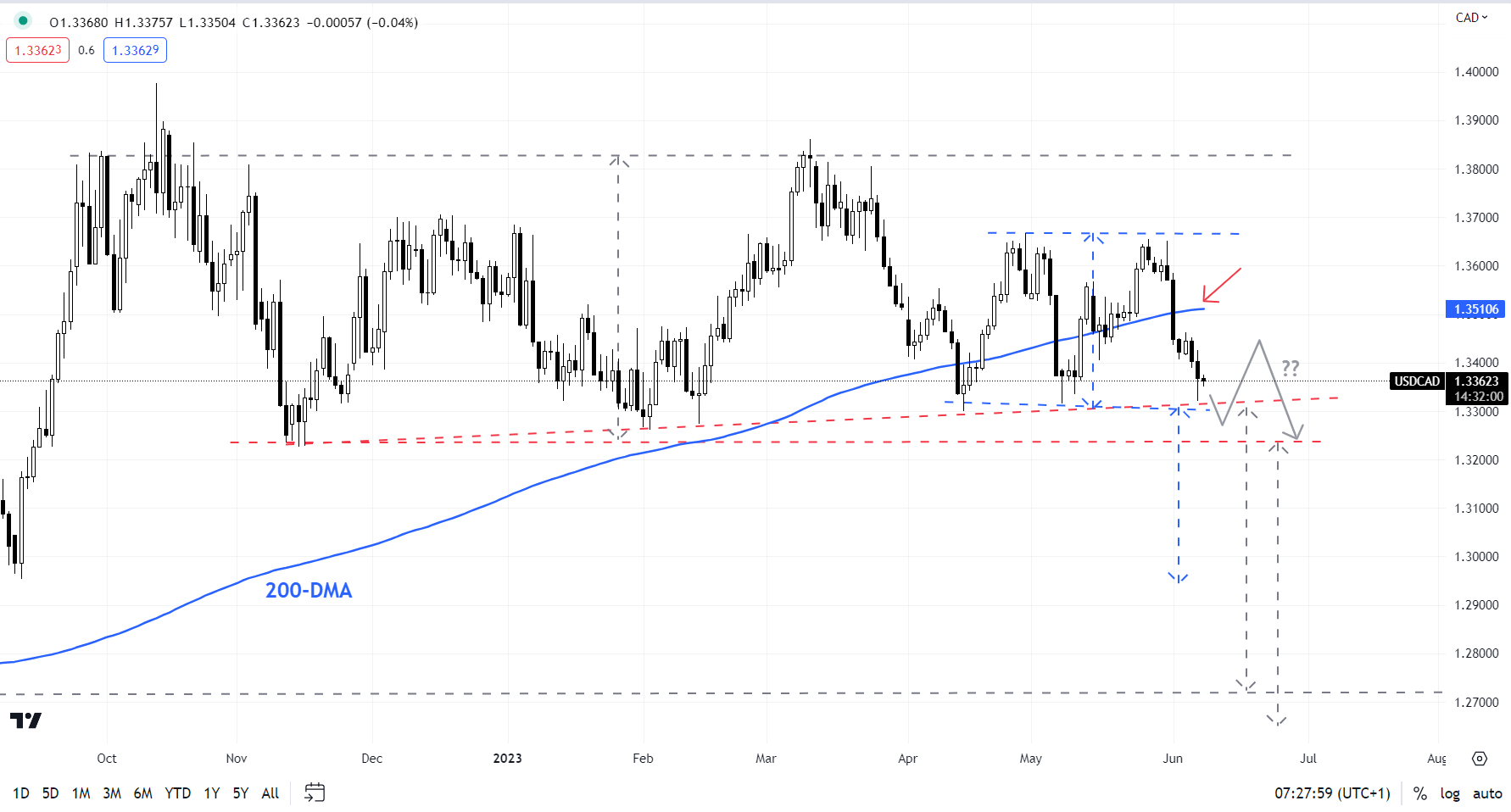

USD/CAD: Looming bearish break

Granted USD/CAD has been sideways for months, but conditions could be getting ripe for a trend. USD/CAD is testing vital converged support around 1.3220-1.3320, a break below which could clear the way for a drop initially toward the psychological 1.3000, potentially toward the August low of 1.2725.

USD/CAD Daily Chart

Chart Created by Manish Jaradi Using TradingView

Moreover, the IG Client Sentiment (IGCS) shows 70% of retail traders are net-long with the ratio of long to short at 2.3 to 1. The number of traders net-long is a whopping 74% higher from last week. The IGCS data at times functions as a contrarian indicator – the fact traders are net-long reduces the hurdle for USD/CAD to fall.

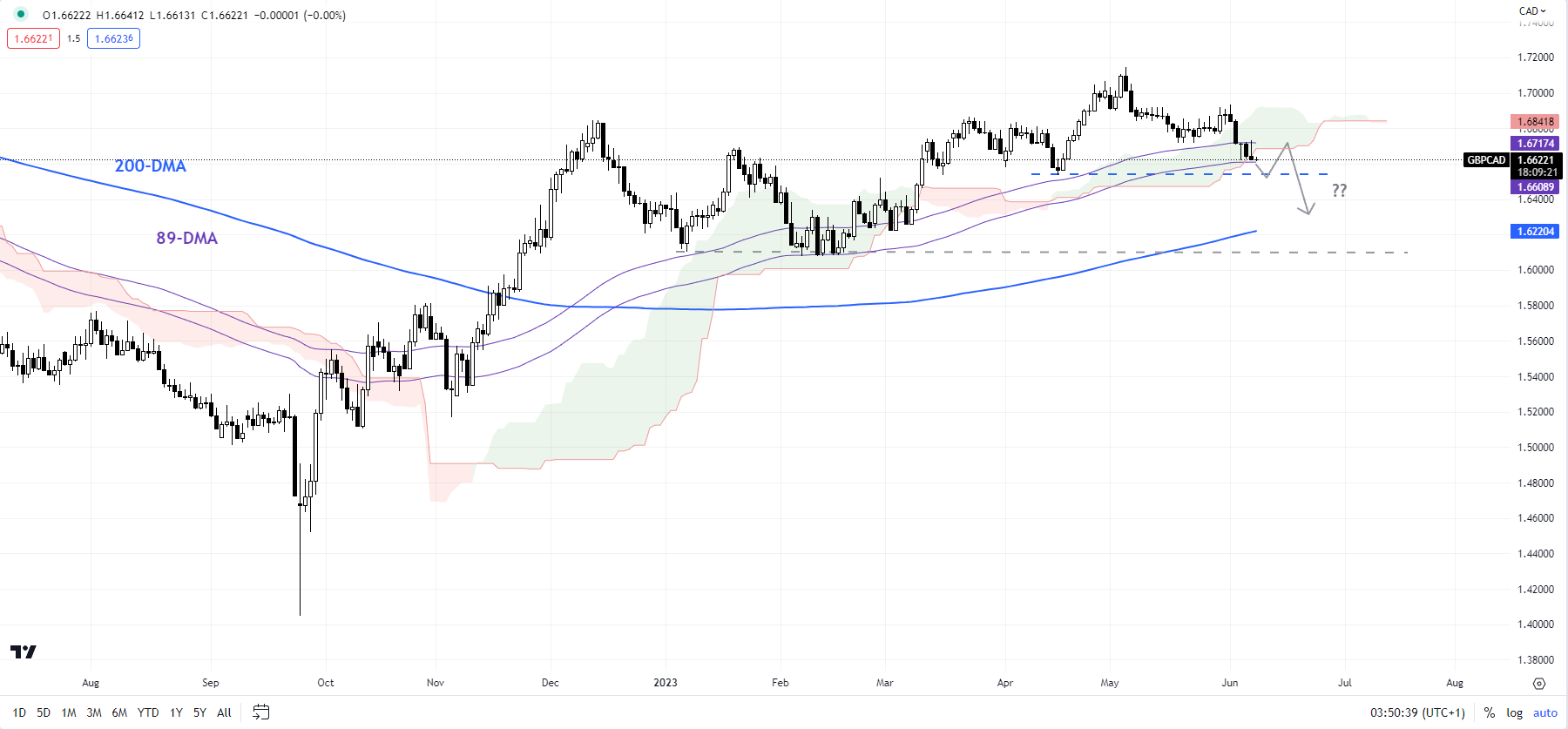

GBP/CAD Daily Chart

Chart Created by Manish Jaradi Using TradingView; Notes at the bottom of the page

GBP/CAD: Risks a drop toward the 200-DMA

GBP/CAD’s failure to rise decisively past the end-2022 high of 1.6850, slightly above major resistance on the 200-week moving average, points to fatigue in the nine-month-long rally. The cross is testing a crucial converged floor, including the April low of 1.6535, coinciding with the 89-period moving average. While a minor rebound can’t be ruled out given the significance of the support, the broader bias remains down, potentially toward the 200-day moving average (now at about 1.6225).

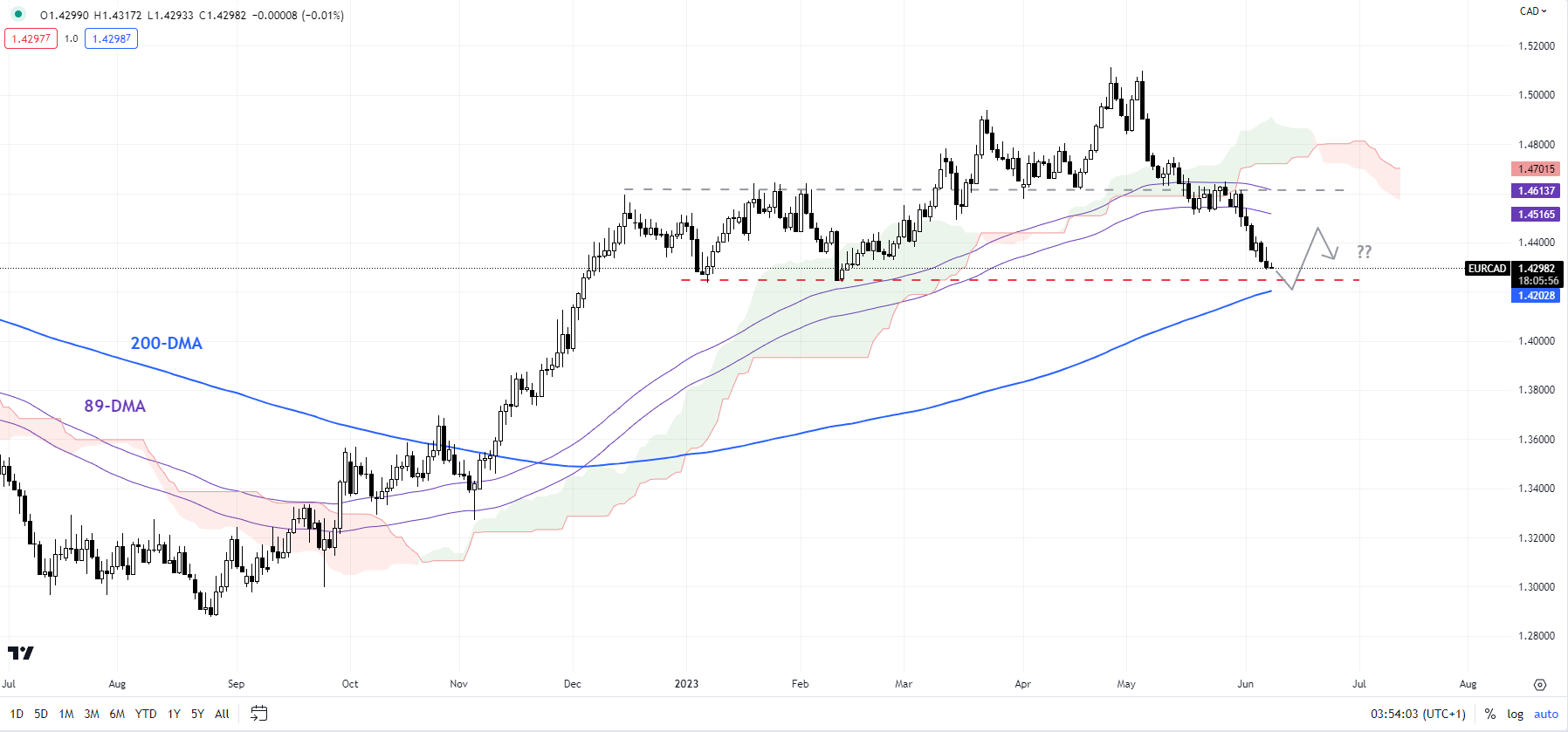

EUR/CAD Weekly Chart

Chart Created Using TradingView

EUR/CAD: A minor pause on the cards?

EUR/CAD is approaching a major converged cushion on the 200-day moving average and a horizontal trendline from January at about 1.4235. Oversold conditions point to a minor bounce, but it may not sustain for long given the recent fall below the 89-day moving average and the Ichimoku cloud on the daily chart. Any break below 1.4235 could expose downside risks toward 1.4000. On the top side, the late-May high of 1.4650 would be tough to crack.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Manish Jaradi, Strategist for DailyFX.com

— Contact and follow Jaradi on Twitter: @JaradiManish

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com