USD/CAD has been following the FED policy projections, being bullish until October last year when the FED started giving signals that they were going

USD/CAD has been following the FED policy projections, being bullish until October last year when the FED started giving signals that they were going to start slowing down with rate hikes and stop at some point. In the last meeting on Wednesday, the FED decided to raise rates by 0.25%, in line with market anticipations.

Although, during the press conference, FED chairman Jerome Powell attempted to ease any concerns among investors by stating that the US banking system was reliable and stable. However, his remarks on the need to focus on lowering inflation while not specifying how this would be achieved left some confusion among market participants. The USD retreated initially, then turned bullish which sent USD/CAD up and down.

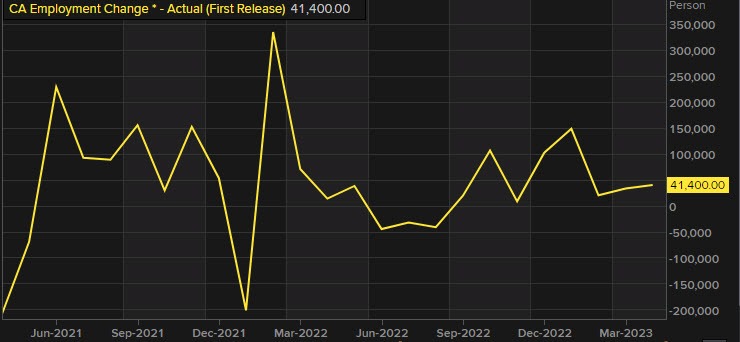

Canada April Employment Report

Canada jobs increased by 41.4K led by part-time

- Prior month 34.7K

- Employment gain for April 41.4K vs 20.0K estimate

- Unemployment rate 5.0% versus 5.1% expected

- Full-time employment -6.2K versus 18.8 K last month

- Part-time employment 47.6K versus 15.9 K last month

- Participation rate 65.6% vs 65.6% last month

- Average hourly wages permanent employees 5.2% versus 5.2% last month

Other highlights

- Employment growth among core-aged men (25-54 years) and men aged 55+; steady for core-aged and older women; little change for male and female youth.

- Sectors with employment increases: wholesale and retail trade, transportation and warehousing, information/culture/recreation, and educational services; decrease in business services.

- Employment rose in Ontario and Prince Edward Island, declined in Manitoba, and remained stable in other provinces.

- Average hourly wages increased 5.2% (+$1.66 to $33.38) year-over-year in April (not seasonally adjusted).

- Part-time employment increased while full-time employment held steady; 15.2% of part-time workers involuntarily working part-time.

- Private sector employees increased by 299,000 (+2.3%) year-over-year, public sector increased by 81,000 (+2.0%), and self-employment remained unchanged, below pre-COVID-19 levels.

Looking at the different sectors, the winners and losers are showing:

USD/CAD

www.fxleaders.com