Canadian Dollar Talking PointsUSD/CAD carves a series of higher highs and lows after testing the 200-Day SMA (1.2745), and the exchange rate may stag

Canadian Dollar Talking Points

USD/CAD carves a series of higher highs and lows after testing the 200-Day SMA (1.2745), and the exchange rate may stage a larger advance over the coming days if it clears the opening range for August.

USD/CAD to Stage Larger Advance on Break Above August Opening Range

USD/CAD appears to be on track to test the monthly high (1.2985) as it retraces the decline the bearish reaction to the US Consumer Price Index (CPI), and the decline from the yearly high (1.3224) may turn out to be a correction in the broader trend with the Federal Reserve on track to implement a restrictive policy.

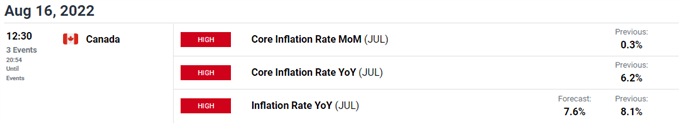

At the same time, fresh data prints coming out of Canada may keep USD/CAD afloat as the headline reading for inflation is expected to slow to 7.6% from 8.1% per annum in June, and evidence of easing price pressures may drag on the Canadian Dollar as the Bank of Canada (BoC) expects inflation to “come back down later this year, easing to about 3% by the end of next year and returning to the 2% target by the end of 2024.”

As a result, the BoC may implement smaller rate hikes over the coming months after deciding to “front-load the path to higher interest rates” in July, as it remains to be seen if Governor Tiff Macklem and Co. will adjust the forward guidance for monetary policy at the next meeting on September 7 as inflation in Canada seems to have peaked.

Until then, USD/CAD may continue to retrace the decline from the yearly high (1.3224) if it clears the opening range for August, and a further advance in the exchange rate may fuel the recent flip in retail sentiment like the behavior seen earlier this year.

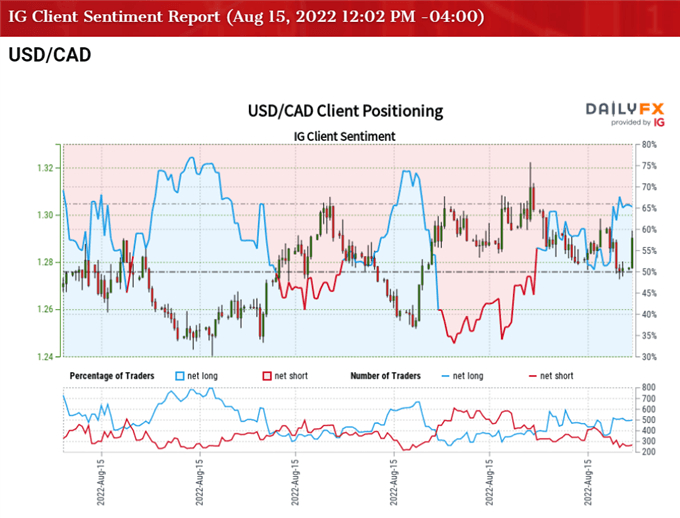

The IG Client Sentiment report shows 43.69% of traders are currently net-long USD/CAD, with the ratio of traders short to long standing at 1.29 to 1.

The number of traders net-long is 31.35% lower than yesterday and 25.59% lower from last week, while the number of traders net-short is 70.88% higher than yesterday and 59.29% higher from last week. The decline in net-long position comes as USD/CAD approaches the monthly high (1.2985), while the surge in net-short interest has fueled the flip in retail sentiment as 61.34% of traders were net-long the pair during the last week of July.

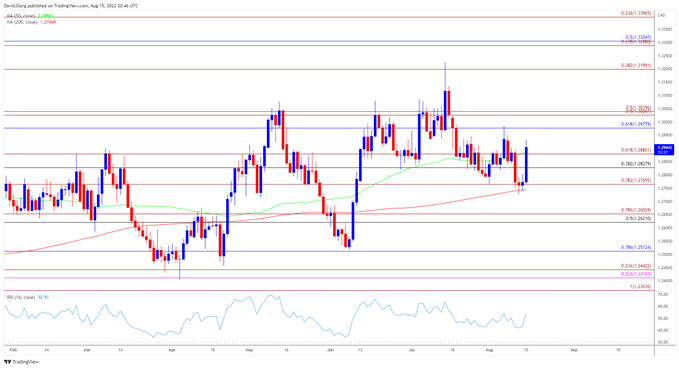

With that said, USD/CAD may attempt to break out of the opening range for August as it carves a series of higher highs and lows after testing the 200-Day SMA (1.2745), and the decline from the yearly high (1.3224) may turn out to be a correction in the broader trend as the moving average reflects a positive slope.

USD/CAD Rate Daily Chart

Source: Trading View

- USD/CAD appears to be reversing course following the string of failed attempts to close below the 200-Day SMA (1.2745), with the recent series of higher highs and lows pushing the exchange rate back above the Fibonacci overlap around 1.2830 (38.2% retracement) to 1.2880 (61.8% expansion).

- A break above the monthly high (1.2985) along with a close above 1.2980 (618% retracement) brings the 1.3030 (50% expansion) to 1.3040 (50% expansion) region on the radar, with a move above the 1.3200 (38.2% expansion) handle opening up the yearly high (1.3224).

- Next area of interest comes in around the 1.3290 (61.8% expansion) to 1.3310 (50% retracement) region followed by the November 2020 high (1.3371), but failure to clear the opening range for August may pull USD/CAD back towards the overlap around 1.2830 (38.2% retracement) to 1.2880 (61.8% expansion).

— Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com