USD/CHF has been sliding for several months to 0.8550s which it reached by July, but then it made a reversal as the UAD buyers started to come back an

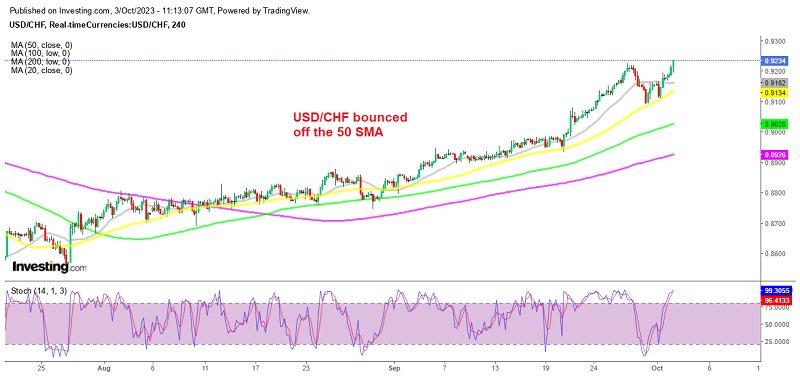

USD/CHF has been sliding for several months to 0.8550s which it reached by July, but then it made a reversal as the UAD buyers started to come back and it has been recovering higher since then. The bullish trend has been consistent for more than two months, with the price climbing above 0.90 first and now above 0.92.

Furthermore, moving averages are acting as support indications on the H4 chart above, keeping USD/CHF well supported during pullbacks lower. In fact, all moving averages have been pushing the lows higher, indicating a stable bullish trend.

This pair experienced a comeback on Monday, which extended on Tuesday, following Switzerland’s softer CPI inflation figures, after last Friday’s retreat lower. Broad-market risk flows are seeing investors jump into the US Dollar (USD) again ahead of another US NFP employment report on Friday.

On Monday, the ISM numbers showed improvement in activity, with September’s Manufacturing number printing a strong 49 points vs. the projected increase to 47.7 points. Manufacturing prices though came in lower, with the ISM manufacturing inflation index falling to 43.8 points, missing the projected increase to 48.6.

USD/CHF pushed higher once again, rising above last week’s high of 0.92.27. Higher rates, with the 10-year yields, continue to surge which is contributing to the positive sentiment. So we remain long on this pair and will try to buy retraces lower to the moving averages, which has been a profitable trading strategy so far. Below is the CPI (consumer price index) inflation report which came in weaker than expected, also contributing to the bullish momentum in this pair.

Switzerland September CPI YoY Released by the Federal Statistics Office – 3 October 2023

- September CPI YoY +1.7% vs +1.8% expected

- August CPI YoY was +1.6%

- Core CPI YoY +1.3%

- Prior core CPI YoY was+1.5%

Headline annual inflation is steadying at just under 2% but the good news for the SNB is that core annual inflation is seen easing further to 1.3% on the month. That vindicates their decision to move to the sidelines last month at least.

USD/CHF Live Chart

USD/CHF

www.fxleaders.com

COMMENTS