April has been a key month on the foreign exchange, highlighted by a fading USD and rising inflation. With only some hours left till we flip the ca

April has been a key month on the foreign exchange, highlighted by a fading USD and rising inflation. With only some hours left till we flip the calendar to Could, the Dollar is on the bull. Key movers have been the EUR/USD (-0.69%), USD/JPY (+0.35), and the GBP/USD (-0.81%). Proper now, sentiment is optimistic as institutional cash adjusts its end-of-month ledgers.

On the financial calendar, there have been just a few noteworthy stories out this morning. Right here’s a quick take a look at the headliners:

Occasion Precise Projected Earlier

Core PCE Worth Index (MoM) 0.4% 0.3% 0.1%

Core PCE Worth Index (YoY) 1.8% 1.8% 1.4%

Private Earnings (MoM) 21.1% 20.3% -7.1%

Private Spending (YoY) 4.2% 4.1% -1.0%

Effectively, it’s official ― the period of U.S. inflation is upon us. In all honesty, the Private Earnings and Private Spending stats are meaningless merchandise of COVID-19 governmental fiscal coverage. Nonetheless, the uptick within the month-to-month and yearly Core PCE Worth Index is an enormous deal. Given final 12 months’s launch of COVID-19 stimulus and the Fed’s limitless QE program, in the present day’s inflation must be no shock.

Traditionally, inflation comes on quick and accelerates till checked; who’s going to examine it this time round? Fed Chairman Powell seems comfy with the current rise in costs, crediting the transfer to “transitory” forces. With Could on the instant horizon, it appears to be like like foreign exchange gamers are contemplating a forthcoming shift in coverage tone.

April’s Foreign exchange Motion Is Almost In The Books

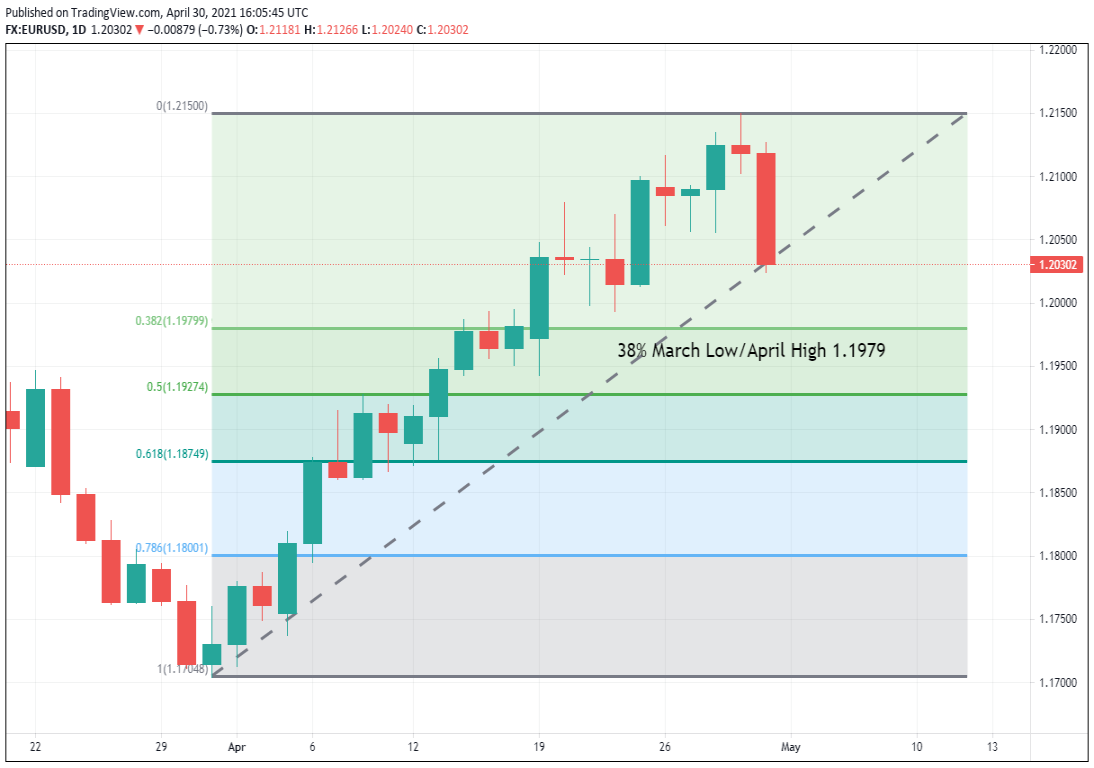

For the EUR/USD, it has been an enormous session. Charges are off dramatically and driving towards a key Fibonacci help stage. Will foreign exchange bidders step up at 1.1979?

Backside Line: So long as 1.2150 is a viable swing excessive, I’ll have orders within the queue from simply above the 38% retracement at 1.1985. With an preliminary cease loss at 1.1874, this lengthy foreign exchange commerce produces 111 pips on a typical 1:1 danger vs reward ratio.