This morning introduced a group of stronger-than-expected U.S. financial reviews. Because of this, shares are on the march north and the Dollar is

This morning introduced a group of stronger-than-expected U.S. financial reviews. Because of this, shares are on the march north and the Dollar is holding agency towards the Swiss franc. Whereas the civil unrest in the US seems to be gaining momentum, it’s starting to seem like the worst of the COVID-19 financial fallout is over.

Though immediately’s American financial reviews are removed from rosy, they’re an enchancment over months previous. Right here’s a fast breakdown of the info:

Occasion Precise Projected Earlier

ADP Employment Change (Might) -2.760M -9.000M -19.557M

ISM Non-Manufacturing Employment Index (April) 31.8 35.8 30.0

ISM Non-Manufacturing PMI (April) 45.4 44.0 41.8

The headliners of this group are the huge enchancment in ADP Employment and uptick within the ISM Non-Manufacturing PMI. These numbers counsel that issues are heading again to regular because the COVID-19 contagion resides. Maybe strengthening numbers will turn out to be a pattern with the onset of summer time.

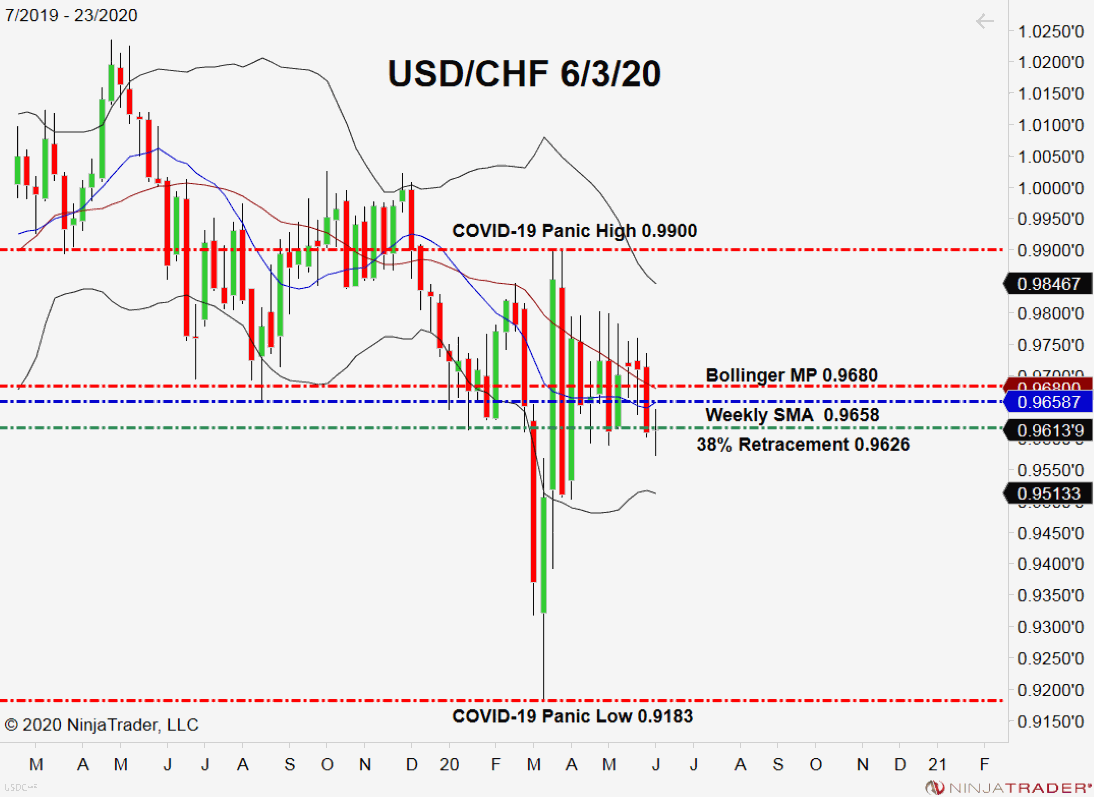

To this point immediately, the USD is on the transfer vs GOLD, the Japanese yen, and holding agency towards the Swiss Franc. Let’s dig into the important thing ranges and weekly technicals for the USD/CHF.

Swiss Franc Enters Consolidation Vs The USD

The previous three classes have introduced tight buying and selling circumstances to the USD/CHF. Costs are hovering round the important thing 38% Retracement degree (0.9626) in a non-committal trend.

+2020_23+(10_30_24+AM).png)

Listed here are the important thing ranges to look at within the USD/CHF for the rest of the week:

- Resistance(1): Weekly SMA, 0.9658

- Assist(1): 38% Retracement, 0.9626

Backside Line: Though charges of the Dollar/Swiss franc are at the moment beneath Assist(1) at 0.9626, the world from 0.9600-0.9575 is drawing bids to the market. If we see a rally from the 0.9600 deal with, a shorting alternative could come into play from the Weekly SMA (0.9658).

For the rest of the week, I’ll have promote orders within the queue from 0.9654. With an preliminary cease loss positioned at 0.9676, this commerce produces 20 pips on a barely sub-1:1 threat vs reward ratio.