USD/JPY Analysis and ChartsUSD/JPY took back some of the previous session’s weaknessWeak Durable Goods Orders had only a modest effect on the pairInve

USD/JPY Analysis and Charts

- USD/JPY took back some of the previous session’s weakness

- Weak Durable Goods Orders had only a modest effect on the pair

- Investors are focused on what Jerome Powell has in store for them

Recommended by David Cottle

How to Trade USD/JPY

The United States Dollar still finds buyers against the Japanese Yen whenever the rate heads South, with Thursday’s Asian and European gains almost enough to claw back the previous session’s losses.

USD/JPY didn’t move much on the latest feeble economic data release. US Durable Goods orders for July fell by 5.2% on the year. That was worse than the 4% expected and the sharpest fall since April 2020, when the US was struggling out of the Covid pandemic.

However, the fall was predicated on a weakness in transport equipment, without which orders still rose, and the Dollar was a little higher after the release.

Fundamentally the Dollar remains underpinned by concerns that borrowing costs in the US could yet rise and, even if they don’t, will remain elevated for longer than the markets hoped at the start of this year.

This is particularly relevant in the case of USD/JPY. Japan’s central bank remains an outlier with its ultra-loose monetary policy, taking the view that inflation is a global phenomenon, with homegrown demand still weak and in need of monetary stimulus. The Bank of Japan’s key short-term interest rate is still minus 0,1%, leaving the Yen a tempting ‘funder’ for carry trades, in which it’s borrowed and sold against other currencies with more attractive yields.

With interest rates in mind, the market is naturally focused on Jackson Hole, Wyoming, as it always is at this time of year. The annual central bankers’ symposium there organized by the Federal Reserve of Kanas City is now underway, with Fed Chair Jerome Powell due to speak on Friday.

The venue is often bankers’ choice for some tough talk, and all financial markets are likely to remain a little nervy until Mr. Powell sits down. Signs that the Fed is still in a hawkish frame of mind will likely support the Dollar but may mean a tough end to the week in global stock markets.

Investors are already concerned about weak economic performance in China. The prospect of US demand further constrained by tighter credit markets won’t cheer them at all.

Recommended by David Cottle

Traits of Successful Traders

USD/JPY Technical Analysis

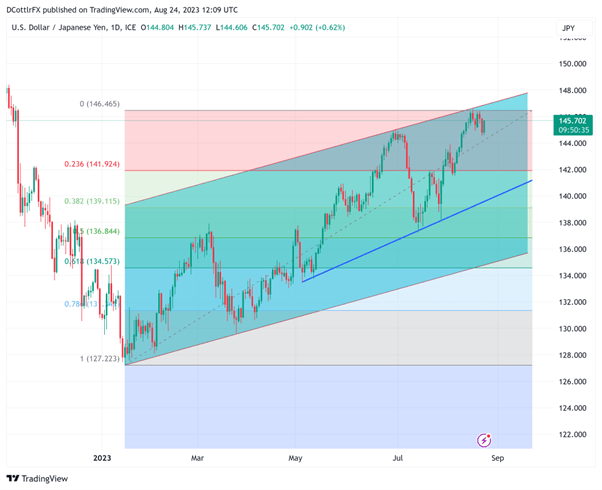

USD/JPY Daily Chart Compiled Using TradingView

You can really take your pick of likely uptrends on the USD/JPY chart right now, with the broad rise from the lows of mid-January last year clearly under no immediate threat at all. Indeed, the base of that uptrend channel hasn’t faced any sort of challenge since March 27.

For now, the uptrend line from May 4 may be a more useful directional cue, but even that now provides support a long way below the market, down at 139.90.

USD/JPY bears will probably want to force an early retest of June 30’s peak, 145.131. If they can manage that then the market may start to fear that the pair is topping out, as a tell-tale head and shoulders pattern would then emerge. Support below that would then come in at the first Fibonacci retracement of the rise up to this month’s highs from the lows of January.

That provides what looks like quite a significant prop at 141.924. Bulls will need to recapture those August highs around 146.61 if they’re to try resistance at the channel top. That now comes in at 147.15.

See how IG Client Sentiment can you when making trading decisions

| Change in | Longs | Shorts | OI |

| Daily | 3% | -5% | -4% |

| Weekly | 7% | -8% | -5% |

–By David Cottle for DailyFX

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com

COMMENTS