Over the previous two classes, no main pair has been extra energetic than the USD/JPY. Charges have fallen by almost 200 pips as safe-haven belong

Over the previous two classes, no main pair has been extra energetic than the USD/JPY. Charges have fallen by almost 200 pips as safe-haven belongings proceed to achieve floor on the USD. For the yen, the outlook has rapidly change into rosy as bidders have entered the market in mass.

Earlier at this time, the U.S. Treasury held their weekly short-term debt public sale. Yields of the three and 6-Month T-Payments held agency, as they’ve many of the summer time. Nonetheless, yields on the 2-12 months Notice fell dramatically from 0.193% to 0.155%. In the intervening time, it seems that the FED remains to be shopping for bonds in live performance with their QE Limitless program.

With little greater than 48 hours till Wednesday’s FED assembly, Wall Road is questioning what the tone shall be from Jerome Powell and the FOMC. Whereas no motion is anticipated to be taken, some merchants are in search of a reasonable shift from the dovish theme of QE Limitless. Though COVID-19 continues to ravage sure areas, it stands to motive that in the end the FED will start occupied with inflation. We’ll see if it’s this week.

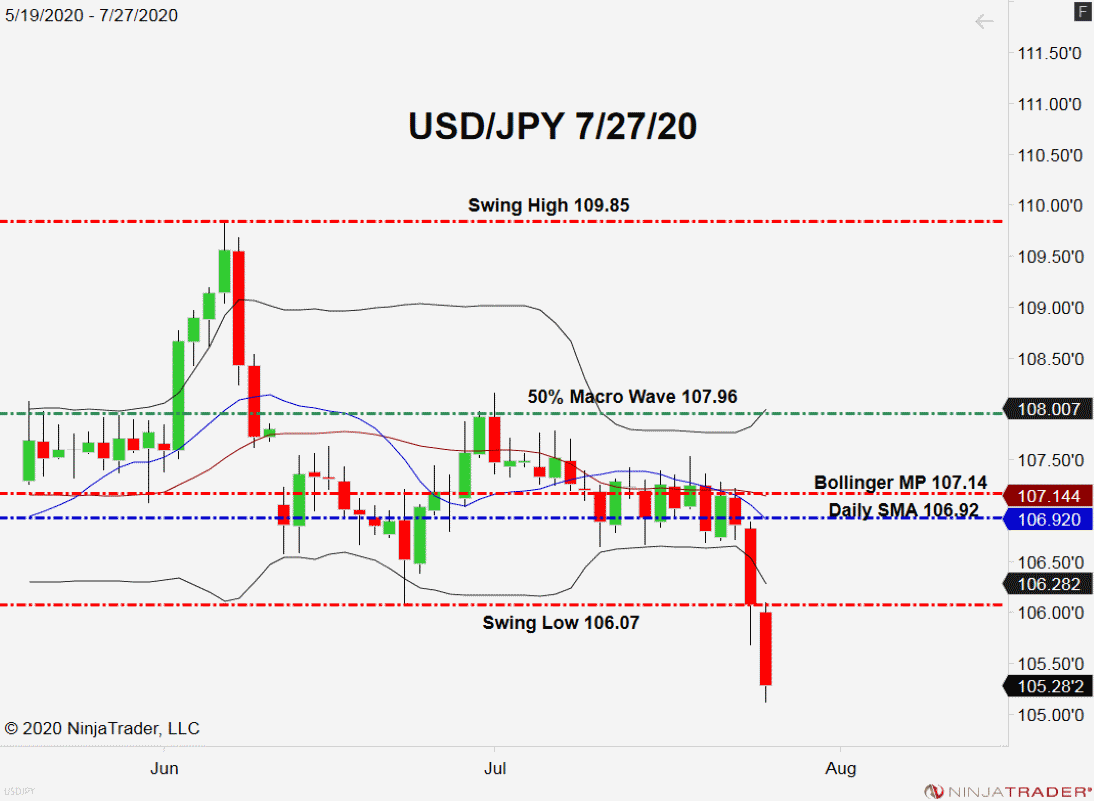

USD/JPY Pushes Yearly Lows

Proper now, the bears are in full management of the USD/JPY. Charges are simply north of 105.00 as merchants proceed to favor the brief aspect of this market.

+2020_07_27+(11_31_49+AM).png)

For the close to future, there are two ranges on my radar:

- Assist(1): Psyche Degree, 105.00

- Assist(2): Psyche Degree, 104.50

Overview: About the one actual ranges of assist for the USD/JPY are big-round-numbers. Apart from that, this market is in a pre-FED freefall. Don’t look now, nevertheless it’s very doable for this pair to increase the bearish month-to-month vary considerably forward of Wednesday’s FOMC Presser.