JAPANESE YEN PRICE, CHARTS AND ANALYSIS:Yen Selloff Resumes Following Gains on Poor US Data Yesterday.BoJ Board Member Naoki Tamura Said that an End t

JAPANESE YEN PRICE, CHARTS AND ANALYSIS:

- Yen Selloff Resumes Following Gains on Poor US Data Yesterday.

- BoJ Board Member Naoki Tamura Said that an End to Negative Rates Doesn’t Mean the Central Bank Will Scale Back Monetary Easing as they Intend to Keep Rates Low.

- USD/JPY, GBP/JPY Remained Cushioned to the Downside with Data Likely to be the Catalyst for Any Further Move.

- To Learn More About Price Action, Chart Patterns and Moving Averages, Check out the DailyFX Education Section.

Most Read:

YEN FUNDAMENTAL BACKDROP

The Japanese Yen had continued its struggle on Monday and continued into yesterday before lackluster US data helped the Yen stage a recovery. Insights provided by a former Bank of Japan (BoJ) official stated that the BoJ is unlikely to intervene on the Yen until USD/JPY tops the 150.00. This coupled with Dollar Strength in the European session yesterday helped propel USD/JPY and GBP/JPY higher ahead of the US session.

Recommended by Zain Vawda

Trading Forex News: The Strategy

The US session brought the first batch of US data this week with Jolts job opening number and CB Consumer Confidence Data both of which came In well below estimates. The impact of the poor data release saw both Yen pairs retreat in what is a welcome reprieve for the Yen.

The Asian session has seen a recovery by both USD/JPY and GBP/JPY as the Yen faced some pressure as investors flocked toward Japanese Stocks. We also heard comments from BoJ Board Member Naoki Tamura who stated the Central Bank may end negative rates if the inflation goal is in sight. Tamura further clarified that even if the BOJ were to end negative rates, it won’t be scaling back monetary easing as long as it can keep interest rates low. These comments may also be aiding Yen weakness this morning as the European session approaches.

EXTERNAL FACTORS CONTINUE TO DRIVE YEN PAIRS

It is not surprising at all that we have been unable to hold onto Yen gains as this seems to be a theme of late post data releases. Initial volatility and gains are usually given back sometimes within the same session with little or no follow through, a sign of how important market participants perceive data releases as Central Banks echo data dependency.

Recommended by Zain Vawda

Traits of Successful Traders

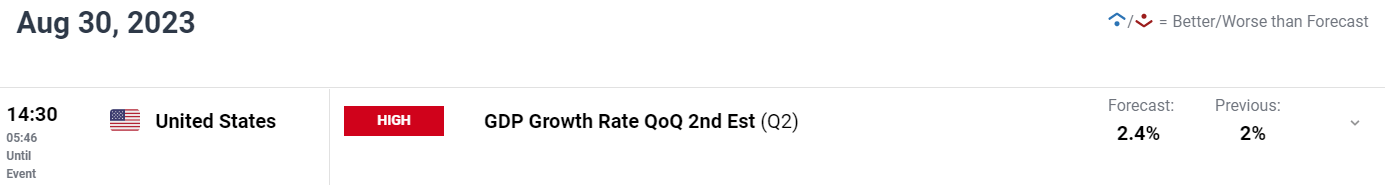

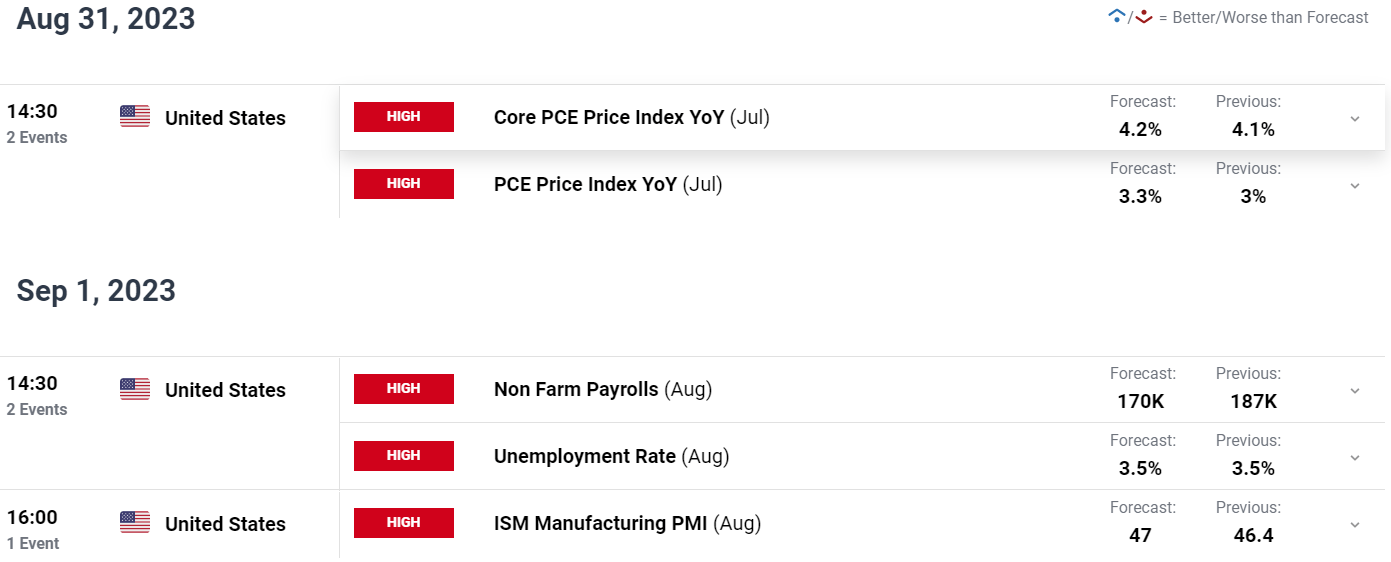

Japanese Yen pairs continue to be driven by external factors with a lot in terms of high impact data releases ahead. The US side brings US GDP data today which will be followed by Core PCE and the NFP jobs report to cap a busy week in terms of data.

Market participants will be keeping a close eye on US data to gauge where the Fed may land at the upcoming Central Bank meeting in September.

For all market-moving economic releases and events, see the DailyFX Calendar

PRICE ACTION AND POTENTIAL SETUPS

GBPJPY

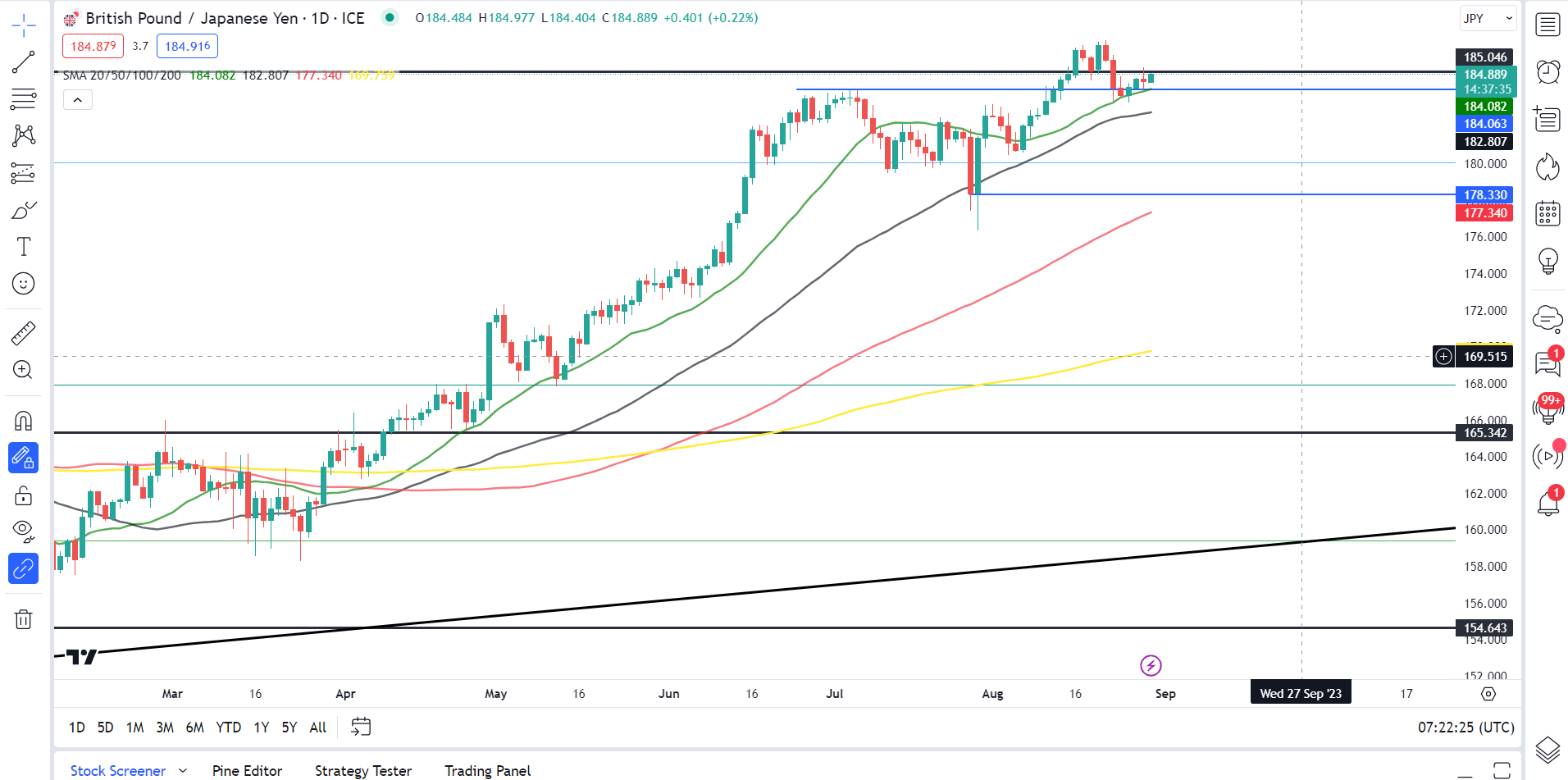

GBPJPY has been enjoying a bit of a lull this week as it remains caught between the 184.00 and 185.00 handles. I expect this to be short lived however, with a lot of support keeping GBPJPY elevated and holding back any significant retracement.

Around the 184.00 handle we have the 20-day MA while the 100-day MA languishes around the 182.73 handle and could come into play should we see a deeper retracement. Considering the lack of data from both Japan and the UK this week market moves could likely be guided by overall sentiment.

This could mean that even a break of the immediate resistance around the 185.00 handle may not have the legs to challenge the YTD high ahead of the weekend. GBPJPY could need a catalyst to break out of this recent range and until the fundamental picture changes or we get a significant miss on any high impact data I do expect the downside on GBPJPY to remain limited.

GBPJPY Daily Chart

Source: TradingView, prepared by Zain Vawda

Key Levels to Keep an Eye On:

Support levels:

- 184.00 (20-day MA)

- 182.70 (100-day MA)

- 180.72 (August swing low)

Resistance levels:

- 185.00 (psychological level)

- 186.80 (YTD High)

- 187.50

USDJPY

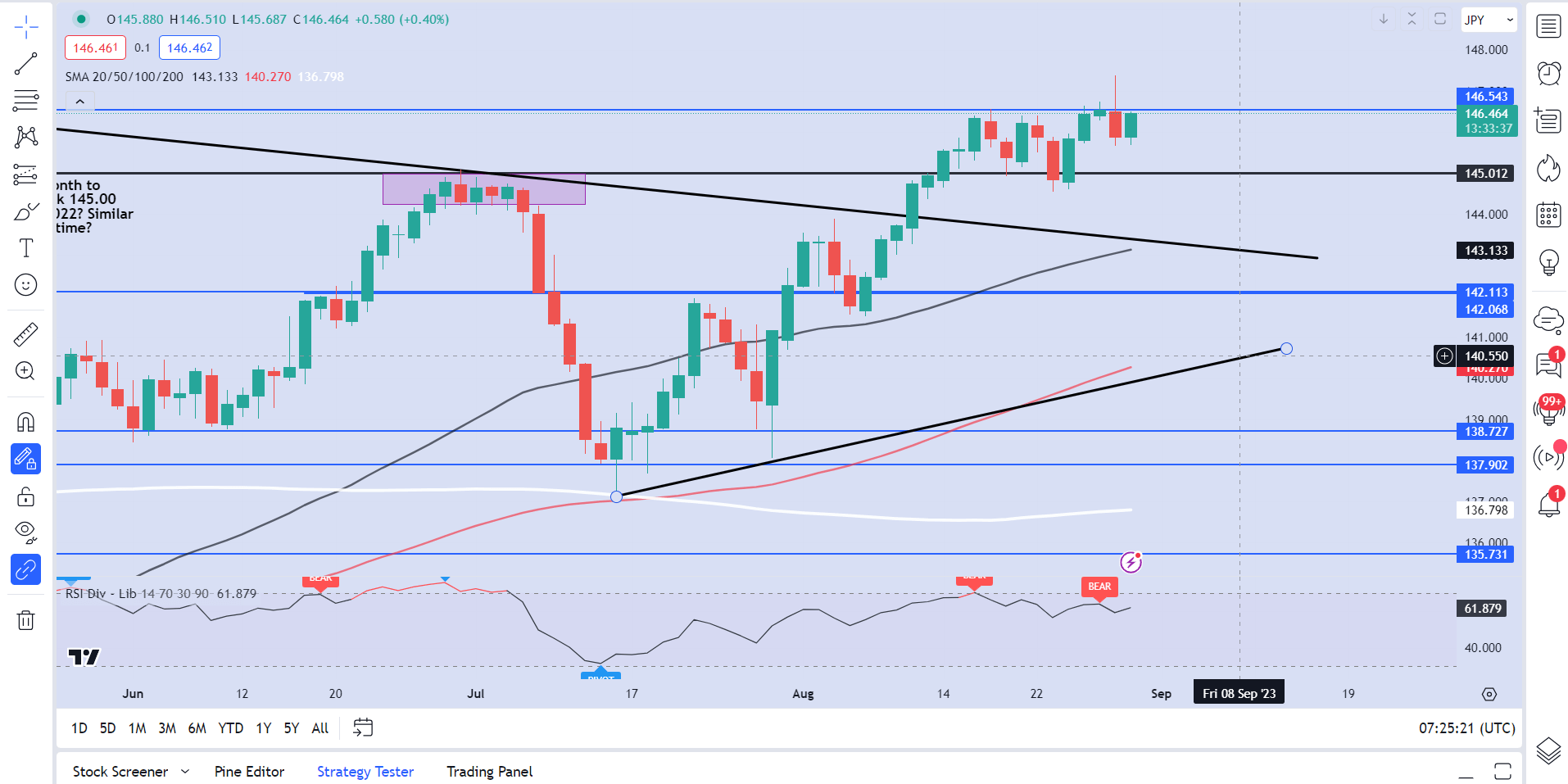

USD/JPY Daily Chart

Source: TradingView, prepared by Zain Vawda

From a technical perspective, USD/JPY printed a massive shooting star candlestick on the daily timeframe. This usually signals further downside ahead which has so far failed to materialize. Similar to GBPJPY downside support remains strong and as long as the DXY continues to hold the high ground expect any selling pressure to be limited. We saw this last week having dipped below the 145.00 handle before rebounding immediately back above.

Today’s daily candle is on its way to retest resistance around the 146.50 handle before it eyes yesterday’s highs. A break of yesterday’s high may be on the cards but this is likely to be down to US GDP later today. A stronger than expected GDP print could provide USD bulls with the impetus they need to continue on their march to the coveted 150.00 handle and potential FX intervention. Either way Yen pairs remaining exciting to watch.

Key Levels to Keep an Eye On:

Resistance levels:

Support levels:

Taking a quick look at the IG Client Sentiment Data whichshows retail traders are 76% net-short on USD/JPY.

For a more in-depth look at USD/JPY sentiment, download the free guide below.

| Change in | Longs | Shorts | OI |

| Daily | -8% | -9% | -9% |

| Weekly | -5% | -5% | -5% |

— Written by Zain Vawda for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com

COMMENTS