The United States greenback versus the Japanese yen forex pair appears to be having some tough occasions in re

The United States greenback versus the Japanese yen forex pair appears to be having some tough occasions in relation to deciding upon the primary route.

Lengthy-term perspective

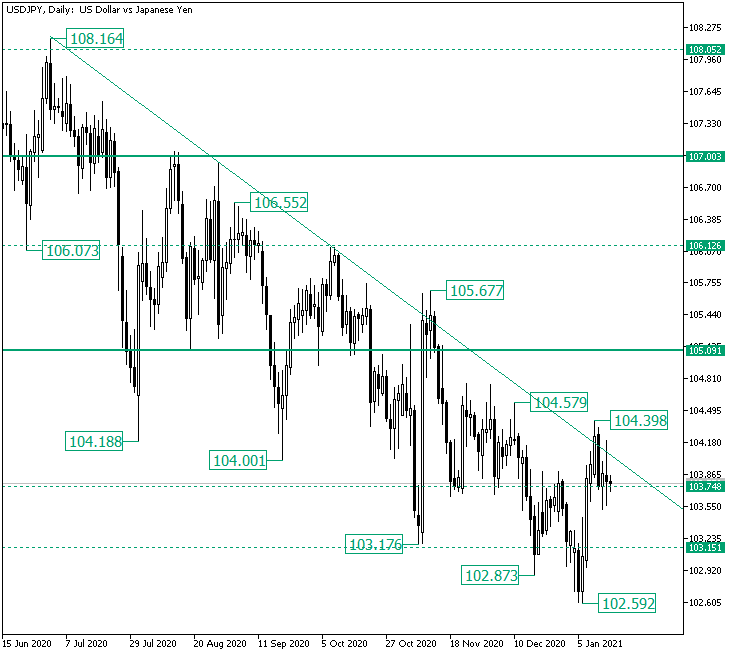

Ranging from the 108.16 excessive, after the middleman stage of 108.05 was falsely pierced, the fall managed to lengthen till the 102.59 low.

The identical excessive of 108.16 is the origin level of a descending trendline that limits the higher motion of the falling pattern that oscillates underneath it.

Since its starting, the falling pattern had solely two makes an attempt to pierce the trendline, the first highlighted by the 105.67 excessive and the second by 104.39, respectively.

The first one ended with the return of the worth underneath the agency space of 105.09, an occasion that, catalyzing the validation of a double resistance space, aided the continuation of the pattern.

The second one, which occurs to be nearer to the current time, appears to have some struggles persevering with to ebb.

So, on the bullish aspect, the 104.39 is seen as a false piercing, which provides credit score to the bears. On the bearish aspect, the false piercing naturally continues with the fall.

Nevertheless, as the fall is just not materializing, a bullish motion could also be anticipated. This situation begins to add up if we put into the image the oscillations that, even when they induced a retracement from the trendline, unfolded above the 103.74 stage.

In different phrases, the bearish want to validate the trendline as soon as extra could have backfired, as, to accomplish this, they needed to convey the worth above the 103.74 supportive space.

The situation is much like the earlier one (see the 105.67 excessive), as the worth was put again above the crucial help space of 105.09.

Nevertheless, this time the bulls appear to be much less versatile, taking the probability to make a pattern change.

So, if 103.74 stays help, the worth could pierce the trendline and head for 105.09, which might be the primary bullish goal. Alongside this path, the 104.39 and 104.57 highs are doable revenue reserving areas.

On the flip aspect, if 103.74 is validated as resistance, 103.15 could also be paid a go to.

Quick-term perspective

From the 102.59 low, the worth appreciated till it bought above the 103.71 zone and later nearly touched the 104.44 resistance.

As lengthy as the worth is contained inside the space outlined by the two ranges, vary buying and selling could also be seen.

Normally, as such developments are continuation patterns, and as this one is preceded by an appreciation, the resistance is predicted to give approach.

Due to this fact, if 104.44 turns into help, then 105.27 — not highlighted on the chart — is the subsequent bullish space of curiosity.

Ranges to maintain an eye on:

D1: 103.74 105.09 103.15

H4: 102.59 103.71 105.27

If you have got any questions, feedback, or opinions relating to the US Greenback, be happy to publish them utilizing the commentary type beneath.