It has been an irregular Fed day, with vital motion hitting all main asset courses. On the midway level of the Wall Road session, the DJIA DOW (-3

It has been an irregular Fed day, with vital motion hitting all main asset courses. On the midway level of the Wall Road session, the DJIA DOW (-387), S&P 500 SPX (-64), and NASDAQ (-188) are all deep into the crimson. At this time’s massive winner is the Dollar. Positive factors vs the euro EUR/USD (-0.42%), Canadian greenback USD/CAD (+0.59%), and Japanese yen USD/JPY (+0.44) are a number of of the foreign exchange highlights.

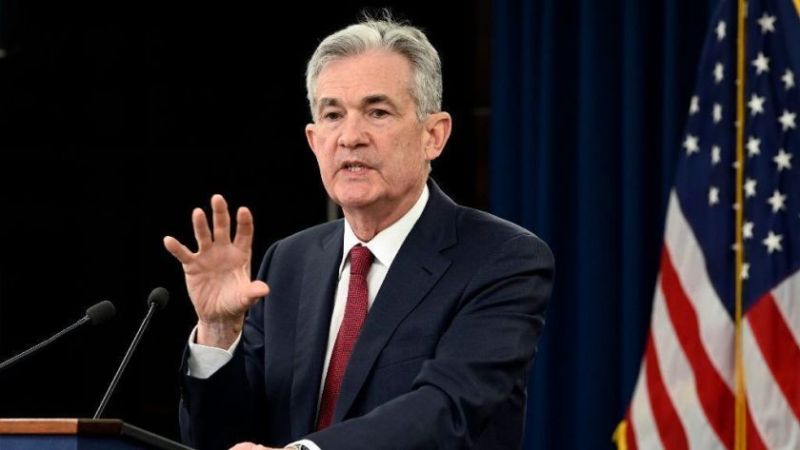

At 2:00 PM EST, the U.S. Fed will launch its ready January assertion. No coverage strikes are anticipated, however the tone will probably be all the things at Jerome Powell’s 2:30 PM EST presser. The markets are reacting as if the Fed goes to kick off 2021 in a hawkish style. This situation will not be probably, however we will probably be watching carefully because the FOMC renders its coverage verdict.

In U.S. actual property information, this morning introduced launch of two key numbers going through mortgage charges:

Occasion Precise Earlier

MBA 30-year Mortgage Charge (Jan. 22) 2.95% 2.92%

MBA Mortgage Functions (Jan. 22) -4.1% -1.9%

The massive takeaway from these statistics is that functions are down 6% over the previous two weeks. Whereas the decline is a operate of seasonality, it’s noteworthy as a result of mortgage charges being so low. Nevertheless, it’s vital to do not forget that MBA Mortgage Functions are nonetheless up 16% year-over-year ― an indication that the market stays strong.

So, is Jerome Powell and the Fed going to throw everybody a curveball at the moment? The probabilities of which are distant, at greatest.

GBP/USD Consolidates Forward Of Fed Statements

After posting recent yearly highs, the GBP/USD has traded sideways this week. Charges are within the neighborhood of 1.3700 and in no hurry to go anyplace.

+2021_05+(10_32_14+AM).png)

Listed below are the important thing ranges to observe for the rest of the week:

- Resistance(1): Spike Excessive, 1.3760

- Help(1): 38% of the Two-month Vary, 1.3521

Backside Line: If we see the USD rally following at the moment’s Fed bulletins, a shopping for alternative within the GBP/USD could come into play. So long as the Spike Excessive (1.3760) stays intact, I’ll have purchase orders within the queue from 1.3529. With an preliminary cease loss at 1.3474, this commerce produces 50 pips on a barely sub-1:1 danger vs reward ratio.