The USD is on the ropes versus the majors as Treasury Secretary Mnuchin and FED Chair Powell testify on the COVID-19 response. So far, there haven

The USD is on the ropes versus the majors as Treasury Secretary Mnuchin and FED Chair Powell testify on the COVID-19 response. So far, there haven’t been any blockbuster revelations from Mnuchin. Under are a couple of highlights from his ready feedback:

- “Whereas the unemployment charge remains to be traditionally excessive, we’re seeing extra indicators that situations will enhance considerably within the third and fourth quarters of this yr.”

- “The Blue Chip Report is forecasting that our GDP will develop by 17% annualized within the third quarter, and by 9% within the fourth quarter.”

- “The U.S. Chamber of Commerce reported this month that 79% of small companies are not less than partially open.”

- “We’re in a robust place to recuperate as a result of the Trump Administration labored with Congress on a bipartisan foundation to move laws and supply liquidity in file time.”

All in all, Mnuchin has been pretty optimistic concerning the pending COVID-19 restoration. The USD isn’t responding, as values are down at the moment in opposition to many of the majors. Let’s dig into the USD/JPY weekly chart and take a look at the Buck’s lone brilliant spot.

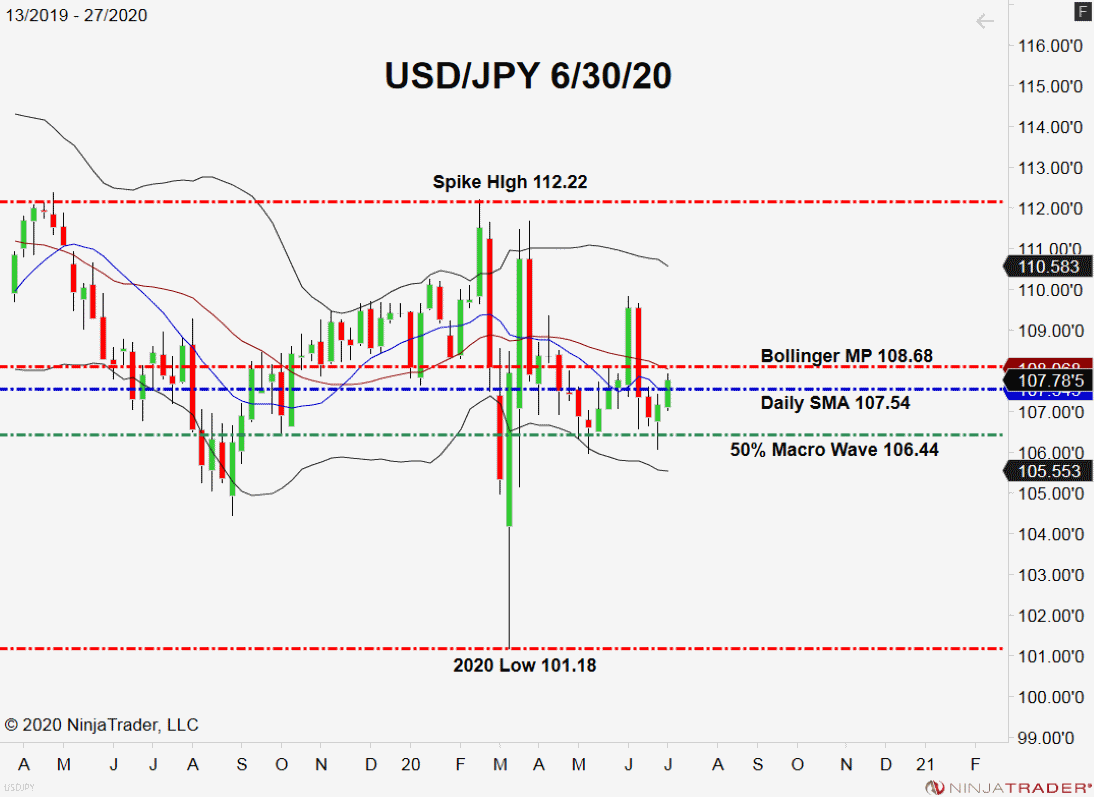

USD/JPY Approaches Weekly Resistance

Though we’re in a holiday-shortened buying and selling week, there are a number of occasions value monitoring. COVID-19 hearings and tomorrow’s FOMC Minutes from June spotlight the motion. At the moment, the Buck is laboring in opposition to all the majors aside from the yen. Subsequently, charges are inside view of a key topside resistance stage.

+2020_27+(10_36_47+AM).png)

Listed here are two ranges value expecting the rest of the foreign currency trading week:

- Resistance(1): Bollinger MP, 108.68

- Assist(1): Every day SMA, 107.54

Backside Line: Within the occasion we see the USD/JPY prolong weekly features, a promote from the Bollinger MP will come into play. Till Friday’s foreign exchange shut, I’ll have promote orders within the queue from 108.64. With an preliminary cease loss at 108.89, this commerce produces 25 pips on a regular 1:1 danger vs reward ratio.