VIX, OVX, VXEEM, GVZ, TYVIX, FXVIX: CROSS-ASSET VOLATILITY BENCHMARKS GO NUCLEAR AS GLOBAL RECESSION RISK INTENSIFIESThe VIX Inde

VIX, OVX, VXEEM, GVZ, TYVIX, FXVIX: CROSS-ASSET VOLATILITY BENCHMARKS GO NUCLEAR AS GLOBAL RECESSION RISK INTENSIFIES

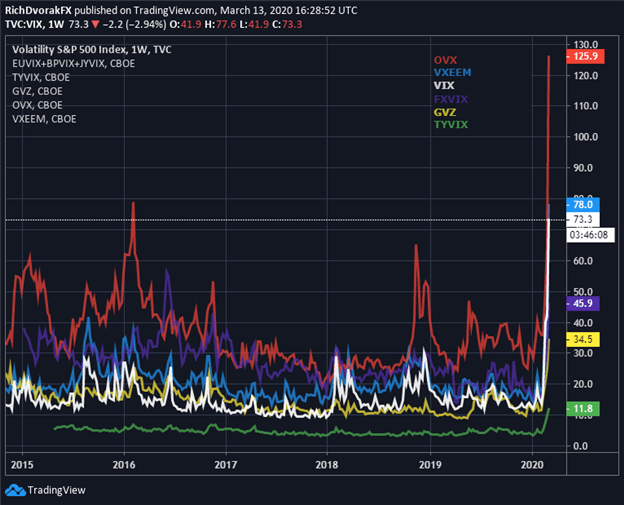

- The VIX Index, a preferred investor fear-gauge, trades round its highest because the 2008 world monetary disaster because the S&P 500 crashes right into a bear market

- Alongside the VIX Index, FX volatility is surging, which speaks to the rise in systemic danger amid the novel coronavirus outbreak and crude oil price battle

- Equities might stay beneath stress if market volatility lingers round report excessive readings, however which may catalyze demand for gold and the US Dollar

The VIX Index, which displays anticipated volatility on the S&P 500 over the subsequent 30-days, simply notched its highest weekly shut since 2008 amid the global financial crisis. The VIX Index is usually used to quantify inventory market volatility – or perceived danger and uncertainty – confronted by merchants. As such, there may be usually an inverse relationship between measures of volatility and investor sentiment.

Historical Volatility: A timeline of the Biggest Volatility Cycles

CORONAVIRUS PANDEMIC SPARKS SURGE IN CROSS-ASSET VOLATILITY MEASURES (CHART 1)

Chart created by @RichDvorakFX with TradingView

The VIX Index and different cross-asset volatility benchmarks started their newest ascent earlier this 12 months, owing to the novel coronavirus outbreak, which brought on a significant…