EUR/GBP continues to remain bearish since early this year after buyers failed to push the price to 0.90 and continues to decline as a result of differ

EUR/GBP continues to remain bearish since early this year after buyers failed to push the price to 0.90 and continues to decline as a result of differentials in monetary policy as conveyed by central banks. Currently, the EUR/GBP pair is experiencing some consolidation, although it remains bearish on larger charts due to the strength of the GBP (British Pound). This GBP strength can be attributed to the emergence of increasing inflation pressures, as evidenced by data released this week, and the Bank of England is still planning to raise interest rates.

In the future, there is the potential for the GBP to encounter selling pressure due to concerns about stagflation. Although, presently, the market is witnessing a situation where GBP buyers are dominant, primarily driven by the anticipation that the Bank of England (BoE) might need to adopt a more assertive approach in raising interest rates. It’s important to note that, beyond a certain point, higher interest rates not only address inflation but also have the capacity to hinder economic growth and we’re getting plenty of signs that the UK economy is heading into a recession.

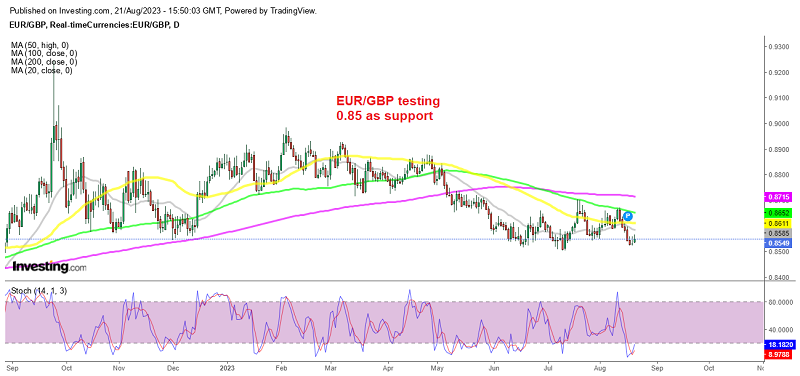

Although EUR/GBP remains bearish and it has encountered resistance from its 100 moving average (MA) on the daily chart twice recently – once earlier this month and again when sellers pushed the price down for two consecutive days. A similar scenario occurred in July when the price also tested the 100-day moving average for two days and met resistance from sellers.

Over the past five days, the pair has been on a downward trajectory. This decline has led the price to a significant range on the daily chart, which dates back to August 2022 and was reaffirmed in both June and July this year. This range spans between 0.85 and 0.8570 with the lowest level reached late last week coming at 0.8520s.

Traders seeking opportunities to buy during a dip or at oversold levels should focus on this range for potential support, with their stop-loss orders placed just below the key level of 0.85000. If the price bounces upward, a move beyond 0.85596 could prompt traders to consider targets around 0.8600, and potentially toward the previously broken 61.8% retracement level at 0.8610.

On the flip side, a breach below the crucial 0.8500 level could pave the way for further selling momentum. In this case, there isn’t substantial support until the vicinity of the 0.8400 level. Today we saw a rebound, but buyers failed to push the price above 0.8560s and we decided to open a sell EURGBP signal a while ago.

EUR/GBP Live Chart

EUR/GBP

www.fxleaders.com

COMMENTS