What the RBA may do subsequent to manage the financial squeeze? – Foreign exchange Information Preview Po

What the RBA may do subsequent to manage the financial squeeze? – Foreign exchange Information Preview

Posted on August 28, 2020 at 2:28 pm GMTChristina Parthenidou, XM Funding Analysis Desk

Australia has two key occasions subsequent week within the agenda. The Reserve Financial institution is setting its coverage on Tuesday at 03:30 GMT, whereas the subsequent day at 01:30 GMT the Bureau of Statistics is releasing GDP figures for the second quarter. Market analysts predict the central financial institution to face pat even when the financial system doubtlessly reveals a steeper contraction in Q2. But, whether or not the aussie will proceed its rally might rely upon how dovish the assertion shall be given the latest virus resurgence. In the meantime, PMI information out of China on Monday at 01:00 GMT may decide whether or not the forex can have a inexperienced begin to the week.

A sharper contraction in Q2 is probably not an enormous shock

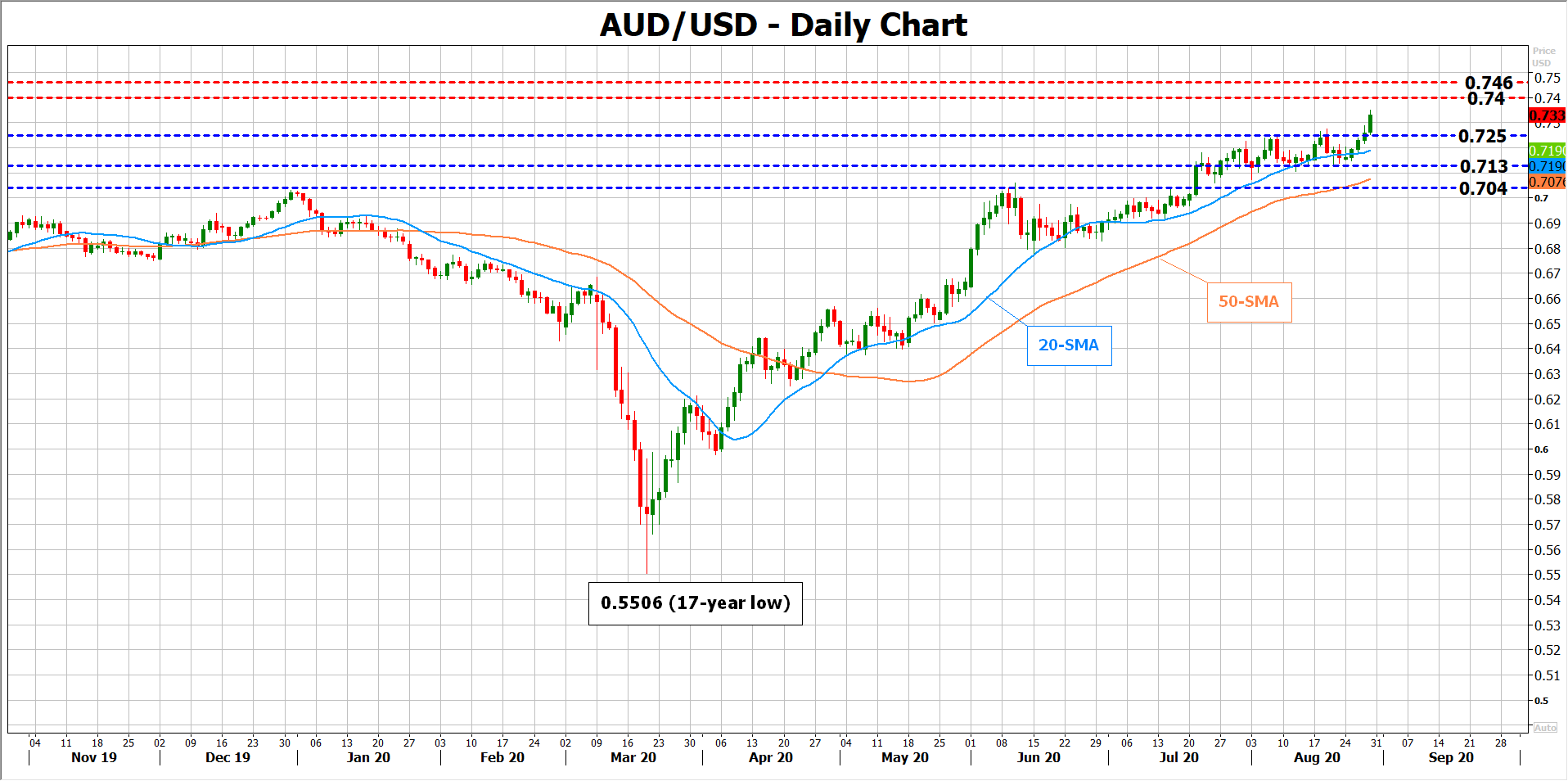

The aussie managed to finish a transparent V-shaped restoration in opposition to the US greenback in 5 months and register new 2020 highs above the 0.7400 degree on Friday because the political noise and the resurgence in new Covid-19 circumstances within the US discouraged curiosity within the buck.

It’s not that Australia didn’t face a bounce within the variety of infections. In actual fact, it did expertise a second wave of the pandemic. Every day new circumstances elevated exponentially to recent peaks throughout the month of July, significantly in the key states of Victoria and New South Wales, forcing the federal government to close components of the financial system and tighten restrictions on actions simply after the nation emerged from the primary lockdown in June.

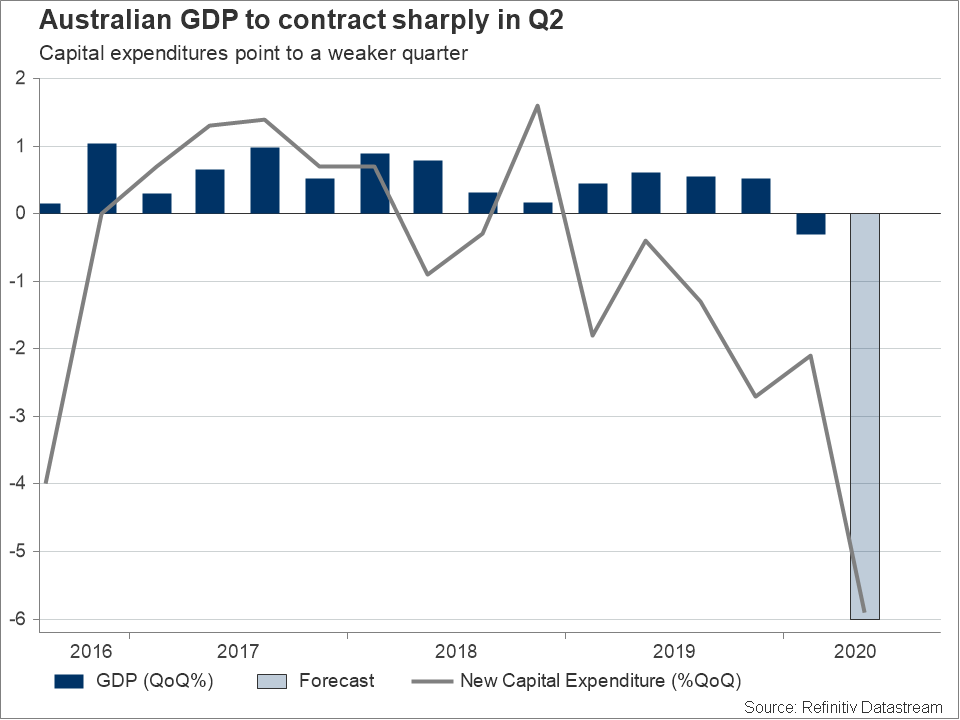

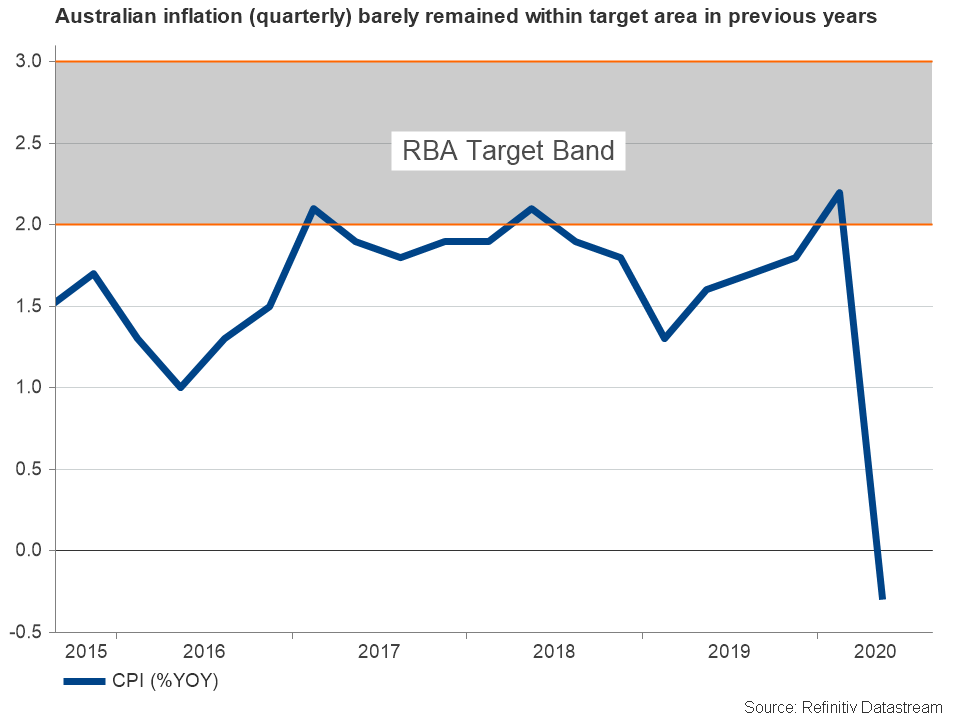

It’s possible that the resurgence in infections has additional squeezed the financial system within the third quarter and the Reserve Financial institution of Australia (RBA) is not going to neglect to focus on the draw back dangers to the financial system when it meets on Tuesday to evaluate its coverage. The unemployment price inched up for the third consecutive month to 7.5% in July and the patron worth index turned destructive for the primary time within the survey’s historical past in Q2, disrupting the RBA’s twin mandate of worth stability and full employment. Final week, new capital expenditures information for the three months to June printed the quickest decline in funding in 5 years, and the destructive building figures additional satisfied economists that GDP figures in Q2 due on Wednesday might reveal a 6.0% quarterly contraction versus the softer 0.3% downfall in Q1. On a yearly foundation, GDP is forecast to plummet by 5.3% after rising at a slower tempo of 1.4% within the previous quarter. That may be the primary annual financial contraction in a long time.

Why financial coverage is not going to change subsequent week

Effectively, destructive rates of interest stay within the toolbox for tough occasions however at the moment such a call would solely injury international funding, which has been distinguished to Australia’s development for a lot of a long time now. Particularly, Australia is offering increased rates of interest (0.25%) than the US is doing now together with New Zealand and Canada and that makes it a horny vacation spot for international funding. In fact, a drop in charges would carry draw back pressures to the aussie and thus profit exporters, although so long as there are different means to depreciate a forex and preserve competitiveness in worldwide markets, the central financial institution may keep away from that technique. The yield curve management geared toward maintaining three-year yields at 0.25% has been applied in March for that objective.

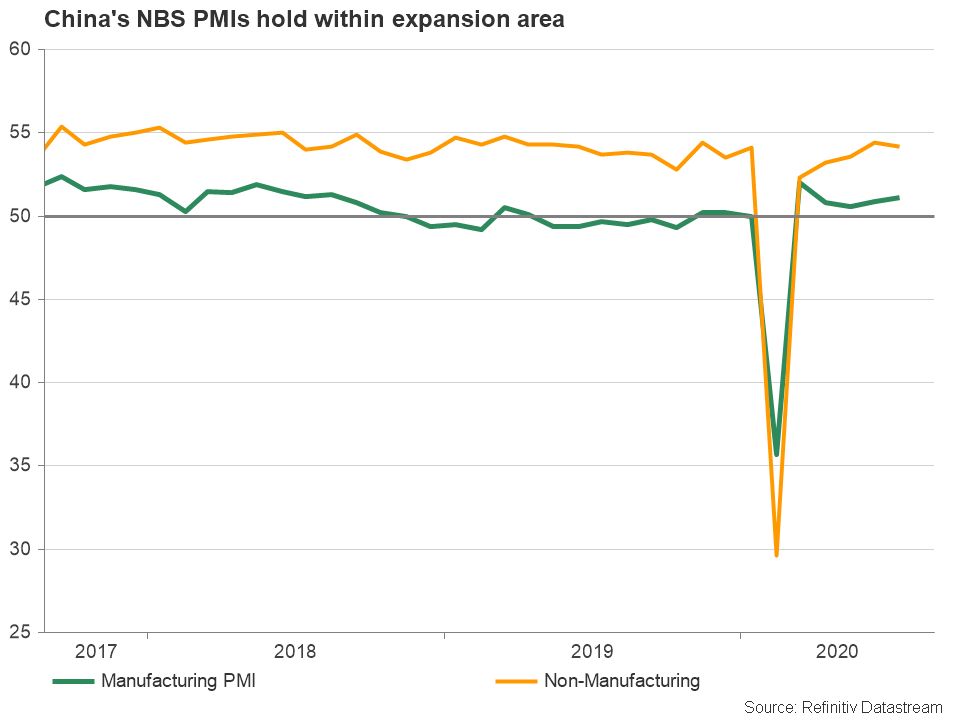

Intervening in alternate markets might be one other means, although based on the central financial institution this could be more practical if the aussie was out of step with fundamentals. For now, Australia’s main export iron ore is buying and selling at a better worth, which helps the aussie, whereas demand from its main commerce associate, China, has been strengthening not too long ago regardless of political tensions between the international locations. At this level it is usually price noting that the Chinese language manufacturing PMI index revealed by the Nationwide Bureau of Statistics is forecast to tick as much as 51.2 from 51.1. Despite the fact that this isn’t an enormous enchancment, it’s nonetheless above the 50 degree that separates development from contraction and therefore it’s optimistic for the aussie. The forex may have a inexperienced begin to the week if the Chinese language PMI surprises to the upside.

Adopting extra versatile inflation concentrating on may flip to be a well-liked device for holding charges low for longer these days. The Fed got here first on Thursday to say that it could enable inflation to rise above its 2.0% goal for some time frame, with out growing charges. Different central banks have been analyzing that case too earlier than Covid-19 kicked off, with the RBA discussing whether or not its 2-3% vary goal may widen to 1-3%.

AUD/USD ranges to observe

AUD/USD managed to speed up above the 0.7250 key degree, the place the 200 easy shifting common (SMA) is hovering within the weekly chart and is at the moment stretching its five-month outdated uptrend in the direction of the 0.7400 resistance space. Upbeat PMI readings out of China may improve the transfer on Monday, whereas a big destructive deviation from forecasts may push it again to the 0.7130 help zone. The RBA’s price announcement may subsequent set off volatility to the pair however since no modifications in coverage are anticipated, the main target will flip to the wording policymakers will use within the assertion. If policymakers give extra weight on draw back dangers than anticipated, hinting a extra accommodative stance within the the rest of the yr, the pair may even head for the 50-day SMA and the 0.7040 barrier.

Alternatively, a much less dovish tone on financial system may see the worth buying and selling between 0.7400 and 0.7460.

AUDUSD