AUD/USD had been on a declining trend for more than a week, despite an impressive jobs report last week, indicating a strong and resilient economy. Th

AUD/USD had been on a declining trend for more than a week, despite an impressive jobs report last week, indicating a strong and resilient economy. This is noteworthy despite the Reserve Bank of Australia (RBA) having implemented significant tightening measures, raising interest rates by 400 basis points since May of the previous year to 4.10%.

In June, the unemployment rate in Australia ticked lower to 3.5%, surpassing expectations of 3.6% and the previous rate. Additionally, the economy added 32.6 thousand jobs during the month, significantly exceeding the anticipated 15 thousand jobs and the 75.9 thousand jobs added in the previous period.

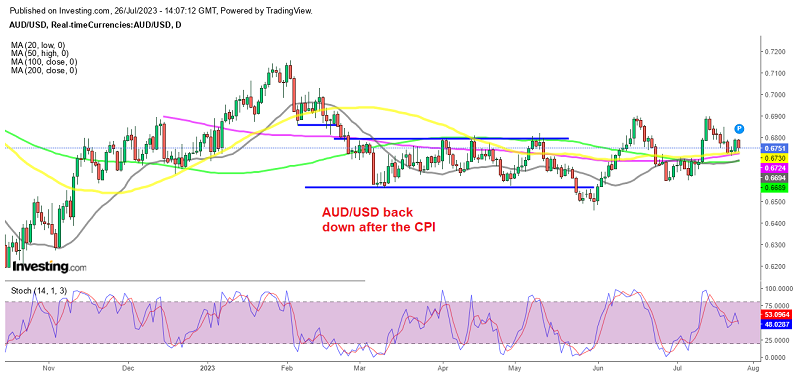

But the decline continued until yesterday when we saw a bounce off the 200 SMA (purple) and a decent reversal. The news that China is implementing monetary measures to help revive the economy and the softer USD sentiment helped the reversal, but traders were also being cautious ahead of the consumer inflation report from Australia and the FOMC meeting later in the evening.

The CPI report was expected to indicate a decrease in the annual rate from 5.6% to 5.4%. Additionally, the second-quarter CPI data was also scheduled for release from 1.4% to 1.0%, and it was anticipated that all inflation indicators would show a slowdown. They did decline, both in Q2 and on an annualized basis, sending AUD lower, as well as the NZD. Although the moving averages seem to be holding once again on the daily chart for AUD/USD . At the moment though, we are seeing some positive action in risk currencies, including EUR/USD .

June CPI Inflation Report from Australia

- Q2 CPI 0.8% against 1.0% expected

- Q1 CPI was 1.4%

- CPI YoY 6.0% against 6.2%

- Previous CPI YoY was 7.0%

- Trimmed mean CPI QoQ 1.0% against 1.1% expected, prior 1.2%

- Trimmed mean CPI YoY 5.5% against 5.4% expected, prior 5.8%

AUD/USD Live Chart

AUD/USD

www.fxleaders.com