US CPI m/mThis post has the potential to age terribly at the bottom of the hour when CPI is released but I think the days of huge market reactions to

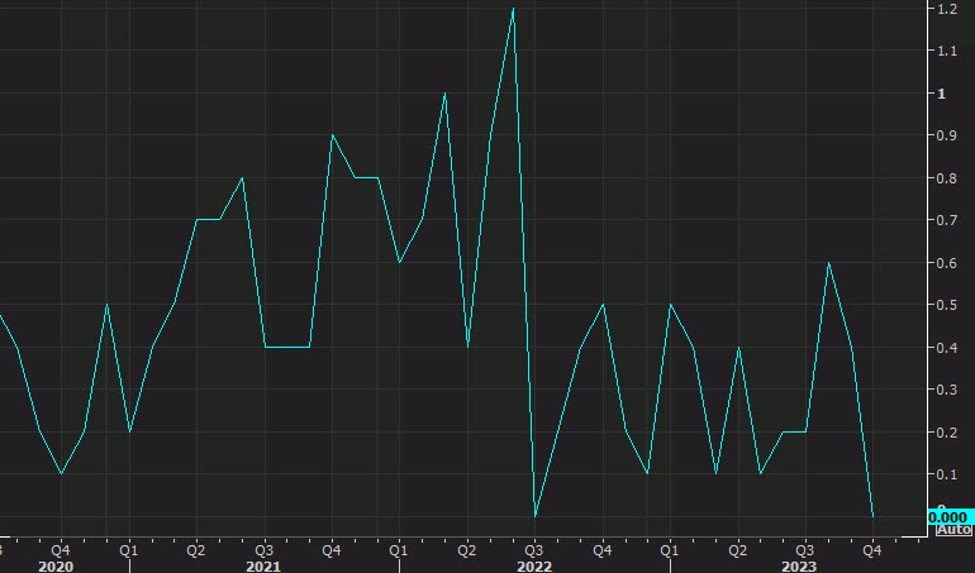

US CPI m/m

This post has the potential to age terribly at the bottom of the hour when CPI is released but I think the days of huge market reactions to CPI are over.

BMO puts it this way:

“We’re left to ponder whether the core-CPI figures will be traded with as much conviction as what might have otherwise been the case given that the verdict seems to be in”

What they mean is that the market has already made up its mind: The days of inflation angst are over. One-year inflation breakevens are below 2% and the market is eagerly pricing in cuts.

Can today’s inflation report change that? Maybe by a month or two. The market is pricing in 115 bps of cuts next year with the first cut in May. A high CPI report could push that back a month while a softer one would put March on the table.

What’s not important is when rates will rise, it’s what inflation regime we’re in and the market has concluded that we’re heading back to something like the 2010s where growth was sluggish and inflation low. The timing on that isn’t clear but the destination is.

The consensus today is for:

- 0.0% m/m

- +3.1% y/y

- Core +0.3% m/m

- Core +4.0% y/y

Globally, there seemed to be something in the air in November with European and Chinese data both undershooting.

www.forexlive.com

COMMENTS