Commerce Wars, US-China Relationship, EU-US Commerce Relations Speaking Factors: US-led commerce wars with China and the EU more

Commerce Wars, US-China Relationship, EU-US Commerce Relations Speaking Factors:

- US-led commerce wars with China and the EU more likely to proceed beneath Trump administration

- Multi-layered geopolitical points not pertaining to commerce might spill into commerce discussions

- Biden administration might ease tensions with EU however much less incentive to alleviate China stress

Donald Trump Turns into President

Doubling Down on China

If re-elected, President Donald Trump would possible double down on China and search further concessions via “Part 2” of their long-awaited, complete commerce settlement. Whereas “Part 1” was signed, the coronavirus pandemic difficult what was an already-fragile state of affairs. Home demand was hammered and because of this, China was unable to carry up its finish of the discount.

10 Key Dates in US-China Commerce Conflict Timeline

- January 22, 2018: US tariffs all imported washing machines and photo voltaic panels (not simply from China)

- March 8, 2018: US orders 25% tariff on metal imports, 10% tariff on aluminum

- April 2, 2018: China imposes tariffs of as much as 25% on 128 US merchandise

- August 7, 2018: US posts record of $16 billion of Chinese language items to be taxed at 25%. China retaliates with 25% duties on $16 billion of US items

- December 1, 2018: China and US comply with 90-day ceasefire, either side speak to debate decision

- Could 5,2019: After commerce talks failed, Trump tweets intent to boost tariffs on $200b of Chinese language goods to 25% on Could 10

- August 1, 2019: US-China commerce talks failed at G20, Trump publicizes 10% tariff on $300b of Chinese language imports

- August 5, 2019: China halts US agricultural purchases, USD/CNY breaks previous 7.000 trade price

- September 20, 2019: After 2-day assembly, USTR publicizes tariff exclusions on 400 Chinese language merchandise

- October 11, 2019: Trump publicizes Part 1 deal. It’s formally signed on January 15, 2020

There are a further +30 key dates worthy of accounting, however the newest developments on the time of writing are listed on this article.

Moreover, reconciliation is made much more troublesome primarily based on completely different accounting strategies each the US and China make use of. Not fully by coincidence, every sides’ method favor their respective positions. Mr. Trump’s pivot in the direction of better leniency within the commerce conflict in late 2020 might have been the results of a sensible maneuver to keep away from stirring financial and monetary turbulence forward of the election.

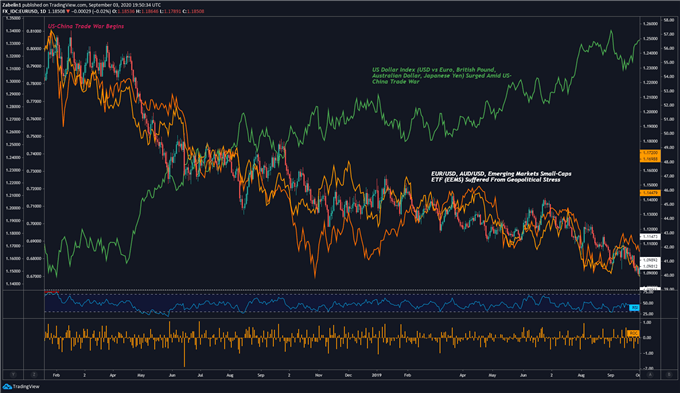

Impression of US-China Commerce Conflict on Overseas Trade Markets – Every day Chart

Supply: TradingView

Having stated that, if re-elected, the President would possible revive stress on China alongside an aggressive pursuit for the ratification of “Part 2”. This may increasingly additionally happen in tandem with the diplomatic strains with Beijing over the sweeping nationwide safety invoice for Hong Kong that has drawn worldwide criticism. Rising rigidity over that geopolitical scorching spot might spill over into commerce talks prefer it did in 2019.

Beneficial by Dimitri Zabelin

Enhance your buying and selling with IG Shopper Sentiment Knowledge

One other hot-button problem which will rattle shares and cycle-sensitive belongings are points pertaining to China-based expertise software program. Controversy over TikTok, WeChat and Huawei’s 5G installations proceed to be sticking factors in cross-Pacific relations and can solely possible be amplified beneath a Trump administration. The restriction of expertise exports to Huawei has led China to begin making a plan to develop its personal semi-conductors.

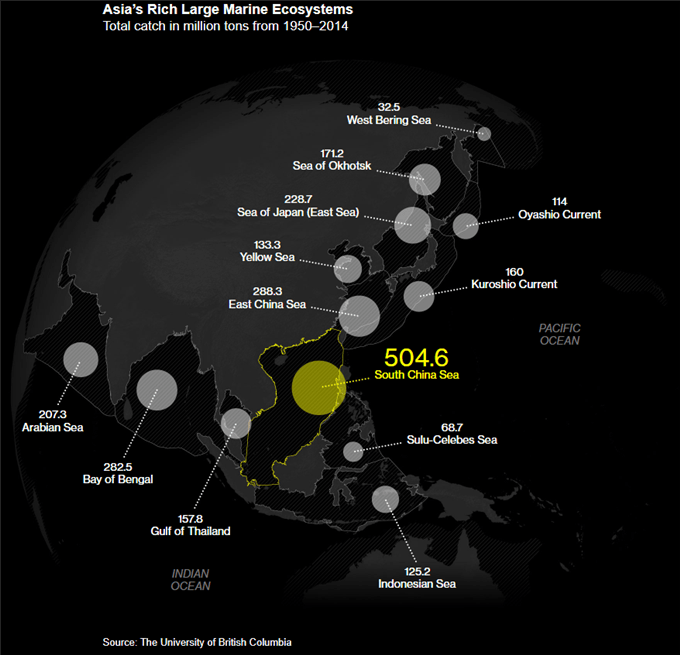

Political stress within the South China Sea over Beijing’s navy and financial actions have additionally intensified US-China relations. Along with island-building and base constructions, the Asian big’s aggressive declare to strategic fisheries has additional created regional discontent with Vietnam, Taiwan and the Philippines to call a number of. The Trump administration’s stronger stance towards China might increase the chance of a head-on battle – although that is nonetheless a comparatively low likelihood.

The South China Sea: A Fisherman’s Utopian Dystopia

Supply: Bloomberg utilizing picture by College of British Columbia

Collectively, these geopolitical dangers might put a premium on haven-linked currencies just like the US Greenback and anti-risk Japanese Yen however a reduction on growth-anchored FX just like the Australian and New Zealand {Dollars}. They might be notably prone to deteriorating US-China tensions given their robust reliance on the latter’s strong financial efficiency. This dynamic could also be amplified if these points spill over into commerce talks.

Open a demo FX buying and selling account with IG and commerce currencies that reply to systemic tendencies.

Beneficial by Dimitri Zabelin

Foreign exchange for Freshmen

Honing in on Europe

From a market-oriented perspective, the re-election of Donald Trump might push the US Greenback increased together with the anti-risk Japanese Yen primarily based on commerce concerns discreetly. In his first time period, the President not solely began a commerce conflict with China that many imagine throttled international development prospects, however his administration’s insurance policies additionally fractured relations with Europe. The latter was hit with aluminum and metal tariffs with threats of further import duties.

Arguably probably the most formidable tax menace towards Europe – which has not but been taken off the desk – is auto tariffs. This one particularly might be economically devastating since it could straight impression Germany – the area’s largest financial system and largest automotive producer – the toughest. Final 12 months, Trump nearly used Part 232 of the Commerce Growth Act of 1962, a Chilly Conflict-era coverage measure that will have elevated auto tariffs by 25%.

The European Union responded in sort through the use of tariffs focused at politically-strategic states with key exports. Orange juice and bourbon have been two of the various merchandise that have been hit. The previous is a key export from Florida, a swing state in US elections and the latter is a signature export of Kentucky – the state of Senate Majority chief Mitch McConnell.

10 Key Dates in US-EU Commerce Conflict Timeline

- March 1, 2018: Trump publicizes US is making ready to impose metallic tariffs

- March 3, 2018: EU plans to retaliate with politically-strategic tariffs like Bourbon and orange juice

- March 8, 2018: US orders 25% tariff on metal imports, 10% tariff on aluminum

- March 22, 2018: US offers non permanent exemptions to the EU amongst others

- Could 22, 2018: US publicizes in investigation on whether or not auto imports pose a nationwide safety menace

- June 1, 2018: EU-US commerce talks fail on everlasting exemption from aluminum and metal tariffs

- June 6, 2018: US imposes tariffs on EU, Europe says prepared to reply with €2.8b value of duties

- July 1, 2018: EU warns US that almost $300b of US auto exports could also be hit with tariffs

- July 25, 2018: Trump and then-EC President Junker dealer a deal, metallic tariffs are lifted

Be aware: From July 25, 2018 on, the EU and US engaged in a a number of tit-for-tat commerce exchanges and threats of further countermeasures too lengthy to record. The newest one is listed within the paragraph beneath.

An nearly two-decade commerce dispute with the World Commerce Group (WTO) over unlawful subsidies to plane giants Airbus and Boeing are one other drive widening the US-EU rift. The newest ruling tilted in favor of Washington, which was given the most important arbitration award within the group’s historical past. It authorizes the US to legally impose $7.5 billion value of tariffs on European items – and Washington took it.

This got here a lot to the chagrin of EU policymakers who have been hoping to succeed in a tariff-free decision. In mid-August, Washington stated it could hold a 15% tariff on Airbus and a 25% tariff on different European items. Brussels is now ready to hit again with its personal tariffs ought to it’s afforded WTO approval for unlawful US subsidies to aeronautical big Boeing.

Beneficial by Dimitri Zabelin

High Buying and selling Classes

Diverging overseas coverage approaches within the Center East – particularly in the direction of Iran – might also add one other layer of geopolitical rigidity that hinders cross-Atlantic cooperation. After Trump backed out of the 2015 nuclear deal and re-imposed sanctions on Iran, EU policymakers scrambled to search out methods to incentivize Iran to stay to the settlement. This got here a lot to the disdain of key officers within the Trump administration.

European officers created what is called the Instrument in Help of Commerce Exchanges (INSTEX). This particular goal car (SPV) permits European companies to avoid US sanctions by facilitating non-SWIFT and non-US Greenback denominated commerce with Iran. Washington warned that such an motion might outcome within the sanctioning of EU companies, however Brussels made it clear that such insurance policies might end in tariffs on US companies.

Joe Biden Turns into President

Lighter Stress on China

Given what Democratic nominee Joe Biden and his operating mate Kamala Harris have stated within the election cycle, it seems their method to China on commerce may have a lighter contact. Mr. Biden stated that “America’s farmers have been crushed by [Trump]’s tariff conflict with China”. Harris echoed this sentiment, saying that the financial battle was “punishing American customers [and] killing American jobs”.

Having stated that, the elimination of tariffs might include strings connected. With a view to keep away from being labeled as ‘smooth on China’, particularly with Beijing’s nationwide safety invoice in Hong Kong, Biden might also have to face as much as the Asian big. Along with rising rigidity within the South China Sea, he might must leverage assuaging stress on commerce in trade for strategic geopolitical concessions within the aforementioned areas.

The prospect of reconciliation – or a minimum of not escalating rigidity – might increase market sentiment and assist restore confidence within the gradual restoration of worldwide commerce norms, a substantial contribution to international development. Cross-continental fairness markets would possible rally from this prospect together with growth-anchored currencies just like the Australian and New Zealand {Dollars}. The anti-risk Japanese Yen and US Greenback, nevertheless, might not thrive on this setting.

Reconciling With Europe

Consistent with Biden’s comparatively extra typical method to coverage, cross-Atlantic reconciliation would possible be excessive on the agenda. Repealing the $7.5 billion value of tariffs on European merchandise and normal normalization of bilateral commerce relations might be one a part of a broader multi-pronged effort to revive fractured relations. This might assist elevate equities however undercut demand for havens just like the US Greenback.

Having stated that, Biden might encounter some friction with EU policymakers on points pertaining to digital sovereignty, via maybe to a lesser diploma than what Trump has confronted. In 2019, France nearly signed right into a regulation a digital tax that appeared to overwhelmingly goal US companies. The Trump administration fell again on their modus operandi and subsequently threatened to impose tariffs if the invoice turned regulation.

The so-called GAFA group – Google, Apple, Fb and Amazon – have additionally had run-ins with EU lawmakers. What a decision beneath Biden’s administration would seem like is unclear, however what is sort of sure is the expectation of continued rigidity between EU officers and US tech giants. Uncertainty right here might harm expertise shares, however the ripple impact could also be comparatively smaller than if Trump have been to take care of it.

— Written by Zabelin, Foreign money Analyst for DailyFX.com

To contact Dimitri, use the feedback part beneath or @ZabelinDimitri on Twitter